Yesterday, Ethereum (Ethereum) fell below the standard amid widespread market volatility.

Analysts are currently assessing where Ethereum could find a bottom. By leveraging technical analysis, on-chain data, and market cycle theory, the following scenarios have emerged: EthereumThe next big move could be unfolding.

Analyst outlines Ethereum bottom scenario

Ethereum’s recent price movements reflect the uncertainty gripping the broader crypto market, with the escalation and de-escalation of geopolitical tensions resulting in significant volatility.

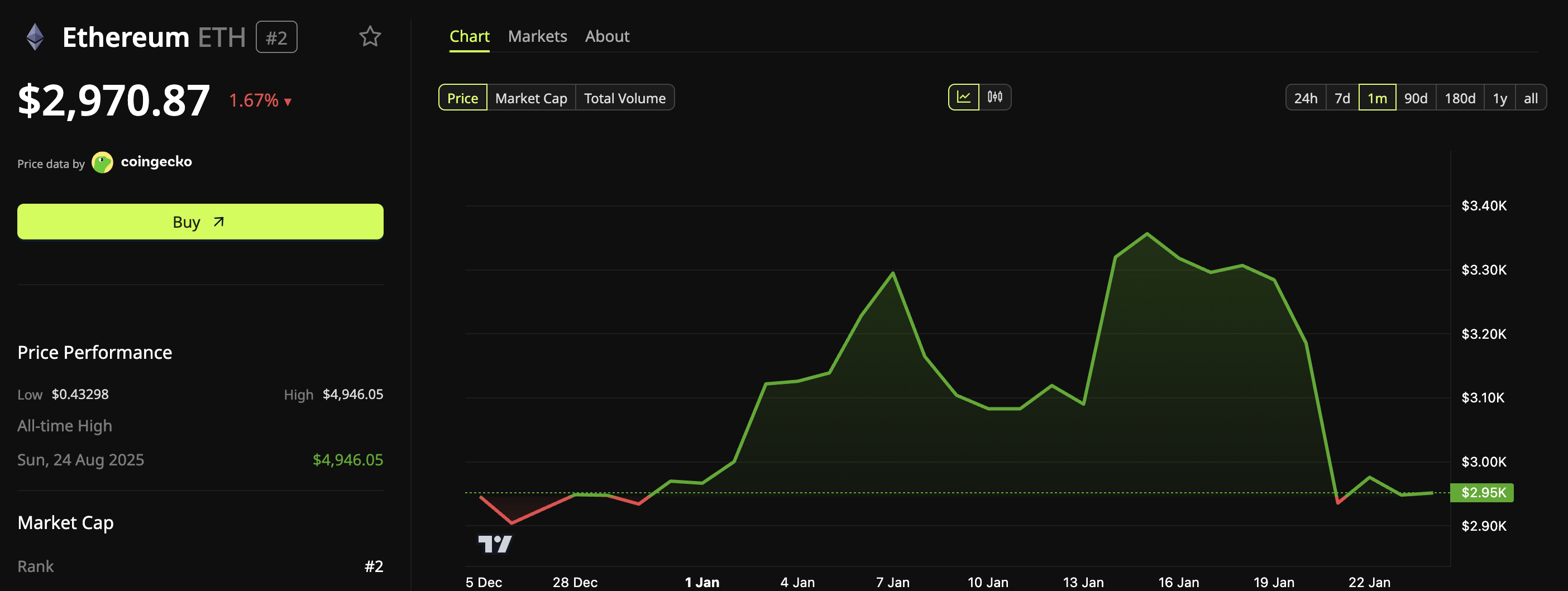

The second-largest cryptocurrency has fallen by 1.67% in the past 24 hours, according to data from BeInCrypto Markets. At the time of writing, Ethereum was trading at $2,970.87.

ETH) price performance. Source: BeInCrypto Markets”>

ETH) price performance. Source: BeInCrypto Markets”>

Ethereum (Ethereum) Price performance. Source: BeInCrypto Markets

Analyst Ted Pillows suggested that a successful rally above the $3,000 to $3,050 range could pave the way for the $3,200 zone. However, if this space cannot be reclaimed, Ethereum could be exposed to new annual lows.

Against this backdrop, other analysts have also outlined fundamental assumptions about Ethereum. CryptoQuant analyst CW8900 observed that the realized price of an Ethereum accumulation address is an indicator that reflects the average cost for long-term holders to acquire the address. Ethereumhas continued to rise and is now approaching the spot market price.

This trend suggests that large investors, often referred to as whales, are still adding to their positions rather than exiting them.

“Furthermore, realized prices are a strong support level for accumulation whales,” the analysis states.

The analyst added that Ethereum is not trading below this cost threshold, suggesting that whales tend to defend this price range by increasing their buying activity. Based on this data, CW estimates that even if Ethereum falls further, the potential bottom could be around $2,720.

“In other words, even if further declines occur, the bottom is likely to be around 27,200, which corresponds to about a 7% difference from current prices,” CW writes.

From a technical point of view, trader Kamran Asghar argued: Ethereum The third “huge weekly round bottom” was formed. The previous two formations were followed by a price increase that could hint at further upside.

On higher time frames, other analysts have also noted a similar reversal structure. According to analyst Bit Bull, Ethereum On the monthly chart, it appears to be forming a double bottom structure alongside an inverted head and shoulders pattern. Both of these are generally considered bullish reversal signals in technical analysis.

“I think Ethereum 2026 will surprise everyone,” Bitbull said.

Ethereum

Ethereum You’re doing what you have to do after a brutal cycle. That is, the base.

The story of “generational bottom” is not about a V-shaped recovery, but about structure.

Higher lows + recovery of previous value = slow transition from laggard to leader.

The real thing is that it is accepted beyond this range… pic.twitter.com/76AsVKX8PR

— CyrilXBT (@cyrilXBT) January 21, 2026

Finally, analyst Matthew Hyland pointed to historical cyclical patterns. He suggested that Ethereum may be moving into a new phase of market structure.

This approach argues that unlike Bitcoin’s 4-year halving cycle, Ethereum follows a 3.5-year pattern. The analyst said the cyclical bottom will form in the fourth quarter of 2025.

“The 3.5-year cycle, like the previous two cycles, will see a new all-time high and then decline until months 40-42. Ethereum “It’s started,” he said.

Overall, analysts’ views remain mixed, but several indicators suggest that Ethereum may be approaching an important tipping point. Although short-term volatility persists, on-chain data, technical structure, and historical cycle patterns point to areas where downside prices can attract new demand, potentially setting the stage for Ethereum’s next move.

The post Where is the bottom for Ethereum? How analysts evaluate on-chain and technical signals appeared first on BeInCrypto.