TL; PhD

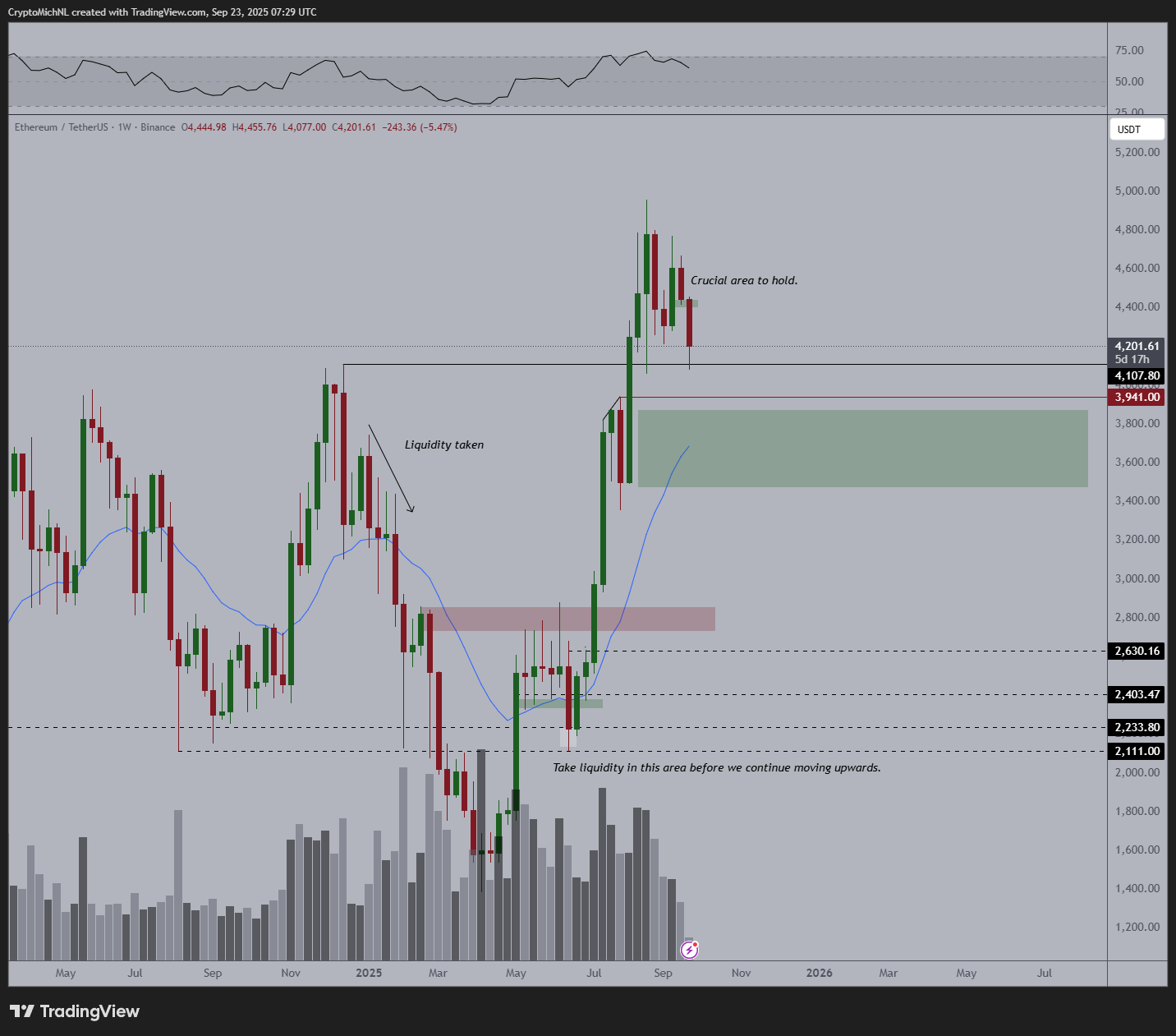

- Ethereum has $4,100 in support while the Wedge and Wyckoff setups suggest a strong upside.

- Price compression near the 20-week MA build is turning to $3,550-3,750 as key dip zones.

- The 2017 and 2020 ETH Q4 rally suggest that the seasonal strength could be repeated in the second half of 2025.

Once compression is built, pullback tests are supported

Ethereum (ETH) is trading nearly $4,200 after a sharp decline of nearly $4,950 from its recent high. As a result of the revision, assets will fall by nearly 20% from their peak. Despite the decline, some market participants view key pricing levels as potential areas of interest.

Market analyst Michael Van de Poppe points out that Ethereum could enter a horizontal period. He points out that the 20-week moving average is approaching price and compression is forming.

He said, “I don’t know if I’ll be soaking deep between $3,550 and $3,750.” I’ll leave the possibility of moving to that range open, but I won’t check it. The $3,550 to $3,750 zone is marked as potential support near a 20-week MA rise.

On the weekly time frame chart, ETH prices continue to be held above $4,100 as a key zone. Just below, there is a wider support area between $3,550 and $3,750, alongside the previous breakout area and the 20-week moving average. The green support box also appears low on the chart, with historic integrated area around $2,800.

Past movements indicate that ETH has responded to these levels. Labels such as “The liquidity has been taken away” For $3,900 “We will be mobilizing in this area.” Nearly $2,800 suggests that the reaction could last if prices revisit these levels. The low volumes in recent weeks support the idea that prices may be preparing for more directional moves.

The chart structure refers to the setup

Another pattern on the chart comes from the lateness of traders who refer to falling slumber. The setup is clear, with assets trending within two downward rows. The falling wedge is near the top and the price tests previous breakout levels. The chart includes movements that could lead to $6,800 if it breaks above the wedge.

Separately, trader Merlijn uses the Wyckoff model to explain the ETH movement. This model indicates that the ether may have completed the indications of spring, testing, and strength phases. Currently, what is labelled as the last point of support is located within the structure where stronger upward movements often begin. “This is where Ethereum accelerates to five digits.” He wrote, pointing to the next stage of the cycle.

Q4 setup is similar to previous cycles

Ethereum has been strong in fourth quarter performance during past bull runs. In 2017, it exceeded 140% in the fourth quarter. In 2020, these returns were above 100%. This year, ETH fell -45.41% in the first quarter, but recovered in Q2 (+36.48%) and Q3 (+79.55%).

Crypto Rand asked, referring to these numbers,

GM everyone! Is $eth preparing for performances like in 2017 and 2020? pic.twitter.com/jaiv9ogrez

– Land (@crypto_rand) September 23, 2025

Recent rebounds and historic Q4 intensity led to comparisons with these cycles. Although no results are guaranteed, traders are checking if a similar trend occurs.