The global Stablecoin market has skyrocketed in 2025, with institutional giants like SoftBank and ARK Investment pursuing investments in infrastructure players like Tether.

Tether and other stubcoins continue to expand, but analysts warn that rapid adoption poses financial risks to the central bank’s ability to manage interest rates and maintain exchange rate stability.

Tether expansion and investor interest

Tether is reportedly investigating a $20 billion funding round. This could potentially place the company in the world’s most valuable private company, which is treasured for around $500 billion. Tether aims to diversify beyond the core stub coin business, which uses capital to support USDT supply over $170 billion.

SoftBank is steadily expanding its cryptocurrency investment, but Ark Invest, led by Cathie Wood, has been pursuing several well-known crypto funding transactions in recent years.

If completed, the round still marks the most extensive search of Tether’s external capital. Tether shareholder Cantor Fitzgerald advises on potential transactions. Market observers say the move reflects the dominant position of Stablecoin publishers and the growing institutional trust in digital asset infrastructure.

Softbank and Ark Investment Management are in discussions to participate in Tether Holdings’ major funding rounds. The agreement could value the company at up to $500 million. It aims to raise between $1.5 billion and $200 billion by selling about 3% of the company. Sponsorship from SoftBank and Ark gives Tether a fresh momentum &…pic.twitter.com/lf7bc8v8sl

-September 26, 2025, Holger Zschaepitz (@schuldensuehner)

Supported by the large US Treasury holdings and the growth of Bitcoin Reserve, Tether has emerged as one of the most profitable companies in crypto. In the second quarter of 2025, net profit was $4.9 billion, up 277% from the previous year.

