According to Balaji Srinivasan, a former Crypto Exchange Coinbase executive and author of The Network State, the traditional economy is being phased out in developed countries that are transitioning to an internet-first economy dominated by high-tech industries and digital platforms.

“Legacy economy is in a sunset in favour of the internet economy,” Srinivasan said on the X-Post Saturday.

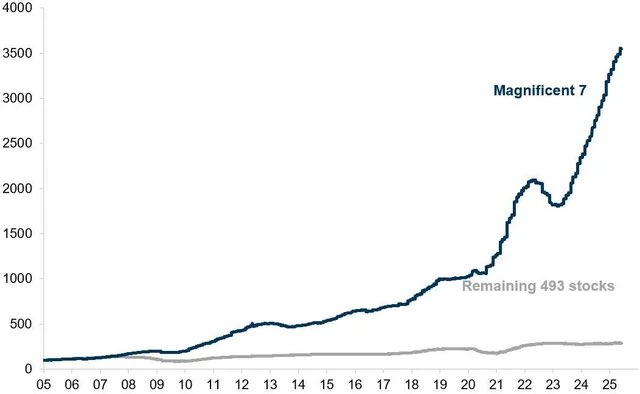

He shared a chart showing price differences between “magnificent seven” tech stocks enjoying meteor growth and the rest of the S&P 500 Index companies that have remained fairly flat since 2005.

7 magnificent high-tech stock performances compared to the remaining 493 companies in the S&P 500 Index. sauce: Balaji Srinivasan

The core economic benchmark, the S&P 500, is the weighted stock market index of the 500 largest companies, by market capitalization listed on the US stock market. Srinivasan said:

“Every transaction and every communication has moved online since the 2008 financial crisis. But we are still at the foot of the mountains. The next step is the internet economy, communities, cities, presidents. The world is becoming internet-first.”

The epic Seven includes Consumer Tech Giants Apple and Microsoft, the online marketplace Amazon, Google, social media, augmented reality company Meta Platforms, high-performance computer chip maker Nvidia, and electric car maker Tesla.

Technology and internet stocks dominate the US stock market. sauce: TradingView

Srinivasan spread the concept of network states and distributed online communities that they said would one day replace traditional nation-states.

These network states require internet native money in the form of cryptocurrency and represent a huge change in human stories, like the transition from agriculture to a manufacturing economy during the industrial revolution.

Related: Crypto is Capitalism 2.0, not Web 3.0 – Crypto Exec

Older things, newer blockchains and AI are disrupting legacy systems

Legacy financial systems and state governments are usually slow to embrace new technologies and often curb innovation.

However, US regulators and lawmakers are now promoting research, development and integration of artificial intelligence and blockchain technology to modernize the financial system.

The Securities and Exchange Commission (SEC) and the Commodity Futures Trade Commission (CFTC) issued a joint statement in September, bullying the shift to capital markets 24/7, and will speed up the legacy financial system with Crypto.

The US government also tapped Oracle Providers Pyth Network and ChainLink to publish government economic data to reveal budget transparency and accountability to the public.

magazine: One thing all of these six global crypto hubs have in common…