The second largest cryptocurrency has experienced a 12% price hike in the past week, reaching around $4,700. The question is whether they can continue to perform well throughout this month and achieve a new record valuation.

The odds look good

Many analysts believe that Ethereum could potentially surpass its record high of nearly $5,000 as early as October this year. To give an interesting twist to the discussion, we asked three major AI-powered chatbots to predict and interpret.

ChatGPT argued that ETH has a realistic opportunity to do so. Grayscale recently launched the US’s first Ether Staking ETP, noting that it is a product that allows investors to gain exposure to ETH while benefiting from staking rewards. The investment vehicle could rekindle institutional interest and push prices to new highs.

The chatbot also pointed out that Ethereum often follows in the footsteps of Bitcoin (BTC), which surpassed its new ATH value of $126,000 on October 6th. But at the same time, ETH warned that it must first surpass the $4,800 heavy resistance line.

Grok, a chatbot built into social media platform X, shared a similar estimate. He argued that past seasonality, strong influx into spot ETFs and other factors would likely result in ETH reaching $5,000-$5,500 by mid-month.

“Cryptocurrency is unstable, with position sizing and stopping the market is key. If bullish, the buying zone will be a drop to $4,375. If careful, the focus will be on $4,450 in support,” he added.

Perplexity estimates that the chances of ETH rising to new records within this month are about 70%. He also predicted that if the market continues to perform well, prices could explode to $7,500. If you’d like to explore additional factors that suggest that Ethereum may be on the verge of a massive rise, check out this dedicated article.

Will $10,000 come in?

Earlier today (October 7th), Crypto Rover predicted that ETH could soon surge to $10,000. X-user, with over 1.3 million followers, has made predictions based on the possibility of a US interest rate cut.

I also recommend this:

- Bitcoin breaks weekly inflows with $3.55 billion surge

- Why Ethereum (ETH) could be the biggest winner of global liquidity surges

- This textbook chart pattern could surge ETH prices to $12,000: Analysts

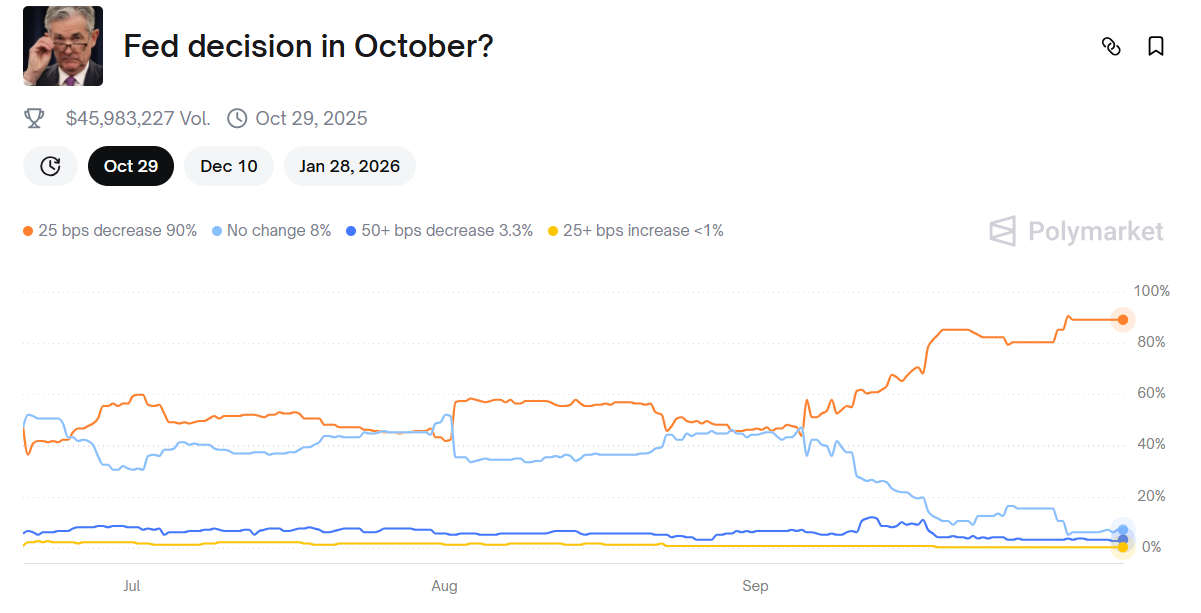

The Fed plans to hold the next FOMC on October 29th, and according to Polymerket, there is a 90% chance that it will cut its base rate by 0.25%. This development could lead to cheaper borrowing and many experts believe that interest in risk-on assets such as cryptocurrencies could increase.