Bitcoin traded at $116,393 on September 19, 2025, with a market capitalization of $2.31 trillion and a 24-hour trading volume of $366.7 billion. The cryptocurrency’s intraday range ranges from $116,349 to $117,888, reflecting integration that is close to major resistance.

Bitcoin

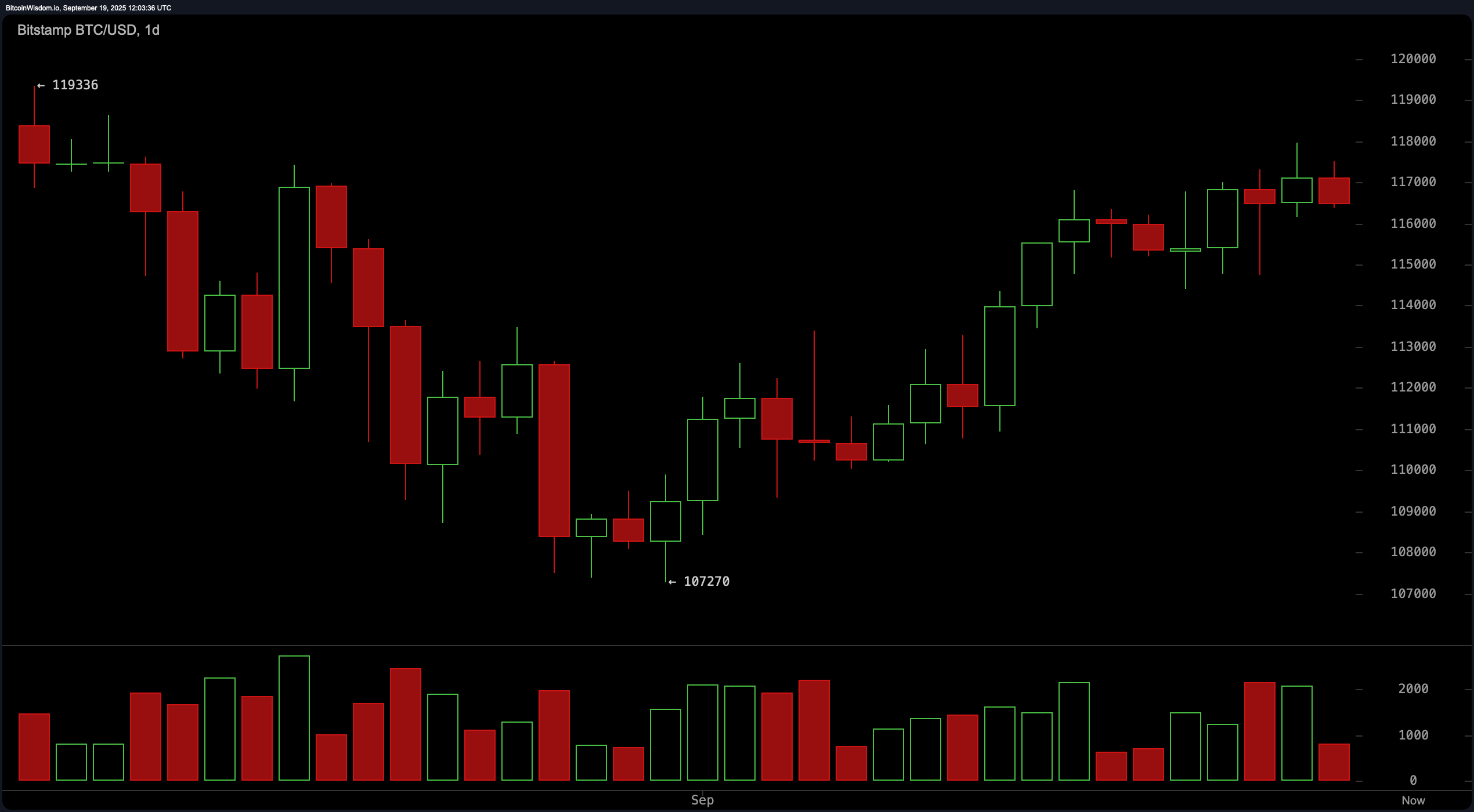

On the daily charts, Bitcoin has been on an uptrend confirmed since early September, bouncing back strongly from its $107,270 support level, which formed a double bottom structure. Price action has since risen steadily, but is now stagnant just below the key resistance zone at $119,336.

