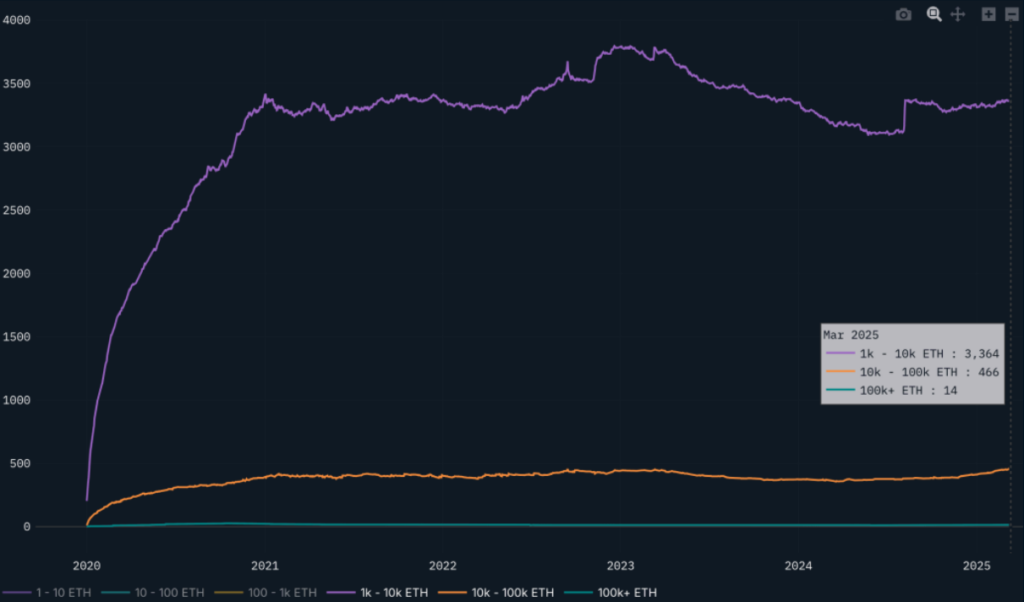

Data from Nansen is accumulating by large ETH owners from late 2024 to 2025.

Although Ethereum (ETH) prices are trading above 44% this year, over $1,900, while some large investors are still adding shares to their holdings, according to Nansen’s on-chain data shared with crypto.news.

Ethereum whales owned | Source: Nansen

Smaller ETH owners are reducing their balances, but more than 12% of whales have 10,000-100,000 ETH in early 2025.

“In the 10K-100K segment, we saw an increase of over 12% in total ETH balance in 2025 alone, but in the 1K-10K segment, we saw an increase of 3% in YTDs we own.”

Nansen

You might like it too: Ethereum’s leadership now sees the growth of Solana styles, says Dragonfly Qureshi

At the same time, Ethereum’s network activity appears to have slowed down, with median gas prices reportedly falling nearly 50 times since early 2024, but some activities appear to have moved to Solana (SOL) and Layer 2 networks.

Ethereum is facing growing competition, and Nansen says the network is “non-existent when compared to BTC, SOL and TIA, as it is competing in all aspects and is a “jack of all trades.”

Despite accumulation from some whales, the broader trend remains uncertain as ETH “many on-chain metrics are desired for many desirable things.”

For ETH to reverse the long-term downtrend against BTC, “significant changes need to occur,” analysts at Nansen argue, but it remains unclear whether recent catalysts can change market sentiment.

read more: Active Ethereum price as a high lipid trader will earn $86 million