Gate Research, the research arm of cryptocurrency exchange Gate.io, has released a weekly report on the Bitcoin and Ethereum markets.

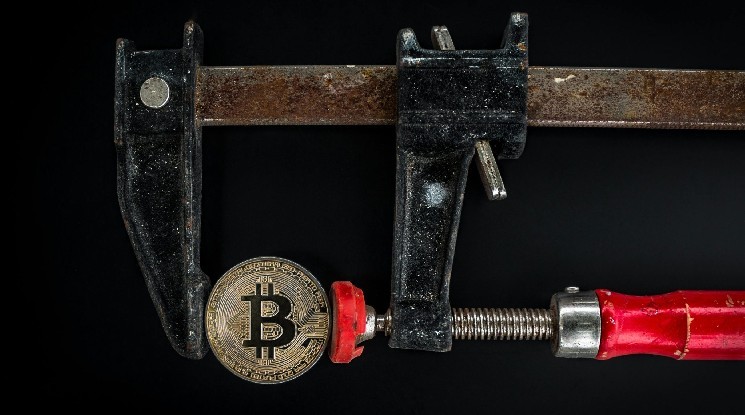

The report noted that while Bitcoin briefly dipped below $100,000 and then recovered to $106,000, this rise may just be a technical correction.

With today’s decline, BTC price is currently trading at $101,180.

Analysts at Gate Research argued that easing concerns about the risk of a U.S. government shutdown and a rebound in risk appetite supported Bitcoin prices, but trading volumes and capital inflows remained weak. According to the report, “While the MACD main indicator shows a positive crossover, this does not indicate a sustained uptrend.”

Meanwhile, Ethereum reportedly fluctuated between $3,400 and $3,650 this week with limited recovery momentum. It was noted that the recent surge was a technical correction rather than the start of a new bullish phase, as overall market sentiment remains cautious.

According to data from Gate Research, Bitcoin’s implied volatility (IV) was 45%, while Ethereum’s was 74%. These high rates suggest that analysts expect market volatility to continue.

Analysts noted that Bitcoin’s realized volatility (RV) has fallen to 39.7%, with the volatility risk premium entering positive territory. This suggests that market participants are starting to overestimate future volatility.

*This is not investment advice.