Institutional cash is poured in as the market explodes

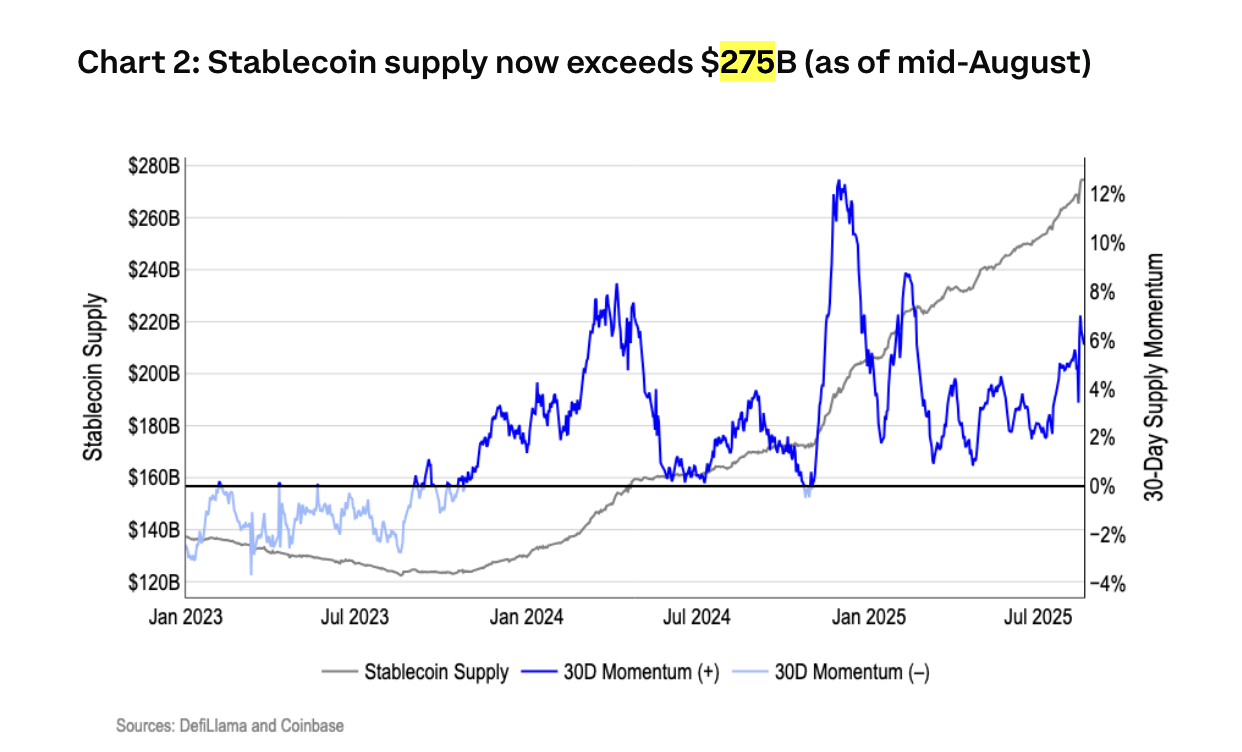

The Stablecoin sector is undergoing an explosive growth phase in 2025. This is driven by unprecedented institutional adoption and clarity of new regulations around the world. Stablecoins’ total market capitalization has skyrocketed to more than $27.5 billion, according to an analysis cited in a Coinbase report in August. Some analysts predict that the market could reach $1 trillion by 2028.

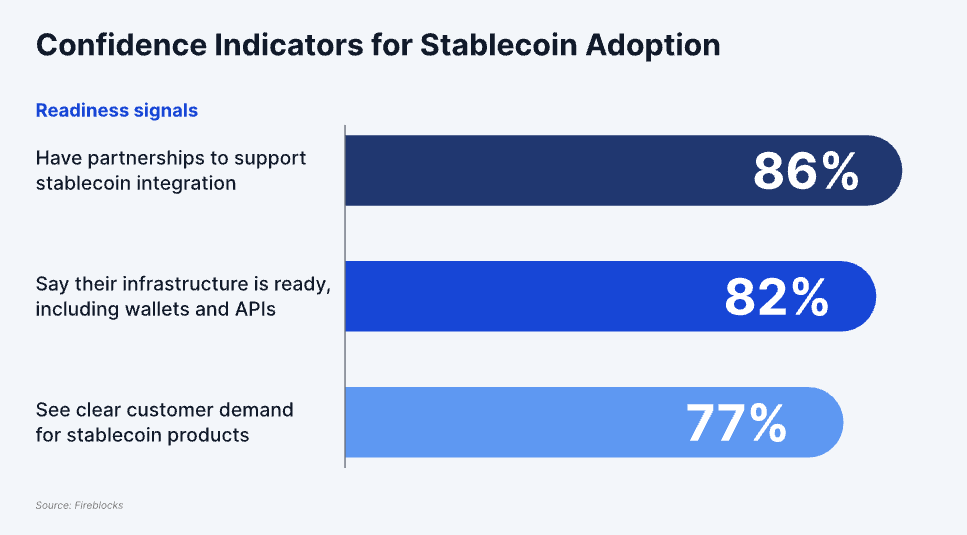

This growth is driven by Stablecoins utility in cross-border payments, which is used for more than 43% of B2B transactions in Southeast Asia. This year we are showing an inflection point where the institution is actively integrating stubcoins. A Fireblocks survey showed that 90% of the institutions surveyed are currently taking steps to Stablecoin integration and accepting them for financial management and international reconciliation.

Beyond Tether’s ambitions, other major players are reconstructing the landscape. Nine major European banks (including ING, Unicredit and Danske Bank) are working together to launch MICA-compliant euro-denominated Stablecoins, with companies like Finastra partnering with Circle to integrate Stablecoins into the scope of bank payments.

The movement is gaining momentum in Asia as well. The major South Korean financial institutions are deeply involved in preparing for the Stubcoin era, and are actively pursuing “two truck strategies” that include both internal development and strategic partnerships to launch the South Korean winning stubcoin.

For example, at least eight major bank groups, including KB Kookmin Bank and Shinhan Bank, have set up consortiums to create joint ventures and infrastructure specialized for the joint issuance of won Stablecoins. Additionally, major banks will meet in person with foreign silly issues such as US company circles (USDC issuers) to discuss cooperation, and at the same time establish an internal task force to conduct proof-of-concept (POC) tests of real-world settlements using their own digital currency systems.

