Investors are turning to safe assets such as Bitcoin and gold as U.S. national debt approaches a record $38 trillion.

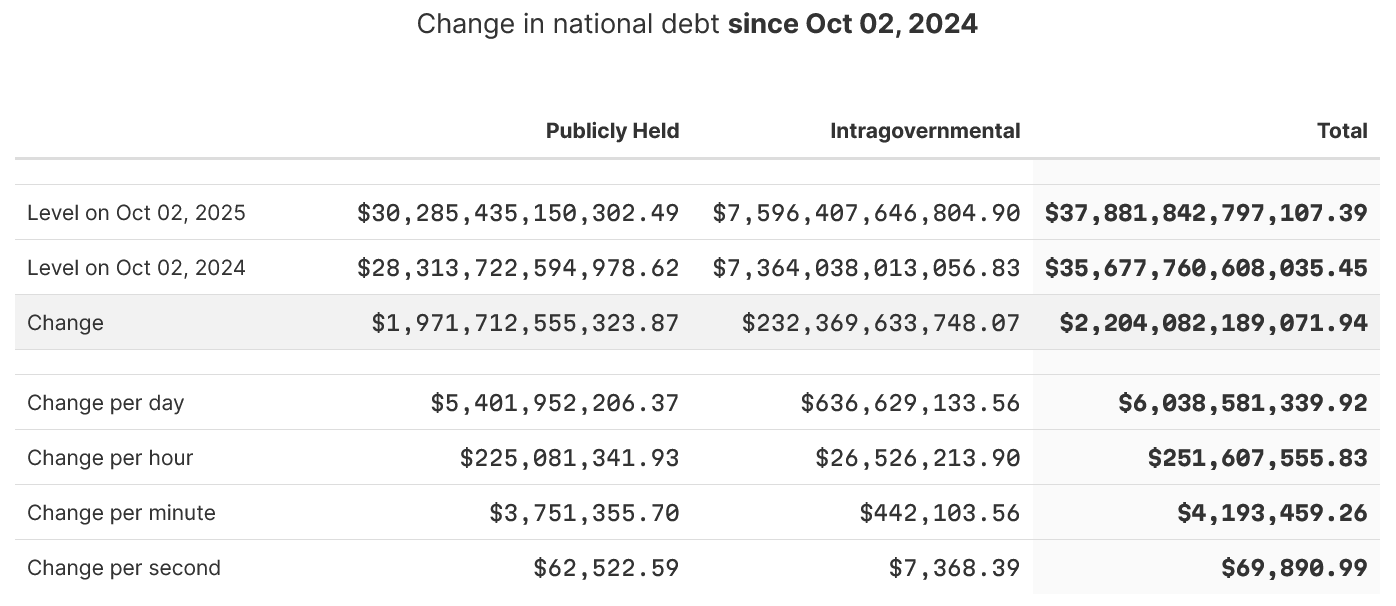

According to the US Congress’ Joint Economic Committee (JEC) Debt Dashboard, US government bonds currently amount to $37.9 trillion, up $69,890 over the last year, or about $4.2 million over the last year.

According to World -Moter data, this amounts to an astounding $6 billion per day, at $6 billion.

Changes in US government bonds over the past 12 months were measured at specific time intervals. sauce: US Congress Joint Economic Committee

US Representative Keith Self said Friday that its debt tally will surpass $38 trillion in weeks and probably exceed $50 trillion in a decade.

“Congress has to act now. There is a demand for financial responsibility from your leader before the progressive slide suddenly collapses.”

At current rates, the US is expected to surpass $38 trillion in 20 days.

Investors flock to Bitcoin and Gold

Last week, JPMorgan touted Bitcoin (BTC) and gold as “collapsing trade” amid rising uncertainty in the dollar.

Bitcoin hit a new all-time high of $125,506 on Saturday, and gold hit a fresh high of $3,920 on Sunday.

The fixed supply and diversified nature of Bitcoin is something like BlackRock CEO Larry Fink (formerly Bitcoin critic) said in January that Bitcoin could hit $700,000 in the fear of a currency collapse.

Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, recommended in July that investors allocate 15% of their portfolio to hard assets such as Bitcoin and Gold to optimize “risk ratios.”

It’s not just America, Dario says

At the time, Dario said other Western countries, like the UK, faced the same “debt doom loop” issues, and their currencies continue to perform poorly compared to Bitcoin and gold.

Reuters reported later last month that global debt had grown to a record high of $337.7 trillion by the end of the second quarter.

Trump’s efforts to slow down our debts

Reducing federal spending and reducing deficits has been cited as a policy priority under the Trump administration.

For months, the Trump administration has taken Tesla CEO Elon Musk to cut spending to help government efficiency, saving $214 billion so far. but,

Related: Bitcoin ETFS Kickstart ‘Uptober’ is recorded at $3.2 billion in the second best week

But President Donald Trump signed what he described as the “Big Beautiful Bill Act” in July, trying to save more than $1.6 trillion in federal spending.

Musk left as a 130-day limit as special civil servants approached completion, but previously strong relations with Trump have deteriorated.

But implementing the bill will help push US debt by more than $37 trillion, and is expected to cost $3.4 trillion over the next decade.

Thanks to one big beautiful bill law, the debt has officially passed $37 trillion. pic.twitter.com/x4icodl2q5

– Thomas Massie (@Repthomasmassie) August 13, 2025

magazine: Crypto wanted to overthrow the bank, but now they’re becoming them on Stablecoin Fight