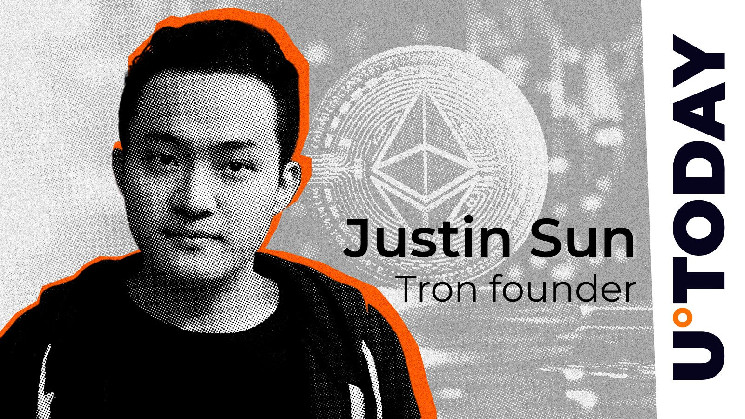

Justinsan, a crypto billionaire and creator of the Tron blockchain, has drawn the crypto community’s attention to key issues with Ethereum that I think will be dangerous in the near future.

Sun Addresses Ethereum Leverage Issues

Justin Sun believes that Ethereum faces major issues with the high leverage used by traders when it operates on ETH on both centralized and decentralized platforms. The Tron founder tweeted that in the short term, the issue is likely to “causing losses of protocols and Defi projects” on the Ethereum network.

Sun urged the Ethereum team to address the issue early and “resolve some of the leverage” rather than wait for the issue to peak and explode.

“A negotiated solution is recommended,” he tweeted.

Leverage use on Ethereum expands rapidly

The issue mentioned by Justin Sun points to the fact that excessive leverage in ETH-based trading has been increasing recently. In particular, it can be seen in derivative markets such as options and permanent futures. Many traders are increasingly using leverage up to 50x (and sometimes 100x) when trading ETH on large platforms. This leads to excessive risk of liquidation if the price volatility is a sudden skyrocket.

Another factor that raises this problem is widely used as collateral for various Ethereum-based Defi protocols. High leverage here means that a sudden drop in ETH prices can cause mass settlement of loans, which will intensify bearish pressure on the market.

Also, if leverage is too high, this will cause a surge in funding rates and in return, inducing traders to short-circuit ETH. This can cause market corrections.

Commentators responded to Sun’s post and shared data that as of today, Ethereum leverage is 5-10 times higher with $5 billion exposure. This could constitute a significant risk as daily liquidation volumes have already increased from $50 million to $70 million, indicating aggressive trading based on leverage.

Ethereum rebounds after 15% crash

Over the past 24 hours, Ethereum, the second-largest cryptocurrency, crashed at an astounding 15%, dropping to $1,811 early today. But now ETH has rebounded 6%, pairing the losses slightly, and is now trading at $1,920 per coin.

Here at Ethereum, Bitcoin is reflecting the rise since below the $80,000 level on Monday.