Ethereum traded over $4,540 at the press on September 12th, up almost 3% over the past 24 hours. Weekly profits are close to 4.7%, with monthly changes remaining muted at –1.9%. Still, the breakout on September 10th brought Ethereum prices back into the spotlight.

The breakout of the currently moving fall wedge suggests room for further profits with on-chain and derivatives data showing that two powerful groups are driving the movement. Together, their actions indicate that if the conditions are met, they could head towards $5,110.

Spotholders retreat while derivative traders are surged

Ethereum’s rally is marked by a sharp decline in used Coin Age Bands (SCABs). On September 4th, coins travelling across all age groups reached 417,000 ETH. By September 12th, that figure had hit just 148,000 ETH (a 64.5% drop), even though it had temporarily surged to 365,000 ETH on September 11th.

This drop or spot cooldown stands out as the recent highs in local ETH prices, such as August 14th and August 27th, with used coins jumping above 500,000 ETH.

Ethereum Spot Market Cools Down: Santiment

In other words, the early summer gatherings saw massive sales from old coins. The opposition is happening now. A decrease in used coins indicates that holders (even those with long-time ETH) are not being sold to the assembly. This adds confidence to your breakout as few coins will hit the market.

The Used Coin Age Band (SCAB) metric tracks the distribution of coins that are moved by age. It reveals whether the old supply is putting pressure on the market or keeping it quiet.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

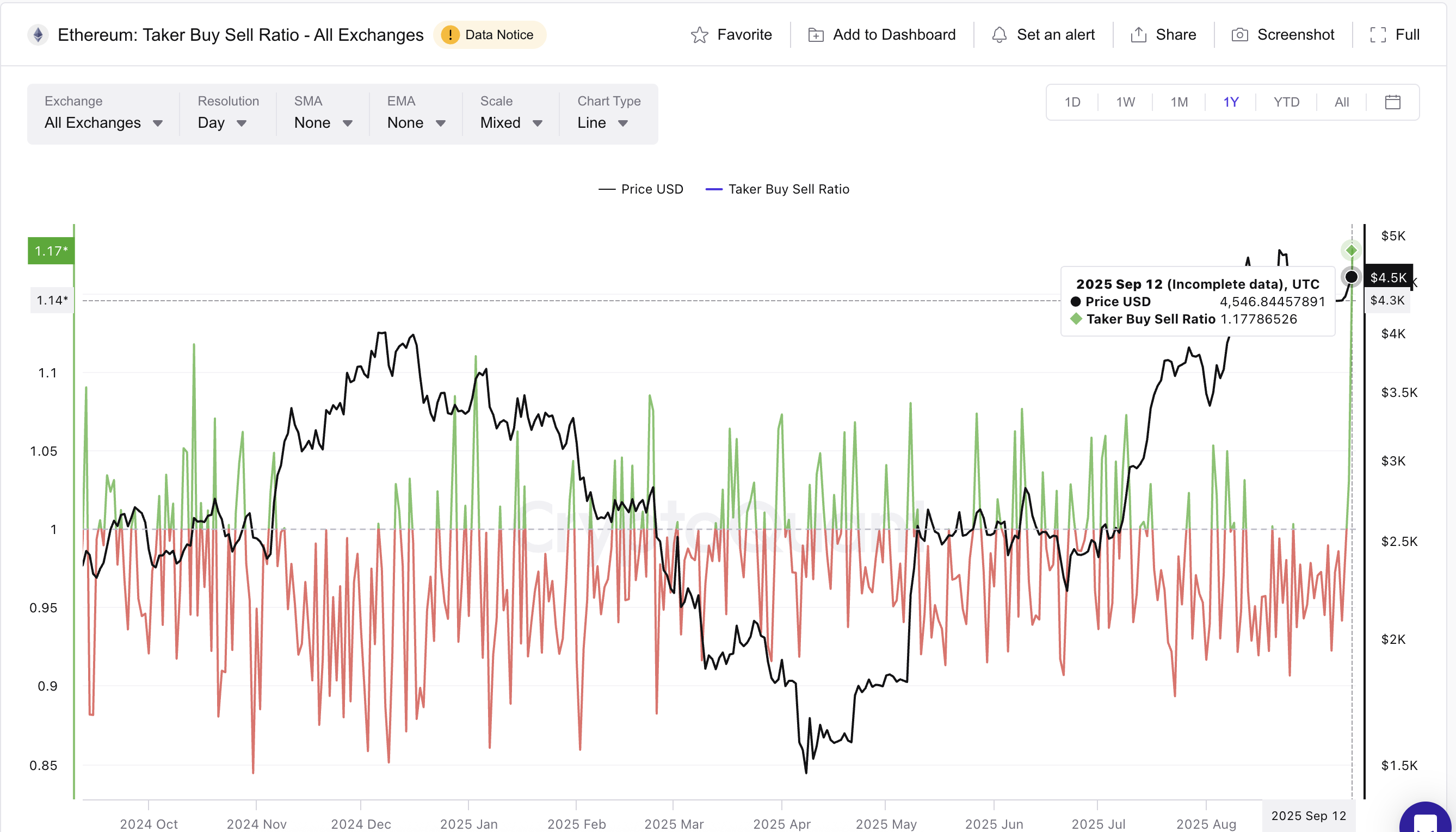

At the same time, the activity of derivatives is rapidly increasing. Taker’s buy/sell ratio has risen above 1.0, indicating that buyers are controlling the orders by absorbing sales orders. This ratio began to rise on September 10, just as Ethereum had escaped from the fallen wedge (more on this later in this work).

Ethereum Derivative Traders Long Time: Encryption

Such peaks usually indicate aggressive purchasing pressure. Due to context, one of the last major spikes occurred on August 3rd. That’s when the ratio jumped, bringing Ethereum up from $3,490 to $4,750. These surges often cool down later in the day, but the current reading highlights strong speculative demands from derivative traders.

The combination is strong. Spotholders have been convicted of not selling, while derivative traders are piling up on bullish bets. These two cohorts provide a supportive foundation for Ethereum breakouts.

Falling Wedge Breakout is heading towards $5,100 at Ethereum price

Ethereum’s technical construction also supports this bullish setup. On September 10th, ETH confirmed a breakout from a falling wedge. This is a pattern that forms lower maximums and lower lows within the line where the price is narrowed, and ultimately splits up upwards.

Ethereum Price Analysis: TradingView

The target for this movement is measured by taking the vertical distance between the highest and lowest points of the wedge. That distance is projected from the breakout level. This will give you a target above $5,110 and if market conditions are allowed, it’s almost 12% higher than the current level.

Before that, Ethereum prices need to clear some resistance levels. The first was $4,630, followed by $4,790, with the previous peak Ethereum price at almost $4,950.

On the downside, $4,380 is immediate support. However, a drop below $4,279 will completely disable the falling wedge breakout and bring ETH back to neutral outlook. When prices fall below $4,060, things become bearish.

Two important groups come together to confirm a post-Ethereum breakout. Is the price heading towards $5,100? It first appeared in Beincrypto.