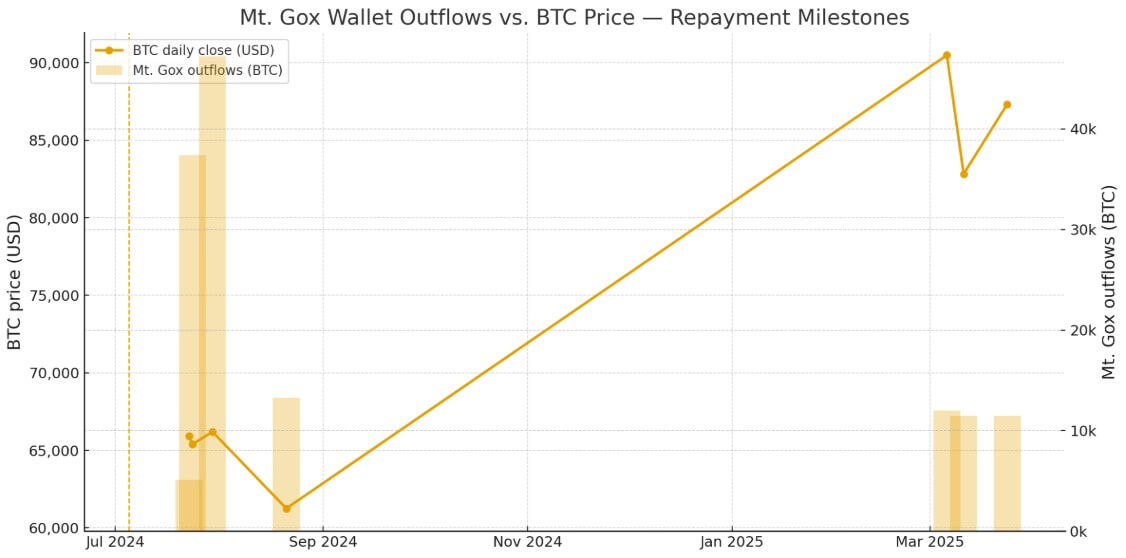

Mt.Gox’s trustees have an October 31st deadline to complete basic, early lump sum, and interim repayments to Bitcoin creditors (BTC), and as the clock ticks, approximately 34,689 BTC still remains in wallets linked to Mt.Gox.

A Tokyo court has extended the original deadline of October 31, 2024, by one year after processing delays and a lack of documents held up the distribution, which began in July 2024.

The trustee will deliver Bitcoin and Bitcoin Cash through designated exchanges such as Bitstamp or Kraken, or in cash to creditors who did not claim the cryptocurrency.

October 31 is the completion date, not a single payment event, and the trustees report that these steps are “nearly complete” for creditors who have submitted all required information.

This backdrop raises the question of whether exchanges will absorb the month-end supply wave, or creditors will put the coins into circulation through custody or over-the-counter channels.

potential routes

Of the original 142,000 BTC in the pool, approximately 107,000 BTC was transferred to the final recipient.

Glassnode reported that 59,000 BTC had reached the exchange by July 29, 2024, and BitGo held approximately 33,023 BTC in tracked wallets by mid-August.

Additional batches continued into late summer, but the current split between exchange-bound and custodial flows remains undisclosed.

Three potential paths will determine how the remaining 34,689 BTC reaches the market by the deadline.

In a staggered distribution scenario, creditors receive their batches during October but choose to keep their coins or move them to storage, minimizing immediate selling pressure.

Kraken and Bitstamp have processing times of up to 90 days and 60 days, respectively. This means that individual credits, even at the same repayment stage, are paid out on different days, spreading potential sales over multiple weeks rather than concentrating them.

In the second scenario, creditors route coins to over-the-counter desks, draining liquidity from institutional investors without accessing the public order book.

Because OTC trading completely bypasses exchange infrastructure, spot trading volume and basis trading will not be affected, allowing distributions to be completed by October 31st.

In the third scenario, a batch of cleared deposited checks is added to the Bitstamp or Kraken order book, resulting in an unexpected currency inflow.

Concentrated inflows are reflected in spot volume and can compress basis spreads as market makers rebalance hedges, impacting ETF arbitrage flows.

Delivery via an exchange has more visibility than a custodial or OTC pass, and sudden wallet movements can be an important signal for traders who monitor Mt.Gox addresses until month-end expirations.

What does history say?

Of the approximately 107,000 BTC distributed, approximately 59,000 BTC reportedly reached exchanges and approximately 33,000 BTC were processed through BitGo. The rest have not been made public. As a result, of the 92,000 BTC tracked, 64.1% was transferred to the exchange.

When applied to the balance of Bitcoin being distributed, the worst-case scenario for a supply dump would be 22,253 BTC reaching exchanges at the same time. At the time of writing, Bitcoin is trading at $106,795.03, indicating potential selling pressure of $2.4 billion.

However, it was the unwinding of the yen carry trade that pushed down the overall crypto market price on about the same day last year, with BTC rising from $58,315.08 to $49,351.27 on August 4th.

Regarding Mt. Gox-related movements, Bitcoin prices were stable on July 30th when 47,229 BTC were moved to three wallets. At the time, the amount was equivalent to $3.1 billion.

Even in the worst-case scenario of $2.4 billion hitting the exchange as a result, Bitcoin’s history suggests that the price may only fluctuate slightly.