Ethereum (ETH) is coming out of a bearish situation. Ethereum price has been hovering around $3,016, up about 2.3% in 24 hours, but is currently less than 2% below a key level that could reverse sentiment.

This boost comes at a difficult time as the market is thin towards the end of the year. The question is simple. Is ETH about to beat the bears or is this another fake?

Bearish Head and Shoulders hits roadblock

ETH has formed a head-and-shoulders pattern on the daily chart, a bearish structure that typically collapses once the price loses its neckline. Here, the neckline is around $2,809. Based on pattern predictions, a 20% drop could be the goal if the breakdown is confirmed.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bearish ETH Risk: TradingView

This decline may not be easy.

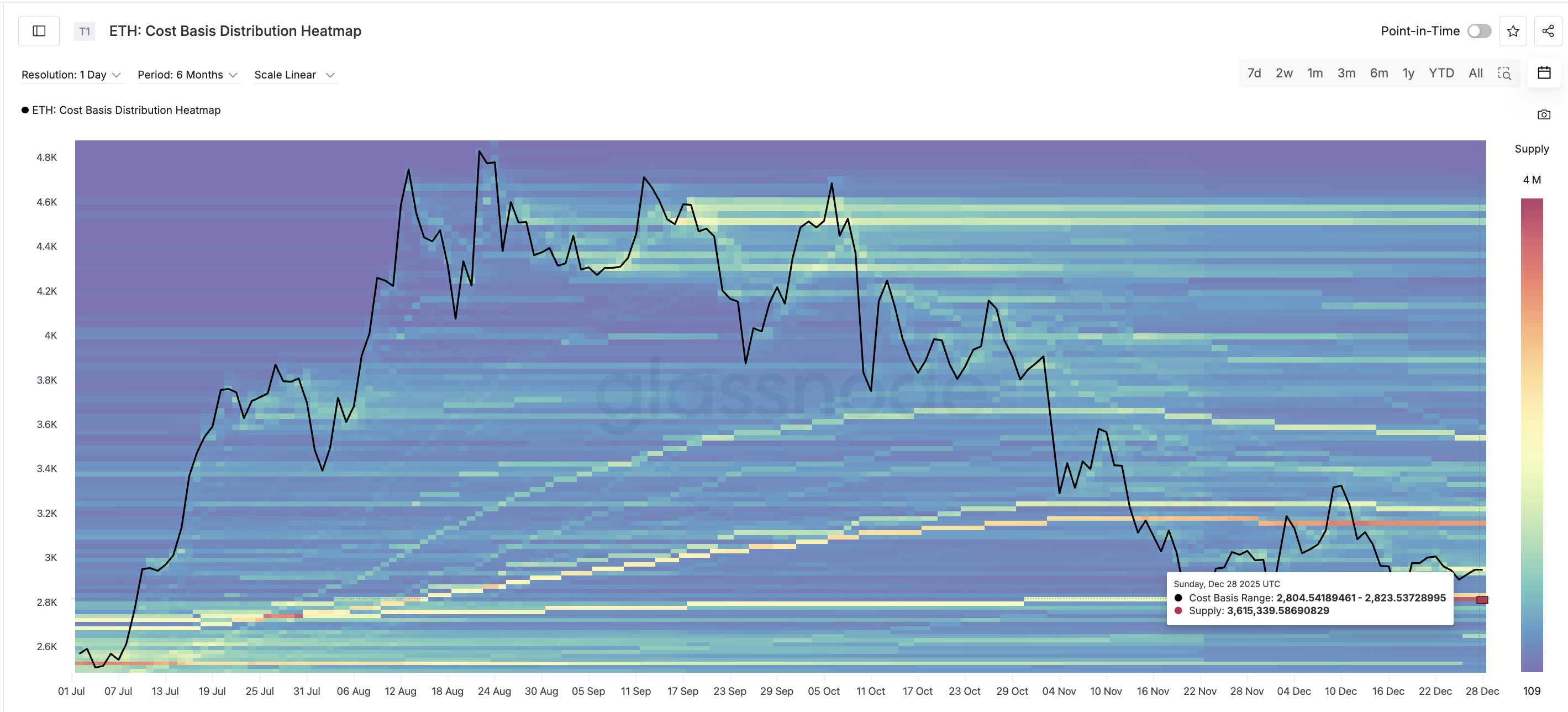

In the cost-based heatmap, the large supply cluster is located between $2,804 and $2,823 and holds approximately 3.6 million ETH. This is where a large group of holders last established positions. Those holders often defend that zone when the price returns to that zone. There is still a risk of Ethereum failing due to this cluster, but it seems less likely.

Strong neckline support: Glassnode

In short, the bearish picture exists, but there is no clear path for the bears.

Whale buying responds to 98% reduction in long-term selling

Currently, two on-chain shifts are supporting ETH’s attempts to fight back.

Whales (excluding exchanges) increased its holdings from 100.65 million ETH on December 28th to 101.05 million ETH today.

This means approximately 400,000 ETH has been added. At current prices, that means about $1.2 billion was bought within 24 hours.

Whales Add Near Support: Santiment

This jump coincided with ETH regaining ground from the right shoulder of the pattern. When large holders accept bankruptcy risk, it often signals confidence. At the same time, 365 days to 2 years of spent coins fell from 45,846 ETH on December 27th to 1,076 ETH today.

This is a 98% reduction in the movement of old coins. Spent coins metrics track coins that are returned to circulation after being held unused.

Long-term ETH holders move fewer coins: Santiment

Reduced movement means long-term holders are no longer selling on strength. This takes pressure off and allows the whale to move forward with its recovery attempts. Supply dynamics are currently pointing to the upside as whales buy and long-term holders refrain from selling.

Ethereum price is close to defeating the bears

ETH is trading around $3,016. The first line that matters: $3,069. This is less than 2% from current levels. Short-term bearish control will be broken if the price closes above $3,069 for the day.

Above that, the bearish pattern’s deactivation zone is located at $3,449. That level is the top of the head in Head and Shoulders. A close of the day above $3,449 breaks the bearish structure and transfers control to buyers.

Ethereum Price Analysis: TradingView

Below, $2,809 is the neckline, and a loss of this will re-open a 20% downside. And that could push the price below $2,623 first, invalidating the bear market setup. For now, ETH is in between the two outcomes, but momentum and supply action will favor the bulls if it clears $3,069.

The post Whales Add $1.2 Billion to Ethereum (ETH) as Price Tests Bearish Formation appeared first on BeInCrypto.