The world’s largest crypto exchange binance suffered a medium-term burn on Thursday from a Terra Luna Classic token. The community has seen a general interchain summit to hear important developments about LUNC and USTC, but prices continue to remain low.

Binance sends more rank tokens to burn addresses

Crypto Exchange Binance burned its fifth Terra Luna Classic token this month. Following the June 19 transaction, over 24,853 Lunk Tokens have been sent to burn addresses.

The latest burns have burned Binance this month totaling 498.6 million lunks. Additionally, the net total burns from crypto exchanges so far have reached 73.04 billion tokens. This represents 17.8% of all ranks burned by the community.

In particular, the Terra Luna Classic Community has burned 41.117 billion Terra Classic tokens so far. Over 383 million tokens have been burned over the past seven days, and 200 million people boldly burned on Wednesday.

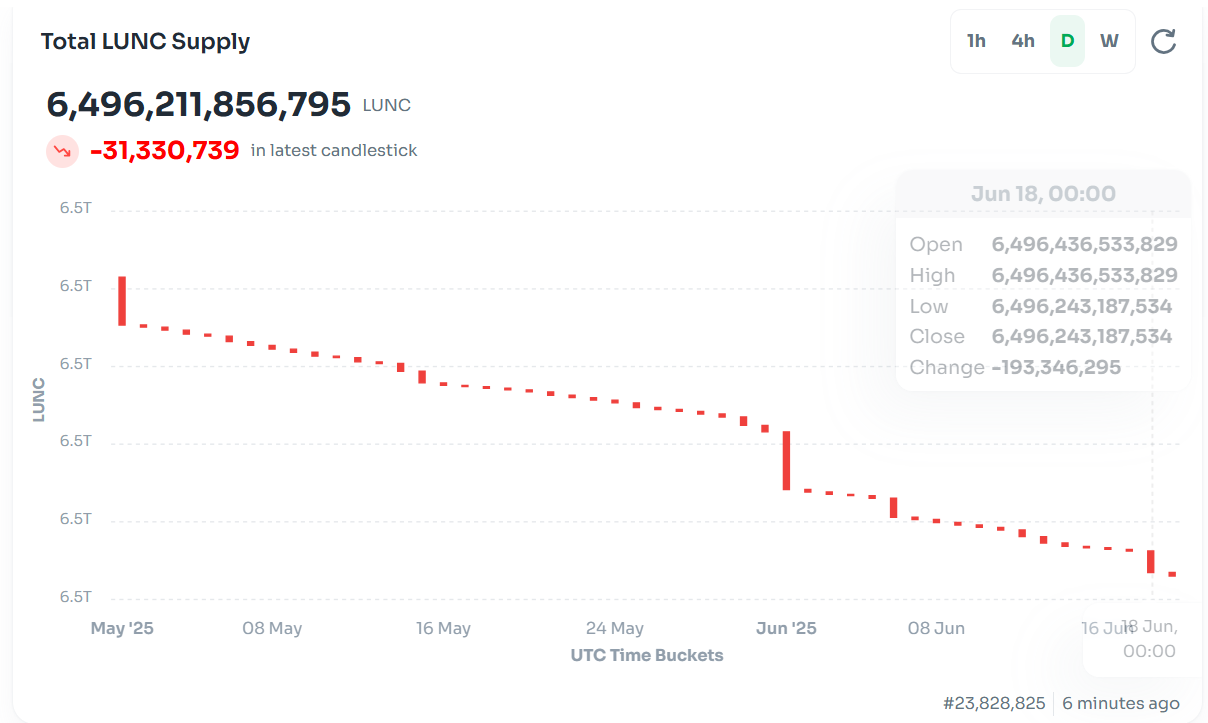

This was one of the biggest daily burns in recent weeks, pushing the total circulation supply to 6.49 trillion Lunk.

Total rank supply | Source: Stakebin

Terra Luna Classic Community to join the Cosmos Interchain Summit

The Cosmos Interchain Summit is scheduled to take place in Berlin, Germany from June 20th to 21st. Many key members are expected to participate in the event, including developers of the Terra Luna Classic Community.

The community also heard about important developments regarding the Terra and the classic chain of Terra. The proposal for Velidator Vegas to reinvigorate the market module will be closely monitored by the Terra Classic Community.

The depletion of Oracle pools has become a concern for the community. It has dropped from 115 billion to 69 billion runns of tokens over the course of one year.

Why are LUNC prices continuing to fall?

