Bybit sent several transactions for the XAUT token, highlighting the growing demand for tokenized gold. Whale has amassed a growing XAUT portfolio worth over $7 million.

Bybit became part of the growing demand for XAUT, Tether’s tokenized gold. The exchange’s hot wallet started sending XAUT transactions the day before, and whale addresses started accumulating tokenized gold.

A recent shift in the narrative has led crypto investors to switch to metals. XAUT is finding new demand and trading volume as it is the most easily available token. Whale’s portfolio rose $6.95 million Following recent records for gold in traditional markets.

Whale’s recent purchase amounted to 450 XAUT, each equivalent to 1 ounce of gold, transferred directly from Bybit. hot wallet. The recipient’s wallet will be newly created and funded with only enough ETH to facilitate the gas fee transfer.

XAUT trading volume increases to 1-month high

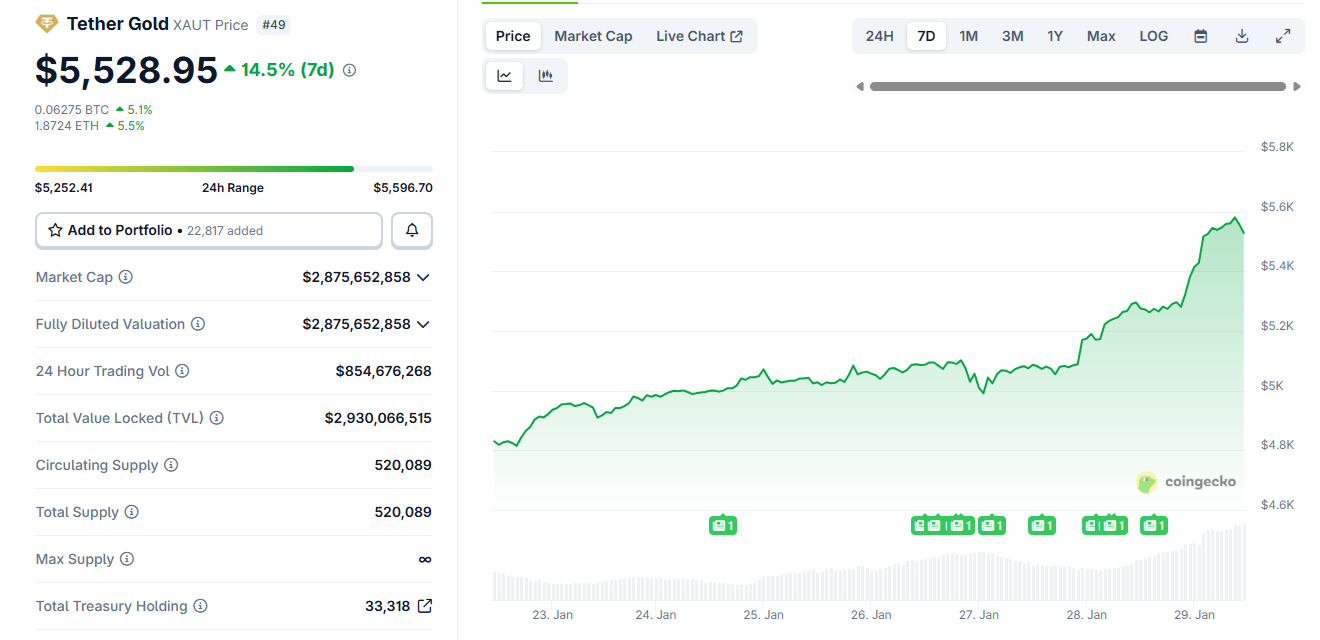

Last month, XAUT trading volume gradually increased as gold set a series of price records. Volume expanded to $854 million, surpassed only by an unusual spike in November. The interest in XAUT coincided with a decline in performance. $BTC And even major altcoins.

Interest in XAUT increased on spot exchanges as Tether recalled its dedication to storing physical gold, expanding its gold inventory, and moving gold to the market. mining.

XAUT traded at a slight premium to physical gold at $5,542.07, reflecting the general demand for easy on-chain access. Spot gold hit $5,537.78 on a mix of speculation and a narrative of hedging against inflation.

XAUT’s accumulation shows that crypto traders are still looking for a market with promising growth and low drawdown risk. The recent purchase of XAUT and speculative trading in other gold-backed tokens will continue for a long time. $BTC Drawdown. The major coin has remained without a new high for 115 days and is down nearly 30% from its cycle peak.

XAUT open interest rises to record high

XAUT has exceeded spot demand and has recently increased its derivatives open interest. Bybit remains the main venue for XAUT speculation, with $177.9 million in open interest. In total, XAUT’s position grew to a record $194 million.

Until recently, metal-backed tokens in cryptocurrencies were relatively niche and a test case for tokenization. Silver does not yet have a metal-backed token, although price speculation has surfaced on derivatives exchanges including HyperLiquid.

XAUT is primarily expected by traders, who expect gold’s rally to continue beyond speculation and into a full-fledged rally.

XAUT was at one point trading at a premium to spot gold as crypto traders increased trading volumes to a one-month high. |Source: CoinGecko.

Hyperliquid supports speculation in PAXG, another major gold-backed token by Paxos. Whales are holding over 85% long positions in anticipation of gold expansion.

Currently, gold-backed tokens are only a small part of the cryptocurrency market, and their appreciation relies on gold futures and general TradFi trading in the spot market. But searches for tickers are accelerating, according to data from CoinGecko.

Mindshare for XAUT 164% in the past. Although the token still has a limited presence on social media, a new trend could be emerging as traders seek the safety of metals in tokenized form.