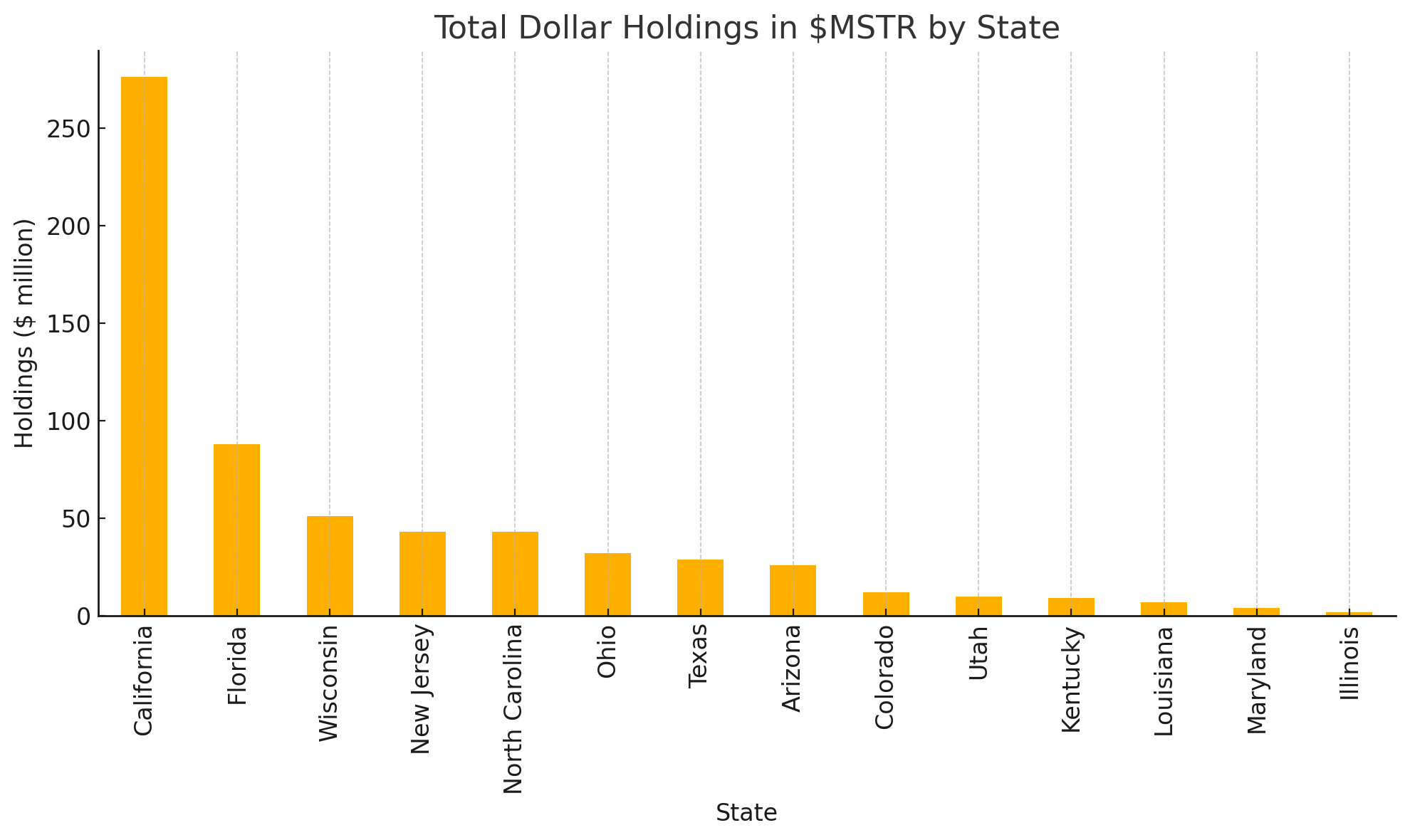

In the first quarter of 2025, 14 US states disclosed their total holdings of $632 million in Strategies (formerly MicroStrategy) MSTR stock held within the Department of Public Retirement and Treasury funds.

The move highlights the state’s growth trend to obtain indirect exposure to Bitcoin (BTC) through its strategy, a company known for its substantial BTC reserves.

Total US state holdings of MSTRs reach $632 million

Julian Farrer, founder of the Bitcoin Act, highlighted X (formerly Twitter). The state increased MSTR exposure by approximately 91.5% compared to its reported holdings of $330 million in the fourth quarter of 2024.