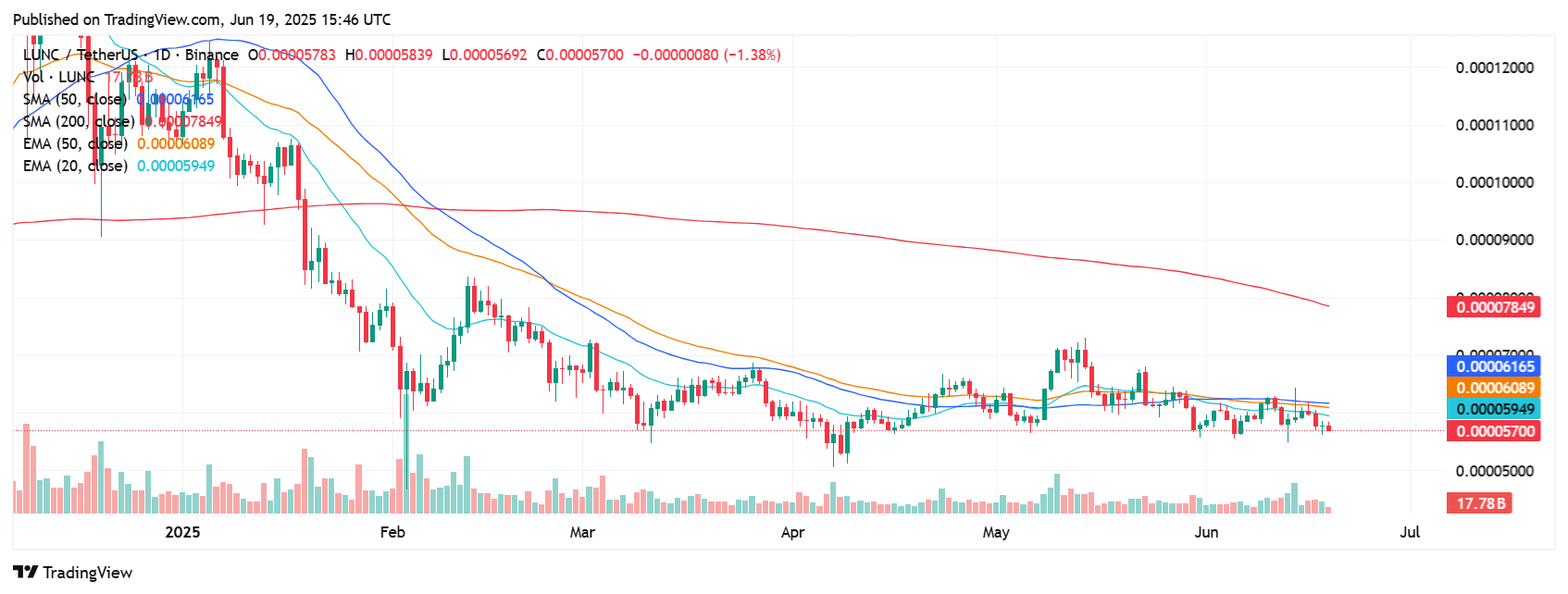

LUNC prices jumped nearly 0.5% over the past 24 hours, with price trading at $0.00005718. The 24-hour lows and highs were $0.00005667 and $0.00005836, respectively.

Furthermore, trading volumes have fallen 27% over the past 24 hours, bringing down traders’ interest. The decline in trading volume comes from reports that the US is probably preparing to hit Iran as the conflict between Israel and Iran escalates.

The formation of the “Crucified Death” in February caused prices to drop. It is evident in the daily charts, showing a 50-SMA (blue) crossover below 200-SMA (red). This indicates a shift towards bearish or downward trends.

LUNC’s main support was nearly $0.000055. If you can’t maintain support of $0.000055, LUNC prices could drop to the $0.000045-0.00005 range.

Another indicator of bearish trends is the exponential moving average (EMA). The short term 20-EMA has a crossover under the 50-EMA. This shows the low odds of recovery in Lunk prices over the next few days, unless major events overturn the trend.

Rank Daily Chart | Source: TradingView

Meanwhile, open interest on total 1000lunc futures has increased by 0.77% over the past 24 hours, according to Coinglass data.

Interest opened in the last four hours increased by 1.54% in two directions, indicating an increase in sentiment among derivative traders. However, open interest fell 1.32% on the Bibit.

Furthermore, total open interest in Lunk futures has also declined slightly over the past 24 hours. At the time of writing, the total ranked futures OI was $8.21 million.

In particular, many crypto exchanges have reduced total open interest. OKX and Bitget have dropped LUNC futures by 0.32% and 3.28% over the past four hours.