Cryptocurrency markets are clearly becoming more cautious as liquidity dries up over the holiday season and uncertainty remains in the air. Bitcoin has managed to remain stable, but the rise in ETF outflows and slowing momentum is hard to ignore.

table of contents

At this point, it is unclear whether BTC prices will fall or if they are just consolidating for the next rally.

summary

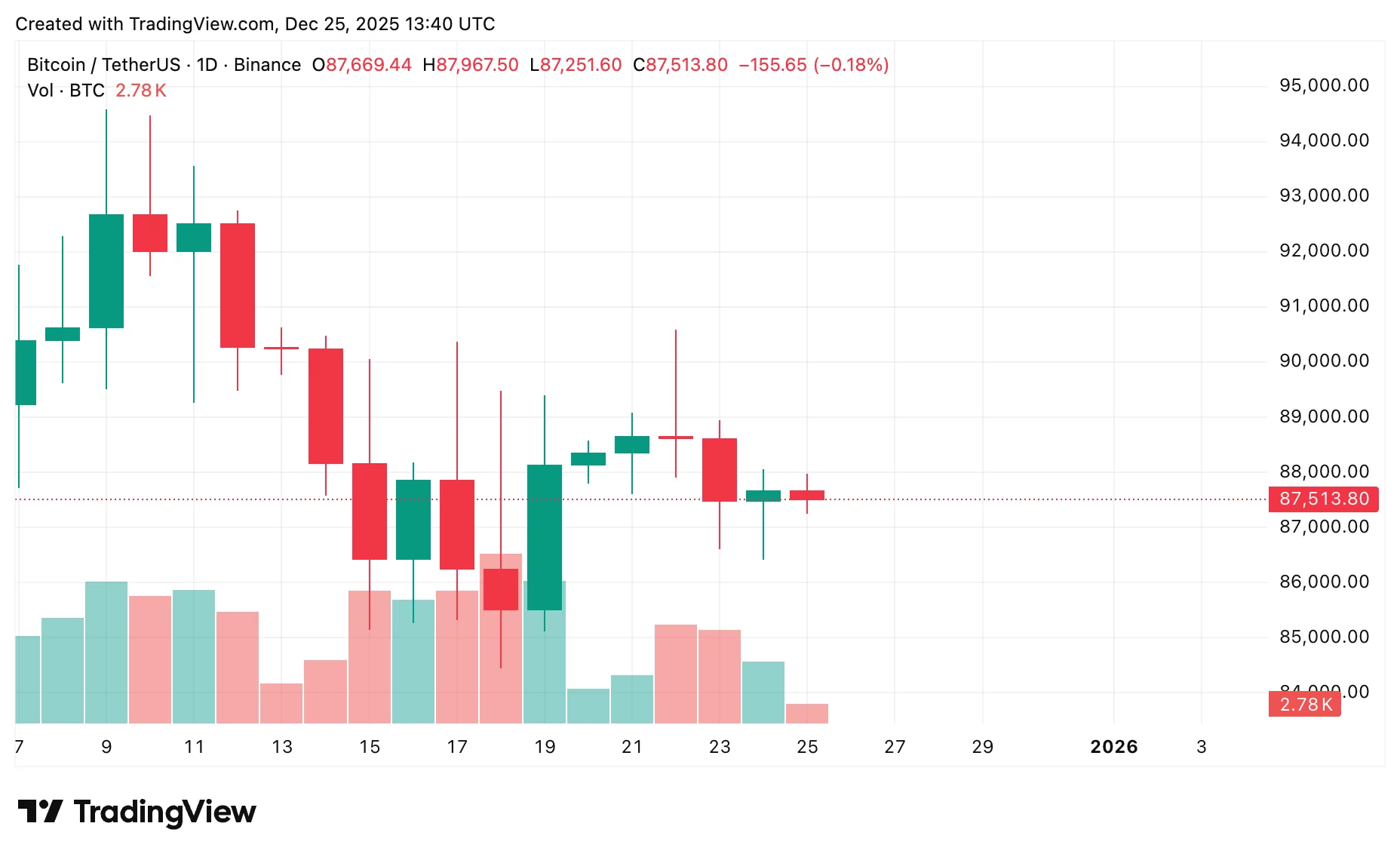

- BTC was trading near $87,500 and consolidated in the $86,400 to $88,000 range amid cautious holiday trading.

- Support between $86,400 and $86,700 remains strong, but $175 million in ETF outflows are weighing on market sentiment.

- A breakout above $89,000-90,000 could push BTC towards $93,000-94,000, indicating new bullish momentum.

- Downside risk remains if the support fails, with a more bearish scenario potentially leading to a fall to $85,500, $84,000-$82,000, or even $80,000.

Current market scenario

As of Christmas, Bitcoin (BTC) was stable at around $87,500, up around 0.3% over the past 24 hours. BTC price remains range bound between $86,400 and $88,000, suggesting consolidation rather than panic selling.

BTC 1-day chart, December 2025 | Source: crypto.news

The support between $86,400 and $86,700 continues to show strength, with buyers flocking in whenever the price reaches this zone, maintaining market confidence.

That said, ETF outflows are hurting market sentiment. The Spot Bitcoin ETF recorded net outflows of $175.29 million on December 24th, which could put pressure on BTC prices in the near term if this trend continues.

Upward outlook

Bitcoin’s technical structure remains constructive, with the price above short-term support and bullish expectations maintained. That said, this zone is acting as a strong ceiling, so to truly regain momentum, buyers will need to clear the $89,000 to $90,000 resistance zone.

If prices break out and end the day higher, market sentiment is likely to improve. BTC predictions in this case would target the $93,000 to $94,000 range, which is known for prior selling pressure. Such a move would mean that ETF outflows would no longer dominate price movements.

downside risk

Bitcoin may seem stable in the short term, but the downside is not negligible. A break below $86,400 during continued ETF outflows could accelerate the rebound, with $85,500 being monitored as initial support.

You may also like: Bitcoin price stalls below $88,000 as ETF falls by more than $825 million amid 5-day outflow

If the sell-off continues, predictions for BTC price will become more cautious, targeting the $84,000 to $82,000 range where buyers have traditionally intervened. In a more bearish market, Bitcoin could even shake off late entrants and test $80,000.

Bitcoin price prediction based on current levels

Overall, this Bitcoin price prediction shows that the market is caught between major support and resistance. The price trend of BTC is not selling but consolidating, and there is strong buying around $86,400. Still, continued ETF outflows remain a downside risk.

As long as support holds, the outlook for BTC remains neutral to cautiously bullish, eyeing a potential rally towards $93,000-$94,000.

If these levels cannot be sustained, Bitcoin could fall further toward $82,000 to $80,000. For now, it’s wise to wait and let the market dictate the next direction.

read more: Top cryptocurrencies to watch this Christmas: Price predictions for Bitcoin, Ethereum, and XRP