Recent data shows that revenue in the cryptocurrency industry is increasingly flowing to user-facing applications rather than the underlying blockchain networks, indicating that where investors and developers focus may shift.

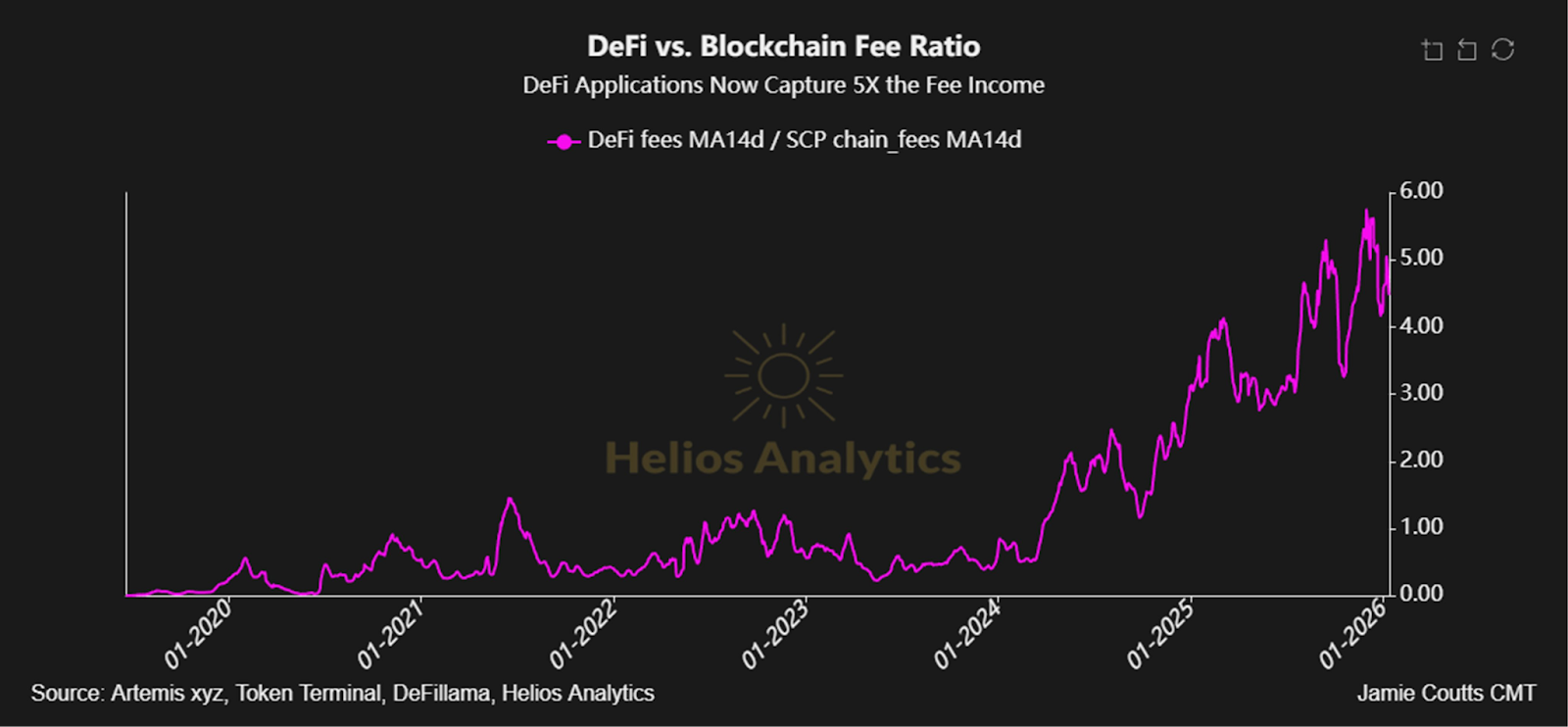

Decentralized finance (DeFi) applications currently collect five times the fees generated by blockchain, according to data shared by Jamies Coutts, chief crypto analyst at crypto intelligence platform RealVision.

This trend suggests that more of the industry’s fees will be captured by DeFi applications such as wallets, decentralized exchanges (DEXs), and other protocols, while the underlying network will receive a smaller share of revenue.