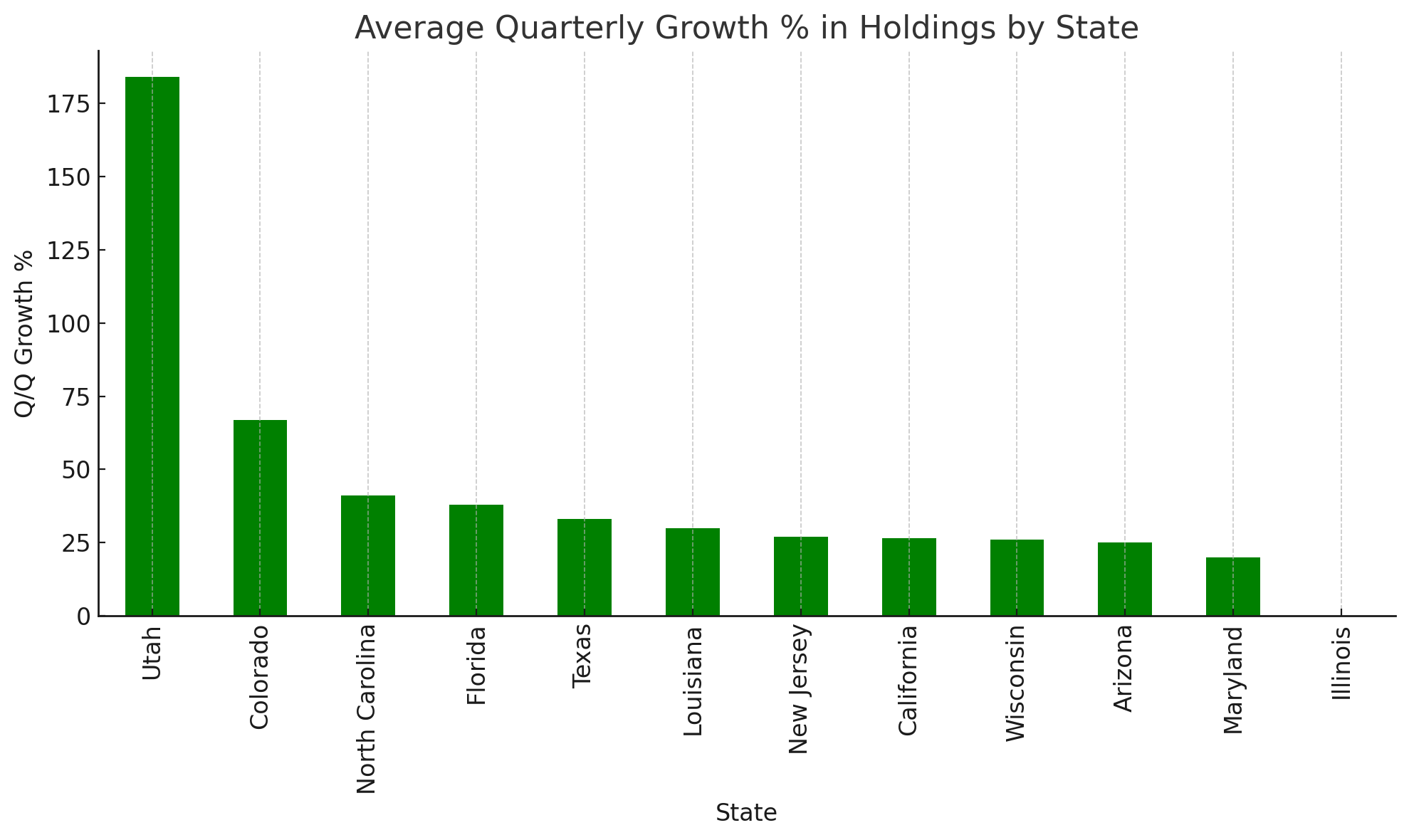

“A collective increase of $322 million in a quarter. The average increase in holding size was 44%,” writes Farrer.

California stands out as the biggest investor. The state holds $276 million in MSTR shares in two major funds: the State Teacher Retirement System (CALSTRS) and the Civil Service Retirement System.

Calstrs holds 336,936 stakes, reflecting 18% growth. Furthermore, the civil servant retirement system holds 357,183 shares. We increased our shares by 35% and added 92,470 shares in the first quarter of 2025.

Holds US MSTR stocks. Source: Data curated by Beincrypto

Florida is following $88 million worth of holdings in the state board of trustees’ retirement system. This represents 221,860 shares and 38% quarterly growth. Both North Carolina and New Jersey have $43 million in MSTR. The former treasurer managed 107,925 shares, with quarterly growth of 41%.

In New Jersey, the police and firefighter retirement system holds 33,628 shares (growth of 40%). Common Pension Fund D has 76,615 shares (growth of 14%).

Arizona, which recently rejected the Bitcoin Reserve Bill by the governor, continues to stockpile MSTRs. Its holdings have increased by 25%. As of the latest data, 66,523 MSTR stocks ($26 million) are held.

The Wisconsin Investment Committee holds 127,528 shares of $51 million, up 26% in the last quarter. Growth shows that it increases the reliability of MSTR.

However, the Investment Committee’s decision to sell entirely from BlackRock’s iShares Bitcoin Trust (IBIT) highlights a cautious approach to certain crypto investments. According to the latest 13 F-Filing for the first quarter of 2025, the board offloaded the entire $300 million shares in IBIT.

“It’s amazing that the Wisconsin Investment Board sold its Bitcoin ETF shares for several reasons. One is that it has a $50 million position in MSTR,” Farrer said.

Notably, despite holding a more modest 25,287 stakes of $10 million, Utah has the highest quarterly growth rate of 184%, indicating a recent rapid accumulation.

Growth rate of MSTR holdings by states. Source: Data curated by Beincrypto

Colorado next appeared, with a strong quarterly growth rate of 67%. The state’s civil servant resignation association holds 30,567 shares worth $12 million.

Meanwhile, MSTR itself has earned strong profits in 2025. According to Yahoo Finance data, its value has increased by 37% since the start of the year.

Strategy (MSTR) Equity Performance. Source: TradingView

In fact, due to Bitcoin’s recent rally, the MSTR price rose to $430 on May 9th, marking its highest price since December 16th, 2024. Still, the stock price fell 19.7% in the past day and closed at $397.