The uptrend remains intact, but current consolidation, close to the $117,000-118,000 range, shows indecisiveness. The volume increased slightly during the upward push, but the latest candles suggest caution as prices approach fictional resistance. The key purchase zone is between $113,500 and $114,500, with optimal take pro bit levels of $118,000 to $119,500 and stop losses of less than $111,000.

BTC/USD 1-Day Chart via BitStamp on September 19, 2025.

On the four-hour chart, Bitcoin recently peaked at $117,968, forming several bearish candles that have declined and have lost momentum. This shift is accompanied by a prominent spike in red volume, suggesting the possibility of short-term distribution. Nevertheless, the wider structure remains supportive, with strong advance support observed at around $114,421. The assets could potentially retest an area of between $115,000 and $115,500 before resuming a broader trend. Traders looking at this zone for bullish flip candles may find favorable risk response scenarios.

BTC/USD 4-hour chart via BitStamp on September 19, 2025.

The one-hour Bitcoin chart shows a clear short-term downtrend, featuring a series of low highs and lows following the top of the $117,968. The recent price action reached $116,369, and he challenged minor support. This movement appears to be corrected within the broader bullish structure context seen in the higher time frame. Volume has been rising gradually on the seller side, and we are also seeing a retracement phase. Unless a powerful bullish candle comes true near the $116,000 level, a long entry is quickly discouraged. If the upward momentum returns, you can consider tough entries from $116,000 to $116,300.

BTC/USD 1-hour chart via BitStamp on September 19, 2025.

Among the key technical indicators, the oscillator draws complex pictures. The relative strength index (RSI) is 58, reflecting neutral momentum. Probability theory is in the territory acquired at 87, indicating a potential sale. Meanwhile, the 95 commodity channel index (CCI) and the 19 mean directional index (ADX) both show uncommitted stances, with Awesome Oscillator reading 3,185 with neutral bias. In particular, Momentum (10) is flashing bear signal at 4,930, but the 961’s moving average convergence divergence (MACD) remains bullish.

Moving averages (MAS) provide more critical directional guidance, with all major short- and long-term averages suggesting bullish momentum. The exponential moving averages (EMA) and simple moving averages (SMA) for the periods 10, 20, 30, 50, 100, and 200 all fall below current prices and show strong underlying trend support. The EMA (10) is $115,575 and the SMA (10) is $115,924, both showing bullishness. Long-term moving averages such as the $105,738 EMA (200) and SMA (200) strengthen the positive outlook.

Overall, Bitcoin remains technically strong in its daily time frame, but traders need to remain cautious amidst signs of short-term fatigue. The ideal entry relies on checking support for lower time frames, particularly close to the $115,000-116,000 range. A breakout over $118,000 backed by volume will disable the consolidation paper, reintroducing momentum and testing new highs.

Bull Verdict:

Bitcoin maintains a structurally bullish attitude, maintaining consistent support from all major moving averages and uptrends established on the daily charts. If prices exceed the support zone between $115,000 and $116,000 and volume checks exceed $118,000, you may see a continuation of $120,000 or more in the near future.

Bear Verdict:

Despite strong daily trends, Bitcoin faces immediate resistance pressure and weakening momentum in the low time frame. Failure to collect $117,500 could potentially start a deeper retrace towards the $113,000 range, coupled with a breakdown below $115,000, which could undermine recent rally.