The latest participants from Sunperp, a decentralized derivative at Tron, opened for traders, and Parp Players such as Hyperliquid, Avantis, Aster, Dydx, GMX and Jupiter have added new venues to the crowded field.

Sunperp opens with Tron. Trader’s Eye Fees, Slips, Funds

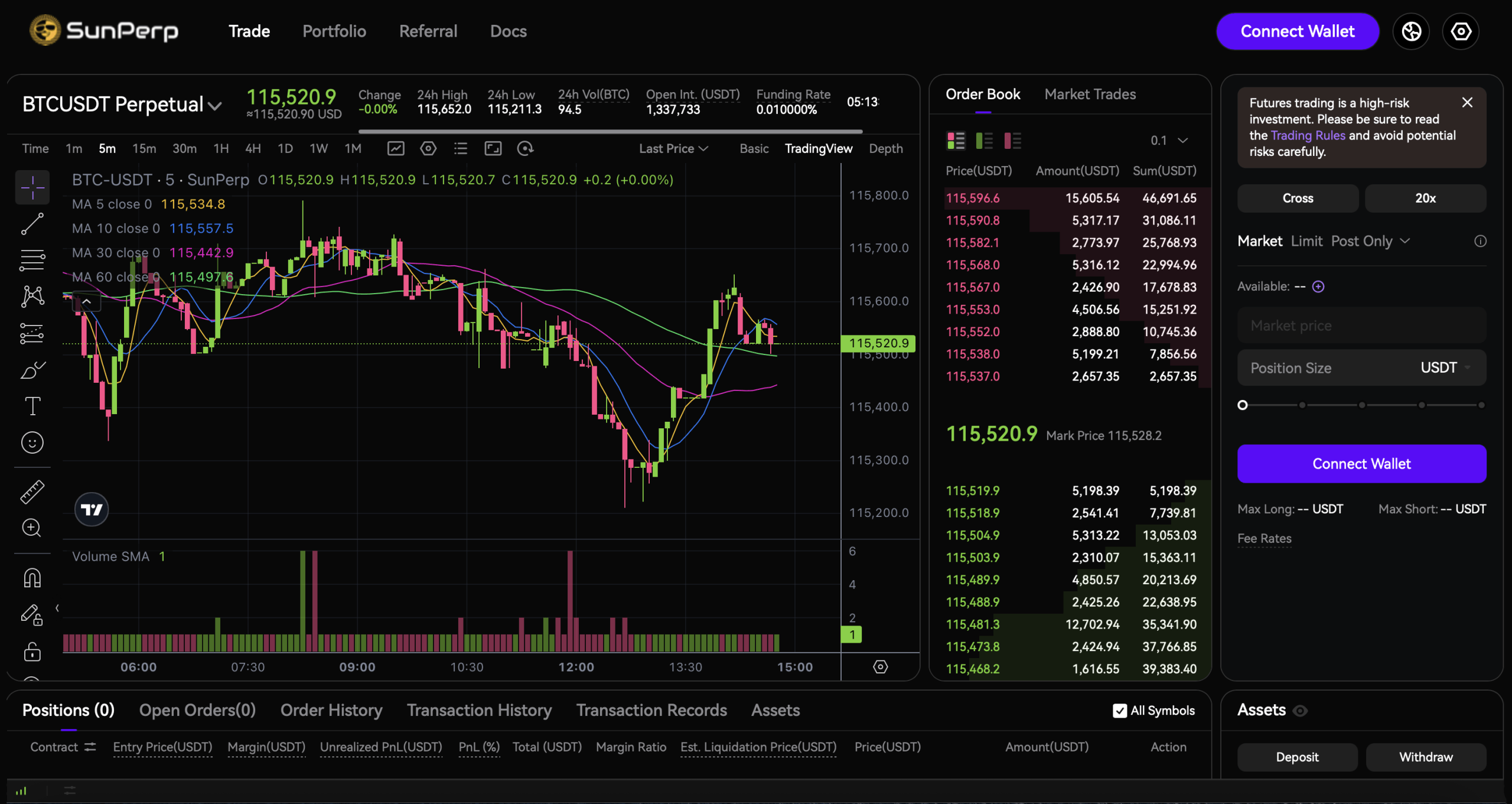

Positioned as a permanently centered distributed exchange (DEX) of the Tron, Sunperp outlines design choices aimed at cost and reliability in implementation. Aggregated liquidity across the network, off-chain matching with on-chain payments to support gas-free transactions, and multi-source price oracles that calculate the ‘mark price’ for the logic of marks and loads and liquids is outlined.

