Michael Saylor, you were forced to recognize that all worthy assets are flawed and pushed you to focus on only assets that aren’t. It does not immunize you to see the medium of exchange cases. From one perspective, we can see how huge the housing market is, and from another it is scary. But if you experience the pain of driving you to maintain billions of dollars of purchasing power, a home is a decent tool to keep it up.

Your SOV obsession is missing the mark. The biggest aspect of Bitcoin is the medium of exchange. The Fiat system is increasingly separating gold’s functionality, but that doesn’t mean it should. I’m kicking the Hornet’s nest saying that Bitcoin is the medium of exchange, and all other currency lords try to stop Bitcoin. If they took part in place instead of fighting it, that’s great. It gives all billionaires certainty that they can put money in, but using Bitcoin just to store value attacks it. That approach turns it into a captured digital gold 2.0.

There is no valuable storage without exchange media! The exchange medium comes first. Receive transactions and save Bitcoin. If the value store is the main point, announce that you have lost the Bitcoin stack key. It still saves perfectly, but without the medium of exchange, the market will wipe out the fictional fiat values layered above. That value lies precisely because it can be moved, but still used as a medium of exchange.

Oxygen tanks are essential for spares, but breathing is even more important. Value stores are secondary and depend on trading ability. Without it, a value store means nothing. Michael, you learned this firsthand when Argentinean million dollar holdings were diluted 90%. You struggled to maintain value, not because you didn’t see it coming, but because you couldn’t use it as a medium of exchange. Certainly, poor value stores weaken the exchange medium, but why is the latter given priority? Because the ability to exchange can respond to you.