Increased use of Stablecoin poses economic risks

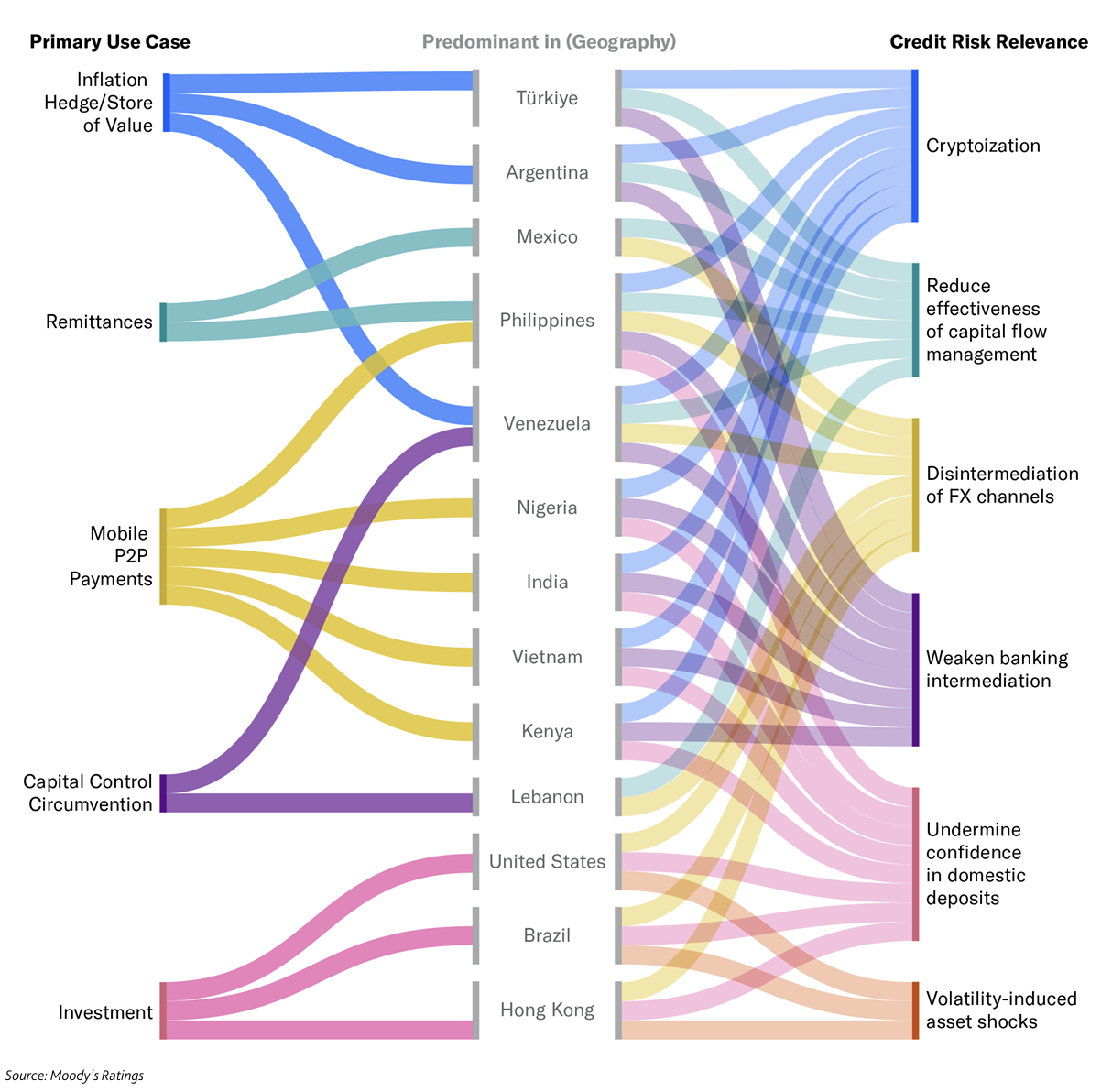

A new Moody’s Rating report issued on September 25th warns that ownership of digital currency has skyrocketed worldwide, reaching 562 million people by 2024, an increase of 33% from the previous year. Emerging markets in Southeast Asia, Africa and Latin America often use cryptocurrencies for inflation hedging, remittances and financial inclusion.

The rapid expansion of Stablecoins results in systemic vulnerability. Wide range of uses could reduce central bank control over interest rates and currency stability, a trend known as “cryptometry.” Banks may experience deposit erosion as their savings move to stablecoins or Crypto Wallet, and unregulated reserves can cause implementation of liquidity that requires government intervention.

Cryptocurrency adoption takes a variety of risks in different markets / Source: Moody’s Rating

However, uneven regulatory frameworks expose countries. Advanced economies are beginning to regulate more strictly and regularly, as Europe implements MICA and the US passes on genius acts while applying a hierarchical framework. In contrast, many emerging markets do not have comprehensive rules, with less than a third of the country enforcing full spectrum regulations.

Amid the growth of the explosive stability market, Post-Tether Eyes was valued at $500 billion.