The project documentation covers millisecond level matching, post-trade payment on-chain, and tiered manufacturer taker fee schedules linked to recent transaction volumes. It also provides detailed information on multi-layered risk parameters that are published by market pairs for transparency to users.

Venue will support markets, restrictions (time of time in FOK, GTC, and IOC), post only, planning orders, subsequent strategies, and time-weighted average price (TWAP) – and use tethers (USDT) as the primary collateral with P&L calculated in Stablecoin USDT.

Source: sunperp.com

Sunperp’s risk tools include insurance funds and automatic terminations (ADLs) that can reduce conflict positions during stress when reserves drop rapidly. Users will see on-screen indicators ranking ADL risk. The platform also highlights price deduction protections performed against Oracle’s prices rather than printing order books during volatile movements.

Sunperp’s documentation further states that core contracts are non-upgradeable and that the system continues to test the risks of smart contracts, market makers, liquidity and network synthesis are revealed.

Sunperp liquidation is triggered when a compworked mark price from a combined major spot venue and funding rate input causes a position threshold. Smaller locations are likely to be fully settled, while larger locations may be processed in stages.

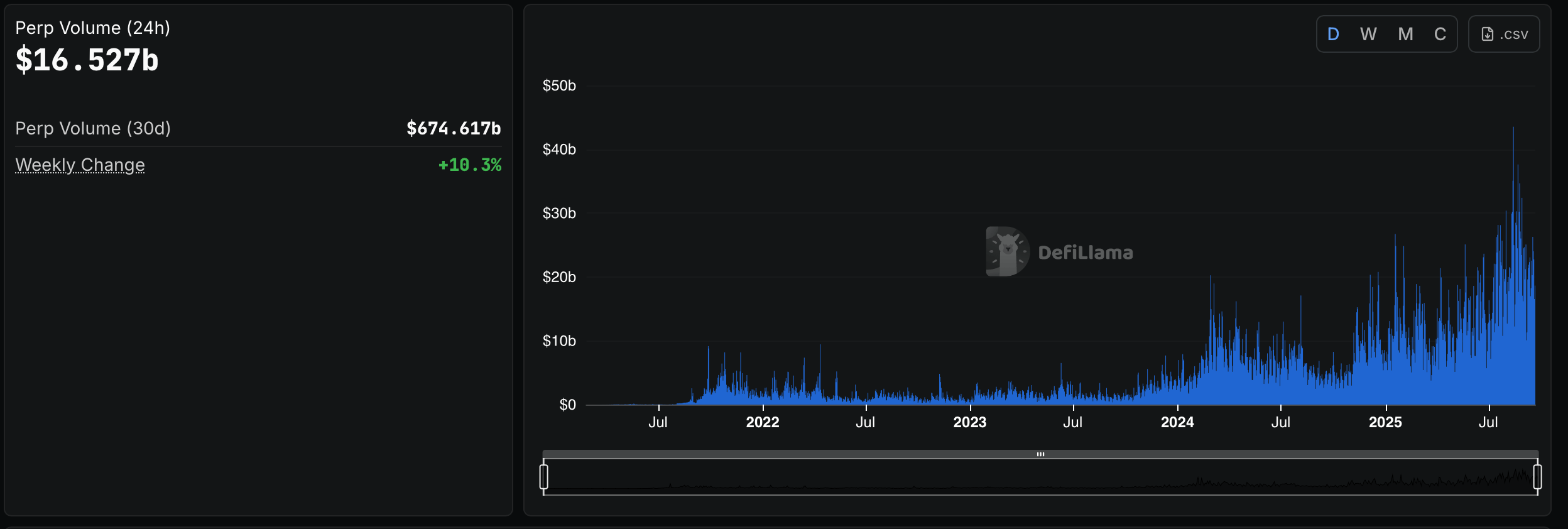

Although the feature set is extensive, Sunperp falls into a highly competitive segment. Onchain Perpetuals has seen an increase in activity from rivals, ranging from general purpose tier Two (L2) to straight app chains such as Hyperliquid.

24-hour PARP volume, according to Defillama.com. High lipids are dominated by gathering at 31.48% of the daily volume.

Traders may compare effective costs, realized spreads, and financing outcomes before shifting the flow from established alternatives. Tron founder Justin Sun has promoted the launch several times on X, saying, “Thumpap has three major perks: deposit collection, lowest rates and airdrop hype.”

Tron executives added:

“Dive in and try out the cheapest Perp Dex on Tron. Do math!”

Similar to decentralized exchanges (DEX), user outcomes rest on slippage, payment latency, Oracle robustness, and funding mechanics during volatility. For now, Sunperp presents a detailed rulebook covering order types, margins, liquidation, and ADL, as well as public invitations to test your approach to actually properly capitalized competitors.