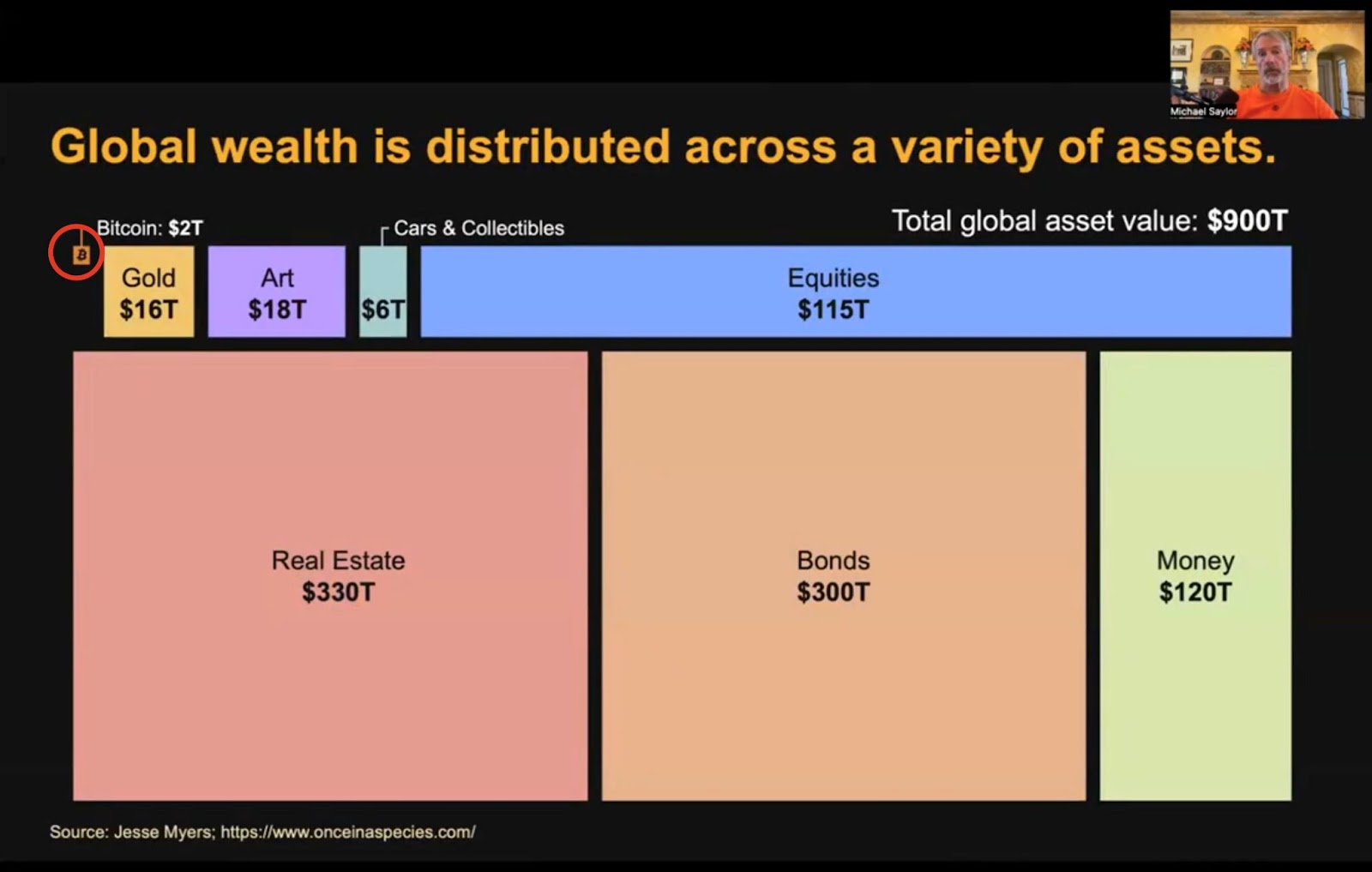

Now most people exposed to Bitcoin know the Jesse Mayers charts you’ve become popular. You claim there is no better idea than a clean store worth $900 trillion, and quickly call Bitcoin one of the most fluid markets in the world, running 365 24/7. guess what? Fluidity means the medium of exchange.

So let’s start with the housing market and break down the Jesse chart. It is valued at $330 trillion, but trading at $1.3 trillion a year is a very poor exchange medium. Regulations and taxes make trade even more stringent on real estate. Still, it’s more than 100 times better as a valuable store, so billionaires praise it, increasingly dominating the market and price the younger generation.

A home may be valuable, but its value grows not only from what it is, but from its connection to nearby utilities. Building a path to it increases value. Adding a superstore or gas station or connecting it to an electric grid will raise the value again. This network creates opportunities for energy to flow into the region and encourages the opportunity to acquire that energy as economic value like money. Therefore, the exchanges that occur in the network are what add value to the home. But I look the other side: if you’re a billionaire and chasing your resources, you don’t want a big network around your home. Instead, privacy is prioritized. While a home may lose value, the goal shifts to increasing the cost that others can reach you, reducing the chances of being attacked.

How about the bond market? The bonds are valued at $300 trillion as a valuable storage, with new bond issuances of $140 trillion and $25 trillion per year. In other words, the medium of exchange value is approximately 50% of the total annual amount. Although it is better than a house in that sense, the numbers still show that people mainly use it as a valuable store.

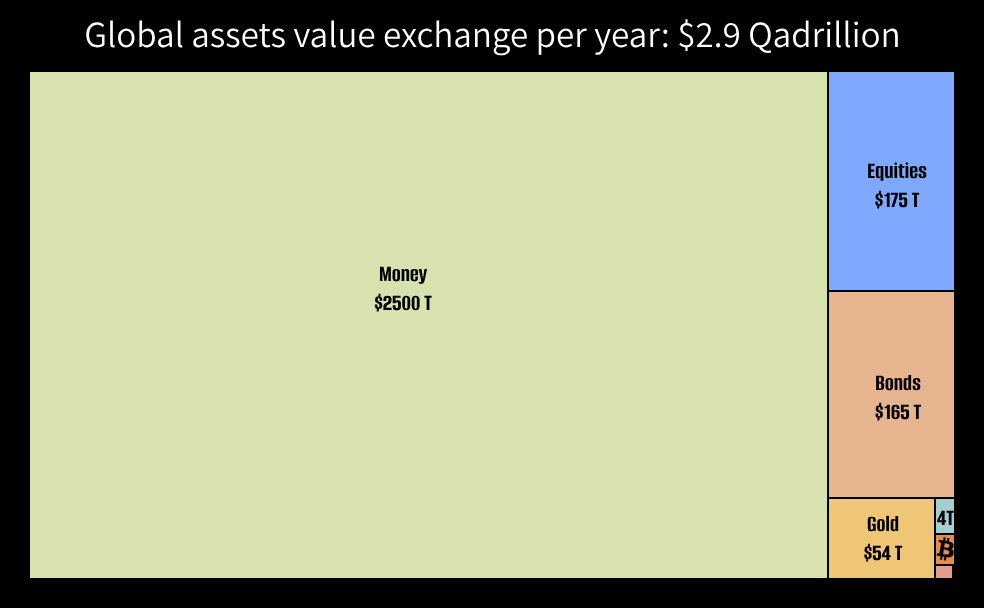

Next is stocks. It was worth $115 trillion and traded for around $175 trillion. This shows their strength as the exchange medium surpasses the reservoir of the role of value. Use MicroStrategy Stock. I know better than anyone else. How much value was preserved last year, and how much was exchanged through it?

