It appears that the moment has finally arrived. Ethereum is trapped at a new history most nearly four years later. This momentum has led many investors to look at the $5,000 mark in the coming weeks as a realistic target.

Technical Analysis

Shayan Market

Daily Charts

On the daily charts, it is clear that prices have been a steady upward trajectory since the rebound from the nearly 100-day moving average of $2,100 from June’s 100-day moving average. Now Ethereum is almost vertically rallied, closing to a new history. With current momentum, even a psychological level of $5,000 will appear within reach. Additionally, the $4,000 level is considered a strong support zone, enhancing the trust of bullish traders.

That said, momentum indicators such as RSI indicate potential excess conditions, suggesting the possibility of integration or pullback before ETH pushes higher. However, the recent bullish crossover between the 100-day and 200-day moving averages shows strong market optimism as the 100-day MA has risen sharply along the price action. This setup suggests that any pullback is temporary and can keep the wider uptrends intact.

4-hour chart

Looking at the four-hour chart, ETH has been moving consistently within the wide ascending channel for the past few months. This formation carried assets through several resistance zones, all of which are currently supported. The channel cap is already sitting on the previous $4,800 record high, so the path to testing the $5,000 level in the short term is clear.

Conversely, the RSI indicators for this time frame, like daily charts, are clearly in the area of buy-out, with the recent 4-hour candles being reduced in size. As a result, some analysts are quickly predicting a pullback. Still, given its strong market structure and momentum, it seems likely that the sharp breakout above its all-time high of $4,800 is unfolding before a notable revision begins.

Emotional analysis

Replacement Reserve

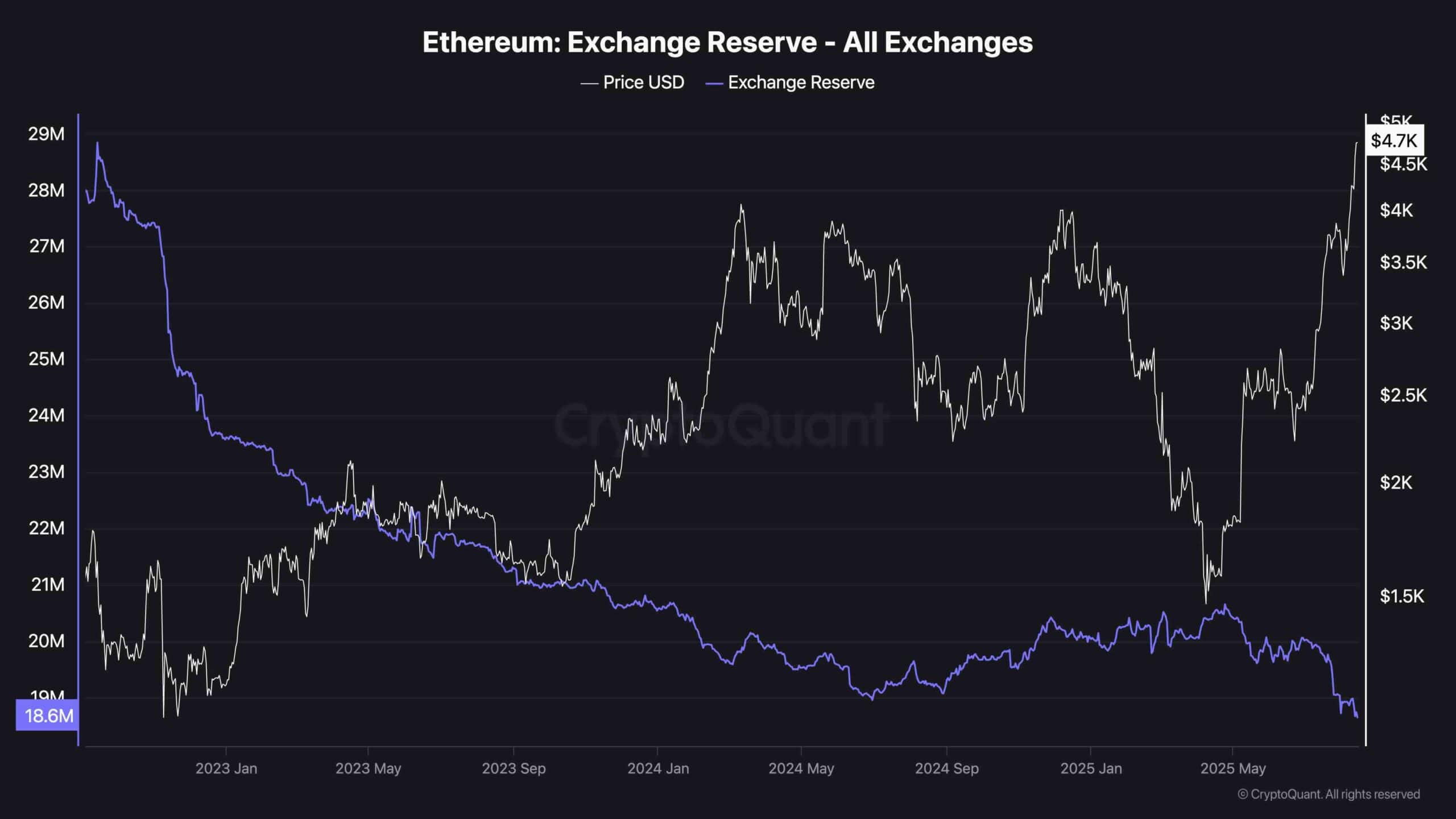

The chart shows Ethereum price transfers across all exchanges in parallel with replacement spares. Over the past two years, exchange reserves have been on a consistent downtrend, down from 28 million ETH in early 2022 to around 18.6 million today.

This significant decline suggests that the majority of ETH is leaving the exchange and is likely moving to refrigerated or staking. Historically, such supply reductions in exchanges have tended to tighten available liquidity, creating conditions suitable for upward price pressures, particularly in strong bullish stages.

The recent surge to around $4,700 is a shy $4,800 ever, coincides with this supply squeeze story. If the exchange continues to decline, ETH could rise even more in the coming months.