- The Ethereum whales have earned almost 1 million ETH in one day. This was the biggest day-to-day consolidation since 2018.

- Replacement spares are lows for several years, with staking and long-term retention rising.

- Surges above $2,700 could show a surge towards $4,000. However, a rejection can cause a 2,000-level revisit.

On-chain data shows that Ethereum whales have won nearly 1 million ETH in one day, the largest daily acquisition since 2018. This massive spike tends to raise confidence among investors despite all the current uncertainty in the market.

Whale bought nearly $1,000,000 ETH in a day

The biggest daily purchases since 2018

– Quinten | 048.eth (@quintenfrancois) June 18, 2025

At the time of writing, Ethereum had a 2% decline at $2,533, following a weekly revision. Nevertheless, the size of this whale’s hoarding is a sign of a breakout revival.

According to the GlassNode chart, there is a clear pattern of increase in ETH Holdings due to addresses with 1,000-10,000 ether. These addresses are currently ETH of around 14 million, breaking the trend of multi-year losses.

The move is due to over 35 million ETH currently being locked, exploded with over 35 million ETH, accounting for 28.3% of the supply. Surprisingly, over 500,000 ETH were staked in June.

Supply decreases as long-term holders intervene

The centralized exchange Ethereum reserve is currently down to ETH of 18.7 million, the lowest since several years. This current leak, sighted by encrypted data, is an increase in long-term retention trends. Netflows for exchanges are negative, and this flow is stable, indicating that more ETHs are away from exchanges than they enter.

Source: Cryptoquant

Addresses without a history of sales control the ETH record high of 22.8 million now. This behavior, coupled with an increase in staking and whale purchases, indicates a drop in sales pressure in the short term. A drop in replacement spares while prices remain stable often reduces sell-side liquidity and may set a supply squeeze stage if demand rises.

Source: Cryptoquant

Impending breakout or another rejection?

The focus is the 50-week index moving average (EMA) and is currently in the range of $2,650 to $2,700. ETH was unable to repeatedly create closings above this level. However, according to Crypto analyst Ibrahim Koshal, the region’s historic breakouts have led to rallies of 25% to 135%.

If Ethereum breaks this mark, technical forecasts show that the initial primary objective is the price of $4,000. This price also coincides with the top edge of the long-term bullish flag pattern. Upwards, the more bullish Fibonacci expansion levels are priced at $5,817 and $8,549.

$ ETH Macro Bull Flag Formation

Ethereum has been integrated in a massive bull flag since 2021.

Each touch of support leads to a strong gathering and we are once again in that rally phase.

$$ETH Technical Breakout Target: $8,000

The next expansion phase is…pic.twitter.com/yd6utashfw

– June 17, 2025

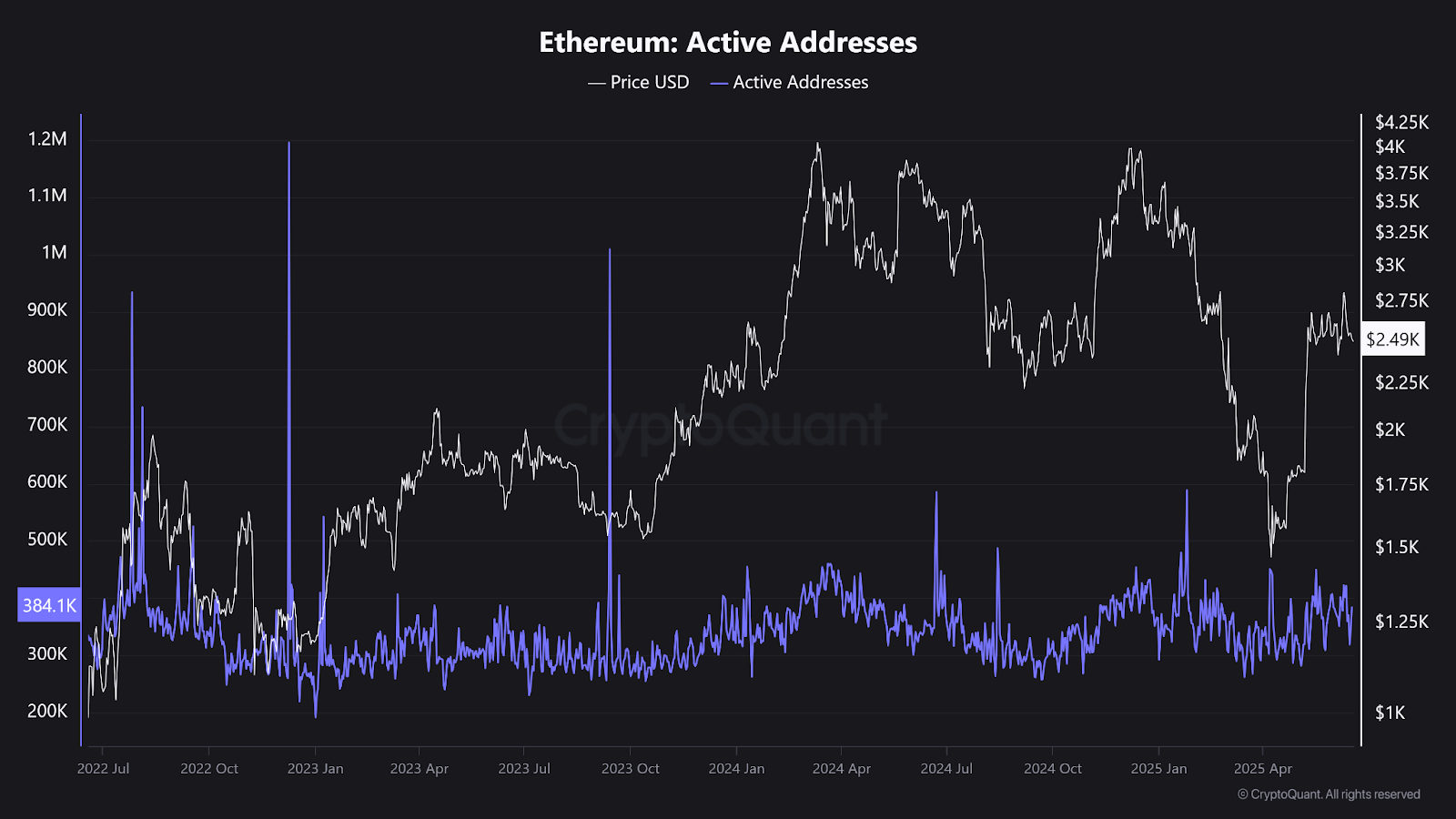

However, the inability to break the 50-week EMA could cause a pullback to support at the $2,000-2,050 mark. On-chain data shows that active addresses are around 384,000 medium numbers, and may require an upward trend to maintain the data’s upward trend.