The next two sections are interesting. Every year trades in the arts industry are so minor that they don’t even get to chart. Meanwhile, the automobile and collectibles sector is seeing trading volumes of around $4 trillion per year. This highlights that they are primarily considered valuable stores every year, but it also reveals how poor the housing market is, even in the automotive market, as a medium of exchange.

Ooooh Gold! Goldbug raves about its existence for over 5,000 years, calling it the ultimate storage of value for some reason. This indicates that when the medium of exchange role was stripped away, it became vulnerable to capture and manipulation. Sorry, the gold bug, the demon, hasn’t returned to the lamp. Gold is worth $16 trillion, and it claims that gold bugs can store $120 trillion worth of money. They are eager to pump bags, but the market agrees and rates flawed Fiat Money 10 times higher than the sparkling, unvibrant rock. Is Gold a better exchange medium? Trades for $54 trillion each year, boosted by derivatives, and the exchange medium uses 3.5 times the value roll store.

Money may not dominate as a store worth between assets, but it is much more of a major medium of exchange. Other stores with value assets are not approaching. What happens if the top currency, the dollar, becomes a mere value store? It will disrupt the USD network and increase the value of non-US assets as the network intervenes to meet demand. Over time, their storage of value assets rises, but USD assets plummet. Global money is around $120 trillion, but take a look at the top central bank transaction volume. Fedwire is $1,182 trillion, target 2 is $765 trillion, $145 trillion with $145 trillion, and the rest (partial) is $500 trillion (conservative data from conservative data). So, the value store is $120 trillion ($1 trillion in a jesse chart), but the medium for these network exchange utilities is over 20 times more, about $2.5. If 2 billion bankers were included, what would happen to the medium of exchange value? How many more transactions does it cause? And what happens if microtransactions are possible?

Where does Bitcoin fit all of this? The general story encourages holders to never sell, and places Bitcoin only as a valuable store. But the market is talking about something else. In 2024, Bitcoin’s market capitalization reached $2 trillion, with the value exchanged in its first layer, blockchain, at $3.4 trillion. The Lightning Network factor (the exact numbers remain elusive), and the total could be close to $4 trillion. This suggests that the role of Bitcoin as a medium of exchange is twice as important as a valuable function. So, what happens when that long-standing “Hold Forever” propaganda story begins to fade?

Bonds and stocks are financial “commodities” that pretend to be money because of their fiat currency. This creates a market that keeps many out of protecting wealth, further splitting the reservoir of valuable roles. But how comprehensive are these instruments? Or is it a tool to suck value from Fiat’s exchange medium and channel it as well as the need to hoard it to privileged individuals, billionaires, etc.?

Globally, only 10-20% of people are exposed to bonds not directly, but indirectly through pensions or investment funds. In the case of stocks, 15-25% of the population has some access. It leaves 80% of humanity at best, and becomes vulnerable to exploitation, unless there are these tools to protect ourselves. Splitting the value store from the exchange medium sets up the dynamic extractor and extract. This amplifies the “effect of sardine shark.” Those who can print exchange media buy valuable assets and stand by over 80%. This is a feedback loop that weakens the system, widening the gap between what you have and what you don’t. The more you print, the more you cut money from its valuable role.

Another very big part of the entire system is the fees. There is a fee for sending dollars through the banking system, but that’s a service, but how much does it cost when switching from exchange medium to valuable equipment? more. It creates so much friction throughout the system and contributes to exclude that it does not have from preserving its value. At this point, the medium of exchange will become increasingly transformed into an extraction medium rather than an exchange. This is also why Value Case stores are more attractive in the Fiat System.

