Bitcoin Price After peaking earlier this year, they have struggled to regain that bullish momentum. As of March 29, 2025, BTC prices were trading around $84,122, indicating signs of weakness after the consolidation period. One burning question dominates the crypto space as investors worry about potential flaw levels. Will Bitcoin crash to $25,000? This analysis will decipher current market structure, moving averages, RSI signals and price action patterns to provide a realistic outlook for Bitcoin in the coming days.

Bitcoin Price Prediction: Is BTC prices losing momentum after the 2025 rally?

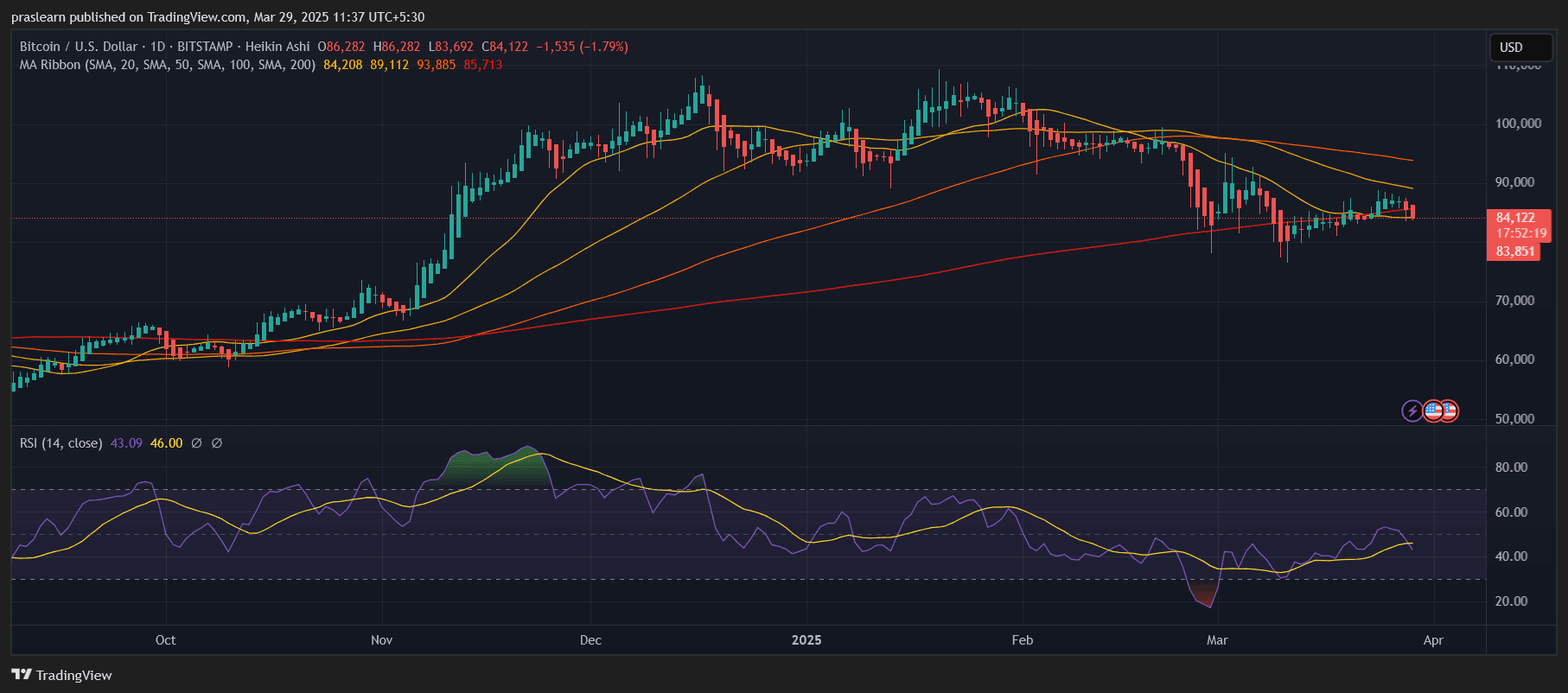

BTC/USD Daily Chart – TradingView

Looking at the daily charts, it is clear that the Bitcoin euphoria rally from late 2024 to early 2025 has faded significantly. After reaching a high of nearly $110,000, the price began a series of low highs and lows. This is a classic signal of weakening trends. What’s even more concerning is that Bitcoin has failed to regain its simple 50-day moving average (now close to $89,112). This is currently acting as a dynamic resistor. The 20-day SMA also exceeded below 50 days, indicating a short-term bearish.

The recent price decline in Bitcoin could largely be attributed to rising global trade tensions, injecting a new wave of uncertainty into global financial markets. The US government’s decision on March 25 to impose a 25% tariff on car imports and other goods from Canada, Mexico and China has intensified fears of an impending global economic slowdown.

As a result, investors’ sentiment has deteriorated across risk-on assets, including stocks and cryptocurrencies. 1.85% of the S&P 500 are not exempt as the announcement clearly shows that traditional markets are also feeling heated, and Bitcoin is often seen as a highly volatile speculative asset.

With increasing protectionist measures and retaliatory trade measures looming, investors could continue to shift capital to safer and more unstable assets, which could cause ongoing sales pressure for BTC in the short term. If these macroeconomic headwinds last without a solution, Bitcoin will struggle to find support, and will be able to revisit potentially much lower levels, even approaching the $70,000-60,000 range in the coming weeks.

Is the moving average a major failure?

Yes, and that’s why it matters. The $93,885 100-day SMA and about $85,713 SMA are tightly compressed near the current price range. Historically, if prices fight 200 days of SMA from the bottom and are not held, it often results in accelerated declines. If Bitcoin prices break more decisively than the 200-day SMA and hold below $83,000, the gates open towards a much lower level, causing panic sales across retail and institutional segments.

What does RSI say about Bitcoin strength?

The relative strength index (RSI) is located at 43.09, well below the neutral 50 mark and is clearly in a bearish area. The RSI has not recovered beyond 50 since early March, suggesting that the buyer is losing his conviction while the seller is slowly gaining control. During a strong upward trend, RSI tends to hover between 50 and 80. Here we reinforce the argument that Bitcoin can see more pain before a sustainable reversal.

Can $25,000 really be on the table?

It may seem extreme to many, but it cannot be ruled out entirely. Bitcoin has a history of brutal corrections. In many cases, they emit 40-60% after reaching a high for the first time in a long time. From the peak near $110,000 from the recent peak, a 60% retracement brings BTC prices closer to the $44,000 level. However, if macroeconomic uncertainty, regulatory oppression, or Black Swan events (such as the collapse of major exchanges) hit the market, psychological levels such as $50,000, $35,000, or even $25,000 could emerge as the basis for panic overrides. It’s not the most likely scenario, but it’s often within the realm of possibilities, especially when the main support levels are broken.

>>Click here to exchange Bitcoin with Bitget <<

What levels should the Bulls follow to avoid crashes?

The closest support is just around $83,000 for a 200-day SMA. Once that level is retained and Bitcoin’s price bounces back above $89,000, the Bulls can regain short-term control. However, if the $80,000-$83,000 range is not retained, the next support zone is around $72,000, followed by $60,000. If these levels also collapse, yes, $25,000 is a realistic downside target for a few months time frame.

Bitcoin price forecast: Is this a dip or the beginning of a deep crash?

Bitcoin is currently in a volatile zone. Bulls have lost steam, momentum indicators are declining, and long-term moving averages are often beginning to be compressed in ways that precede important failures. The crash to $25,000 is not imminent, but it is a scenario that traders and investors must prepare if current support fails.