“I believe that blockchain network effects will always command a premium, but it stands to reason that more value will flow to the front end – the wallets, DeFi apps, and protocols closest to the user – than is currently thought,” Coutts wrote in a post on X on Thursday.

Source: Jamie coots

This graph shows that the fee share captured by DeFi protocols has increased significantly from about the same in mid-2024.

Related: Short squeeze hits top 500 cryptocurrencies as traders unwind bearish bets

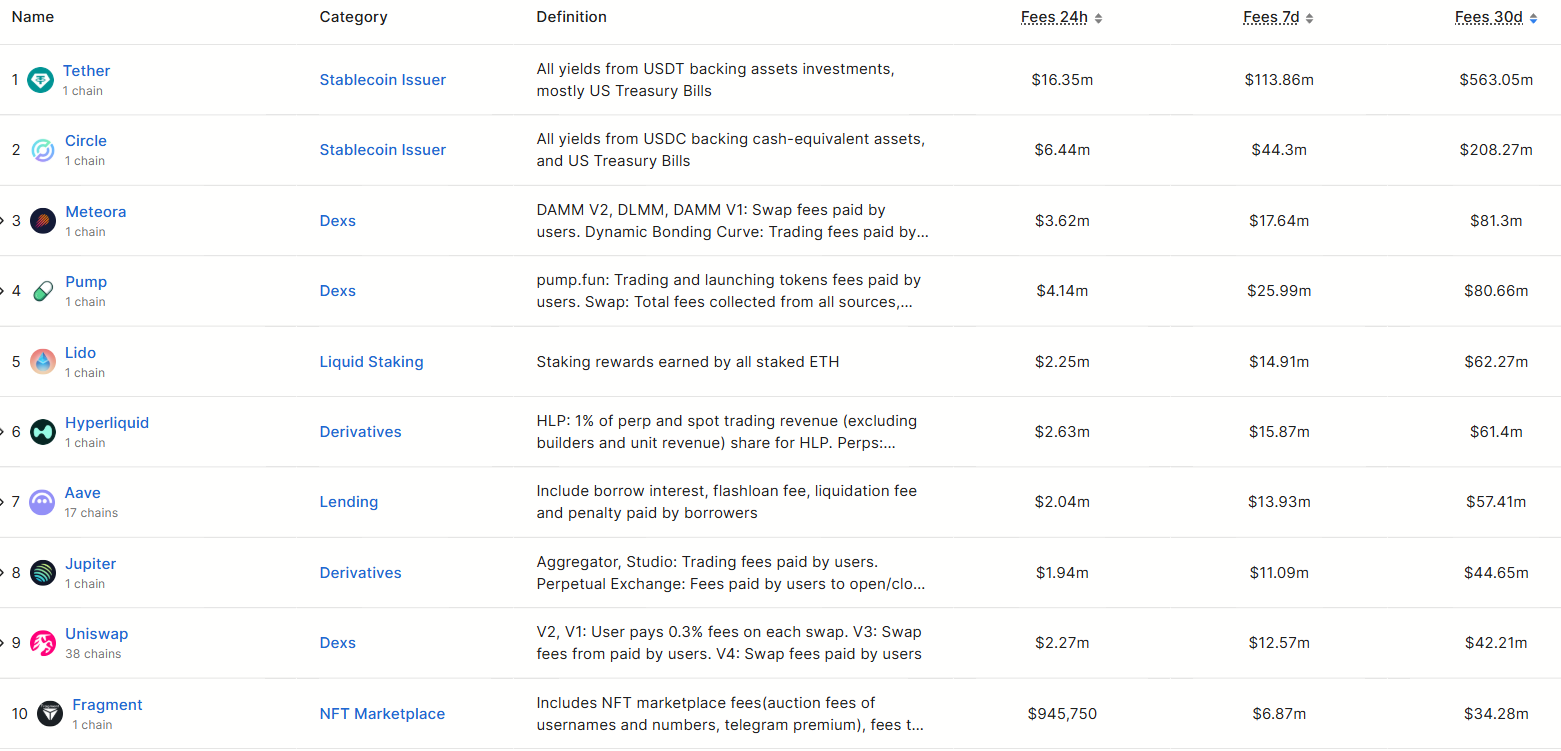

DeFi apps and protocols rank among the top 17 by revenue in the blockchain industry

DeFi protocols currently dominate the ranking of the most profitable cryptocurrency products, according to data compiled by DeFiLlama. The top 17 fee-generating entities in the past 30 days were applications or protocols, not base-layer blockchains.