Bitcoin doesn’t pretend to be money like everything else. It’s the first engineering money that won’t erode and discriminate like a melted ice cube. It was money that I chose that. There is no printer behind it, so there is no urge to exchange it for a valuable “better” store. Even people without Bitcoin can use it to shape their own life into the life they want. Keep it away from chasing money and in something, instead building something that enriches your life on Bitcoin.

The biggest idea is not to preserve value, it drives it. But to move the value, you need to save some first. Again, someone has to move your path first to do some storage. That’s why the rich prefer non-eroded assets like melted ice cubes. Meanwhile, people starting their careers focus on receiving value rather than storing things they don’t have yet.

Why does Value Case stores attract so much attention? One reason could be an effort to get involved. In a worthy store, you don’t need to improve your life. In exchange media you have to work to increase your savings and persuade others to pay for your goods and services. Another factor: In most cases, their Fiat portfolio still outperforms their Bitcoin portfolio. Only when Bitcoin surpasses Fiat Holdings will they consider improving their lives with it. This shift is not tough for many of the world’s population, which lacks savings and assets anyway. This may explain why the current system will leave them.

Even ossification is associated with the need for more exchange media. Michael, Michael is a strong supporter of ossification, but if you’re not used to Bitcoin to reach more people, you’re delaying it. Unlike you, the US knew that in order to make the dollar a global reserve currency, it had to be widely distributed to lock the network effects. They viewed the network as the key to ossification and there was little cost to printing and sharing invoices, so it worked easily. With Bitcoin, its absolute rarity requires a balance between how far it spreads to the store. Still, that doesn’t mean you shouldn’t use it at all.

The metaphor for storing fat in the body is key to long-term survival. Certainly, however, it overlooks the need for a stable food income to stay alive before storing fat. If you don’t have any income, you have nothing to store. So the exchange comes first. But for those who are not worried about hunger, the focus shifts to food storage to prevent corruption. I will continue to bash this point, underscore your bias against a store of value that distorts your judgment and misleads others.

At this stage of my Bitcoin journey, I am sure of this: chasing money will corrupt you. Bitcoin shifts that. It will stop you from pursuing money infinitely and allow you to use it in the life you want. What happens if you have enough of everything you want? So what? With Bitcoin, it is completely possible and every bitcoiner must be ready with an answer about when it happened. But chasing money is a bottomless pit you can’t fulfill. The Bible says that money love is the root of all evil. I agree, but how does it unfold? What is the mechanism? Chasing money – making it your number one priority and lowering other things – is a mechanism.

We are not building a Bitcoin standard. I’m stacking decks. Like gold in the past, you are stocking up on Bitcoin from people and institutions this time, further entrenching Fiat standards. Saylor, you’re not attacking the dollar as some believe. You are strengthening it by boosting your stocks and their ecosystem. Instead, you speculatively attack people who fund your Bitcoin purchases. You’re not just hurting them. By strengthening the dollar, it amplifies the pain of other currency owners. Are you saving while the world is watching? It’s not a cyber city. It is a gated property funded with their own money.

I think people want to invest Bitcoin in your securities. How many actually do that? The largest list of true Bitcoin is sure that they won’t trade the perfect storage of value assets for Fiat’s “instruments.” Ask yourself: At this point, do you want to use Bitcoin to buy Apple stock? After all, you invested in them. That doesn’t make sense – I’ll turn it into some Fiat stuff, pay the Fiat fee, give you bitcoin to strengthen Fiat custodians and third parties, so you can buy Bitcoin again on the other side.

In the end, I have no evidence, but I’m sure I already know everything I’m saying in this article/message. It’s written to you, but Michael, it’s aimed at people who see you as a new Bitcoin yes and blindly chase your actions without questioning. They make reckless bets on their lives – bets that could wipe out their bitcoin – undermine the financial protections and interest rates you have. Your message they reflect does not apply to most of humanity.

Bitcoin is not just another asset or financial tool, it is money that is not crossing borders and is not permitted for people. Otherwise dealing with it reduces its true value. Simply storing it does not provide freedom. Allowing the SATS flow will create a network. SATS Flow promotes cooperation for a better future. SATS flows strengthen the ecosystem. I’ll keep some for tomorrow, but not the wealthiest man in the grave. List them for plans to keep moving later.

This is a guest post by Ivan Makedonski. The opinions expressed are entirely unique and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

Vehind the Vault: Why the true power of Bitcoin is in motion first appeared in Bitcoin Magazine and is written by Ivan Makedonski.