The newly launched XRP exchange-traded fund’s total assets under management (AUM) is on track to surpass $1 billion in its first month of trading, according to the latest data compiled by Finvold from the XRP Spot ETF’s real-time tracker. XRP Insights.

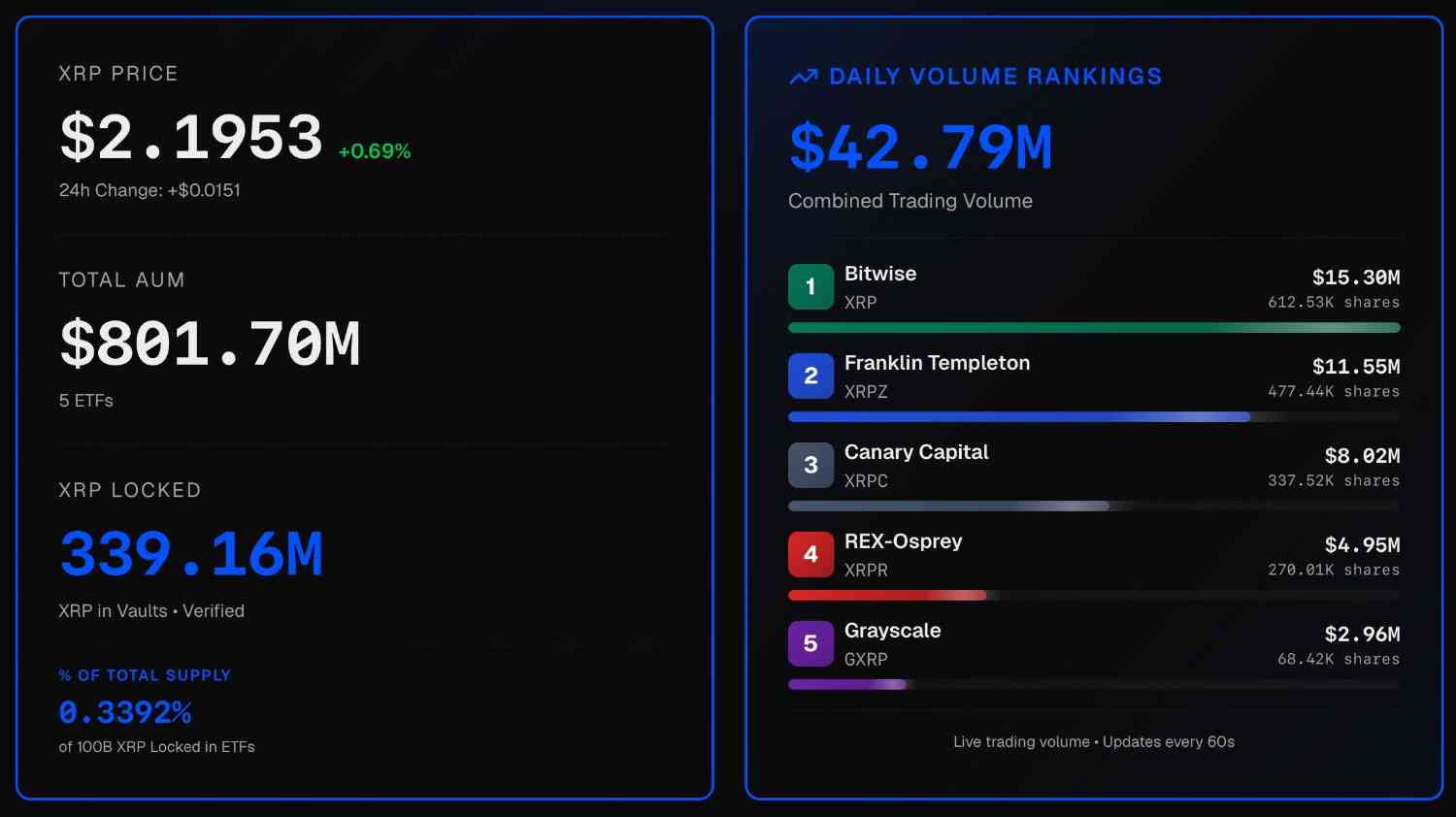

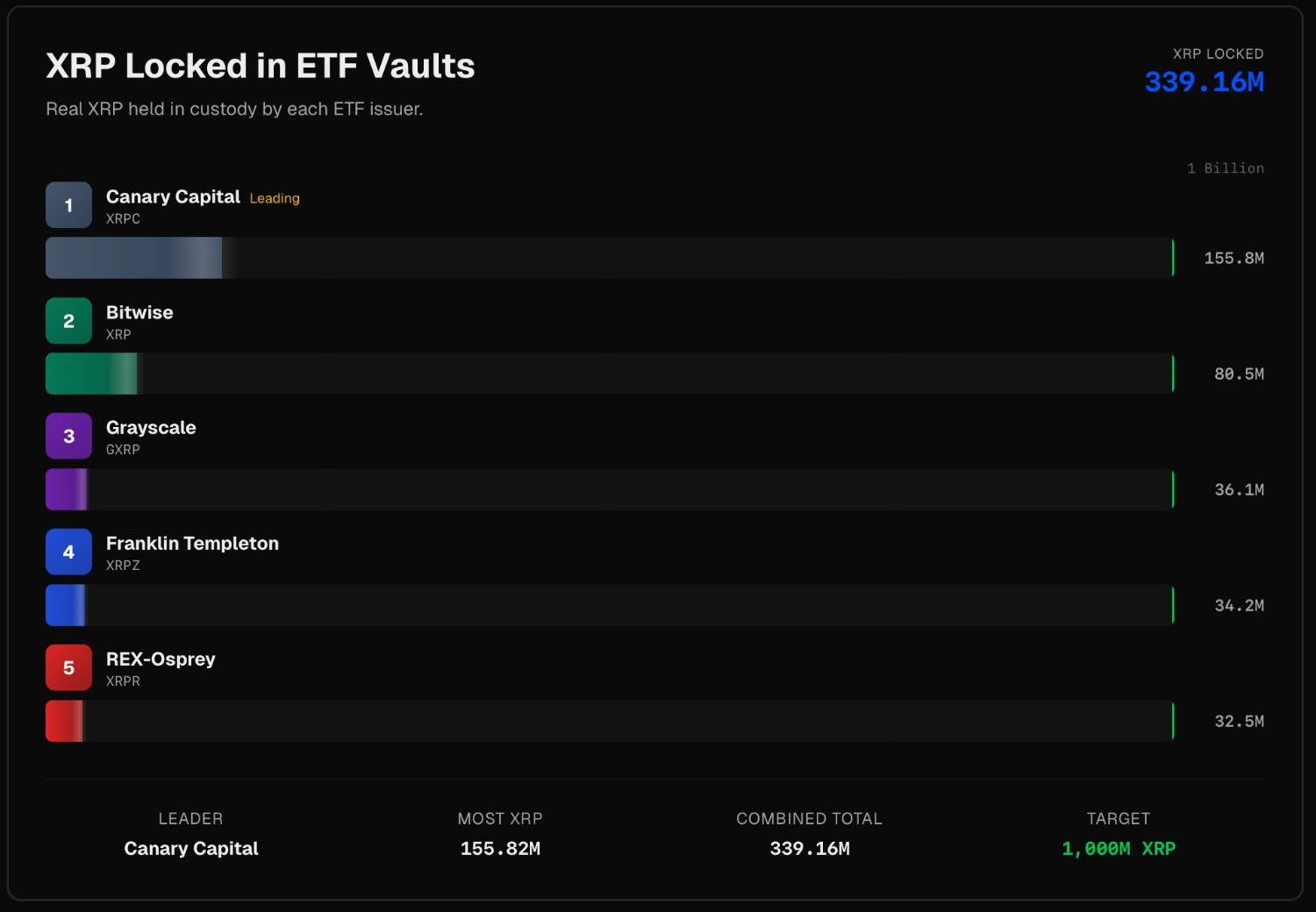

As of November 28, 2025, the five currently active ETFs had a total AUM of $801.7 million with 339.16 million XRP locked, representing 0.339% of circulating supply, and although it is early days, there is a clear shift in institutional positioning for this asset.

Canary Capital remains the ETF leader with 155.8 million XRP, followed by Bitwise with 80.5 million XRP. The total daily trading volume currently stands at $42.79 million, with Bitwise leading the trading activity with $15.3 million. This number reflects active participation from both institutional investors and professional traders who took advantage of the vehicle’s liquidity and regulatory structure.

XRP price rises as institutional demand accelerates ahead of 21Shares launch

In particular, the XRP price was stable at $2.21 at the time of article publication, recording a significant increase of only 0.69% in 24 hours and 14.66% in the week.

With the impending launch of 21Shares’ TOXR ETF, the growth trajectory is likely to accelerate further. The ETF received SEC Form 8-A approval on November 20th and is scheduled to begin trading on the Cboe BZX exchange on November 29th with a management fee of 0.50%. Industry participants expect the addition of TOXR to expand access among market participants in Europe and the United States, particularly those already onboarded through the existing 21Shares digital asset product.

The XRP ETF’s first month’s performance is notable when compared to early Bitcoin ETF flows in previous cycles, which showed a slow start before scaling up to structural demand vehicles. What distinguishes XRP’s early acceptance is a combination of legal clarity after a 2023 court ruling, growing demand for non-Bitcoin payment networks, and growing traction in banking and enterprise blockchain trials.

Although the current locked supply is less than 0.5 percent of XRP’s total circulation, analysts argue that this ratio makes sense given the relatively limited availability of institutional-grade vehicles that previously supported the asset.

Huge inflows into XRP ETFs

The speed with which the XRP ETF is attracting capital suggests that institutional portfolios are under-exposed to this asset class and are now initiating risk-weighted entries. Furthermore, this growth is consistent with the decline in foreign exchange reserves observed in recent weeks, a trend that may signal a shift towards long-term custody-driven positioning rather than speculative short-term trading.

If net flows remain stable over the next two weeks, the $1 billion threshold could be reached by the end of December without significant price increases.

With the 21Shares product ready for launch this week, and additional applications expected to follow, momentum within the ETF segment could continue to build through the first quarter of 2026. Ultimately, how much capital moves into structured ETF holdings versus a self-custodial environment will shape the asset’s liquidity profile going forward.