Solana was the only blockchain in the top 20 with over $20.4 million in fees over the past 30 days. However, this pales in comparison to the $563 million generated by stablecoin issuer Tether, the top protocol by fees, according to DeFiLlama.

Top protocols and chains by fees incurred in the last 30 days. Source: Defilama

The only other blockchain in the top 30 was Ethereum, which ranked 27th with $10.3 million generated.

This move suggests that developers and institutional investors may increasingly focus on DeFi applications rather than the underlying blockchain layer as applications account for an increasing share of total revenue.

Related: BitMine to invest $200 million in YouTuber MrBeast’s Beast Industrie

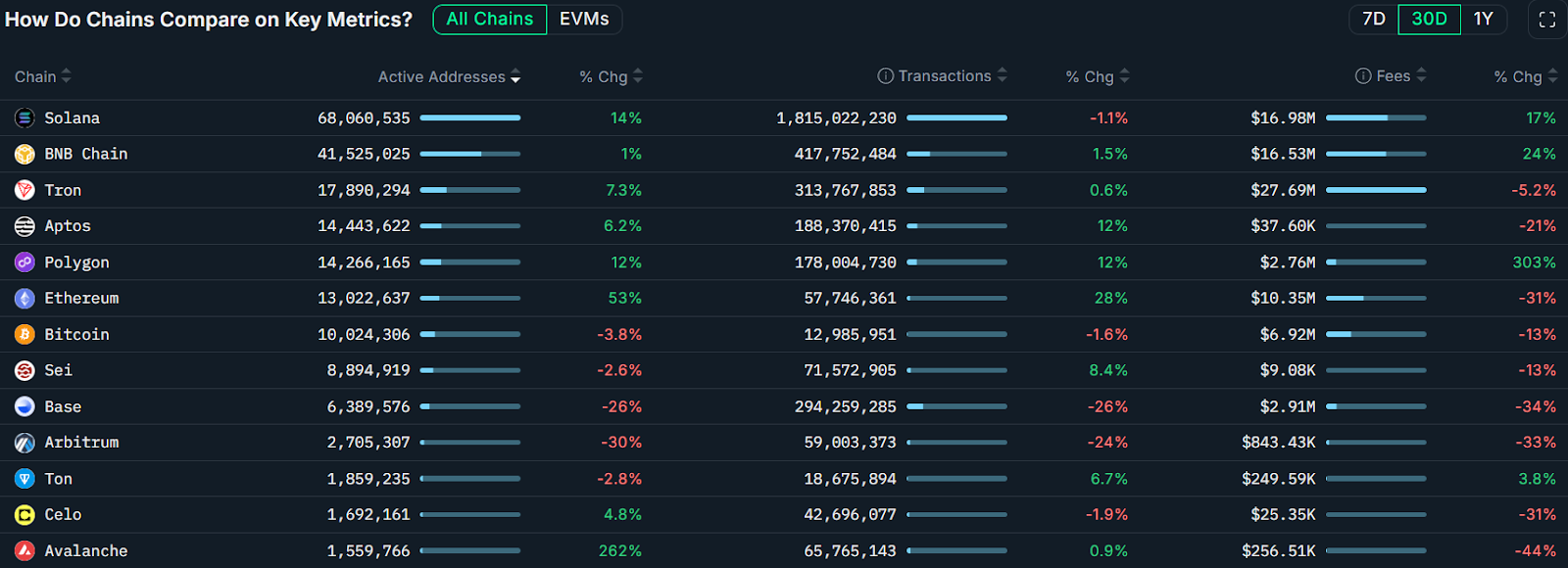

Blockchain by active users, 30 day chart. Source: Nansen

Solana’s lead among the chains can be attributed to its activity, as Solana was the most used network in the past 30 days with more than 68 million active addresses, an increase of 14%, according to cryptocurrency intelligence platform Nansen.

Ethereum is in 6th place with 13 million active monthly addresses, an increase of 53% in the past 30 days.

magazine: Pakistan will deploy Bitcoin reserves to DeFi for yield, says Bilal bin Saqib