After what many traders call the long “winter winter,” there are early signs that the crypto market may be warming up. Despite extensive frustrations over the months of record-breaking social media engagement and side-to-face price action, the data points to a budding recovery led by Ethereum’s incredible strength.

The “Ethereum Cycle” appears

In this darkness, Willie Wu’s report identified an important turning point. The market is in the Ethereum Cycle. Historically, as Ethereum begins to outperform Bitcoin, it shows that wider altcoin strength is being built.

Over the past few weeks, ETH has actually surpassed BTC by 40%, but many small coins continue to slide. Big names aren’t waiting for bystanders. BlackRock purchased $36.7 million worth of Ethereum in a day.

Source: Carlhawley

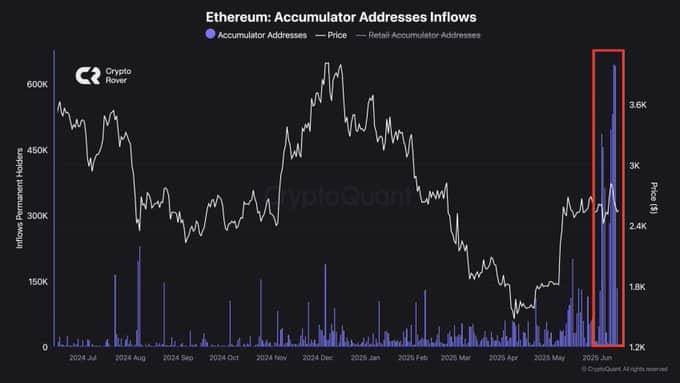

Ethereum prices have bounced back strongly from their April lows, but have since been trading sideways. However, despite the price falling below $4,000, the Ethereum Accumulator Address is currently being purchased at some of the highest rates ever. This level of accumulation has not been seen as the market peak and Q4 appears to be very bullish for ETH.

Related: These altcoins are against the crypto slump with double digit profit

Source: TradingView

A closer look at the total crypto market capitalization (excluding Bitcoin) reveals that it quietly opens up high and lows. This is the same pattern that marked the bottom of the market in the past. This indicates that the worst could be delayed and the breakout could be gaining momentum beneath the surface.

Can Cardano trigger a wider gathering?

All eyes are also directed towards Cardano (ADA). Despite the continued weaknesses of the market, the ADA quietly raised nearly 200% from the low bare market.

Related: Whales accumulate ETH and ADA as retailers are sold in fear, according to data

If Ethereum’s leadership shows thawing, Cardano’s strong performance could be one of the first Altcoins to “bloom” in this new cycle.

Older playbooks do not apply

According to analyst Michael Van de Poppe, some of the problems with Altcoin’s investors have been clinging to an outdated market cycle since 2017 or 2021. Today’s crypto environment is more complex and driven by large-scale forces, including rising and rising interest rates, inflation trends, and weakening of the US dollar. These factors have now shaped the code movement as much as the activity of the chain.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.