The Federal Reserve’s 25 basis point (BP) rate cut has sparked a critical move across the largest whales in the crypto market.

From large Ethereum (ETH) purchases to facility solana (SOL) withdrawals and shifts in the dynamics of XRP supply, this response reflects how macropolicies shape the cryptographic flow.

Eth Whale deploys $112 million post-feeding cuts

Hours after the Fed announced its quarter point cut, on-chain trackers flagged the incredible Ethereum purchase.

According to lookonchain, the whale’s address 0xd8d0 spent $112.34 million to get 25,000 ETH for $4,493.

After FRB is reduced by 25bps, OTC whale 0xd8d0 spends 112.34m $usdc to buy 25,000 $eth at 4,493.https://t.co/7euzqpgfro pic.twitter.com/vf55m9te9e

– lookonchain (@lookonchain) September 18, 2025

Aggressive accumulation reflects new confidence that borrowing costs and soft dollars can lead liquidity to risky assets.

Already reducing demand and hoping for upgrades to scale, Ethereum saw an immediate increase in whale activity. This suggests that the agency is at the forefront of wider gatherings.

Another whale, address 0x96F4, individually withdrawn 15,200 ETH, worth about $70.44 million from the Binance exchange within two hours. This adds to speculation that the accumulation is intensifying among deep players.

The institution continues to stack Solana

Solana is not that active. Agency broker Falconx has withdrawn 118,190 Sol, worth $28.39 million from Binance, marking yet another indication of institutional trust.

LookOnChain data shows that six strategic reserve entities each have over 1 million SOLs.

The forward industry is taking the lead, earning a massive 682 million Sol portfolio worth $1.58 billion with an average cost of $232.

Currently there are six strategic $SOL reserve entities each holding over $1 million.

Among them, the forward industry has a massive $6,822,000 Sol ($158 million), with an average purchase cost of $232. pic.twitter.com/yxs6azmfdr

– lookonchain (@lookonchain) September 16, 2025

The volume of Solana Futures has reached $22.3 billion in recent weeks, and it appears that SOL currently has a stronger demand from both institutions and whales among assets covered by the ETF list based on the SEC’s new generic standard.

XRP Whale moves $50 million to Coinbase

XRP activities took a different form. The Whale has shifted its $16.4 million XRP to Coinbse Exchange, which is more than $50 million.

The move coincided with another XRP milestone. The XRP reached 6.99 million holder bases in September 2025, making it the new ATH (ATH).

XRP holders will skyrocket to ATH. Source: Santiment

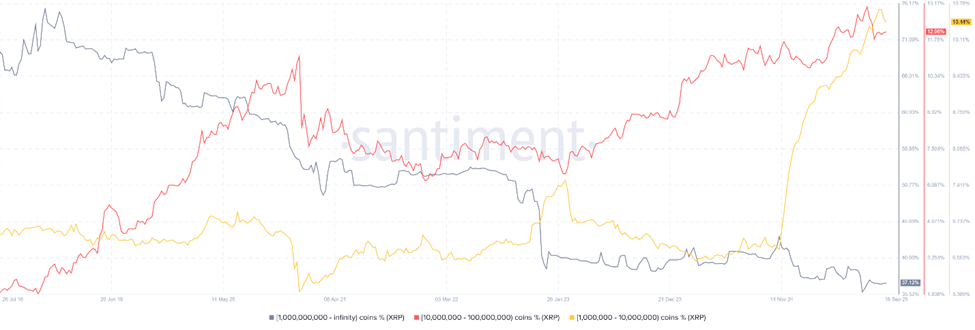

However, under the surface the distribution is changing. The supply share of wallets with XRP exceeding 10 billion has declined, but the number of mid-sized holders of XRP to 1 billion has skyrocketed.

XRP holder distribution. Source: Santiment

This indicates a structural shift from enriched whale holdings to wider retail participation.

XRP’s Expanding Institution Profile

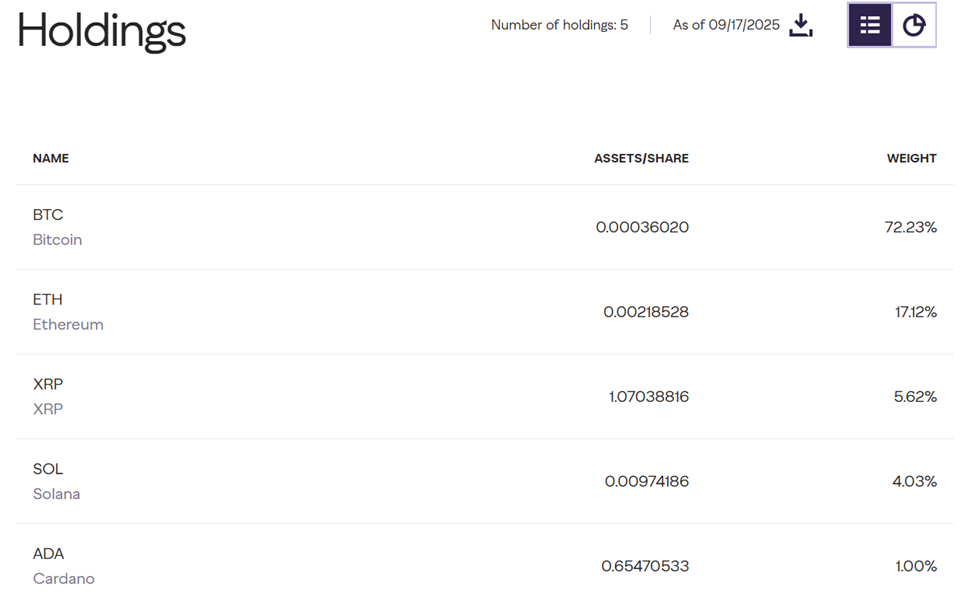

Nevertheless, XRP continues to punch beyond the facility’s market weight. It currently holds the third largest allocation in Grayscale’s Digital Large Cap Fund, which was recently approved by the SEC generic ETF list standard.

GDLC Holdings from Grayscale. Source: Grayscale Investments

“The Grayscale Digital Large Cap Fund $GDLC has been approved for trading along with generic list standards. The Grayscale team is working quickly to deliver the first multicrypt assets ETP to the market along with Bitcoin, Ethereum, XRP, Solana and Cardano.”

At the same time, CME is planning to launch futures on XRP, with the option debuting on October 13th with regulatory approval.

Falconx and DRW are one of the companies supporting launches, allowing them to unlock new demand from deeper hedging tools and institutions. Already, XRP futures have reached $1 billion of public profits, highlighting strong liquidity.

Accessing whale rearrangement convergence, shifting supply distributions, and extended derivatives paint bullish mid-term paintings.

While XRP’s short-term prices remain low, the market structure suggests that the foundation is laid for wider adoption and investor trust.

What ETH, SOL and XRP whales did is what they did after the Fed’s 0.25% interest rate cut first appeared in Beincrypto.