Toyota, a leading Japanese car manufacturer, is investigating the financialization of car ownership and converting its fleet into assets.

summary

- Toyota proposed a blockchain that links all important data from a car

- NFTs can represent ownership of vehicles, and traders can bundle them in their portfolio

- This concept is especially useful for EVs, robot taxes and fleets.

Toyota is actively investigating the concept of tokenization of cars. On Tuesday, August 19th, Toyota Blockchain Lab released a white paper on the Mobility Orchestration Network (Mon). This new blockchain could track key vehicle data and turn the vehicle into tokenized assets.

The proposal explains that all vehicles, including logistic trucks, rental fleets, or robot taxes, leave a trace of information behind. This information, including registration, manufacturing and maintenance, can be bundled with tokens as proof on the network.

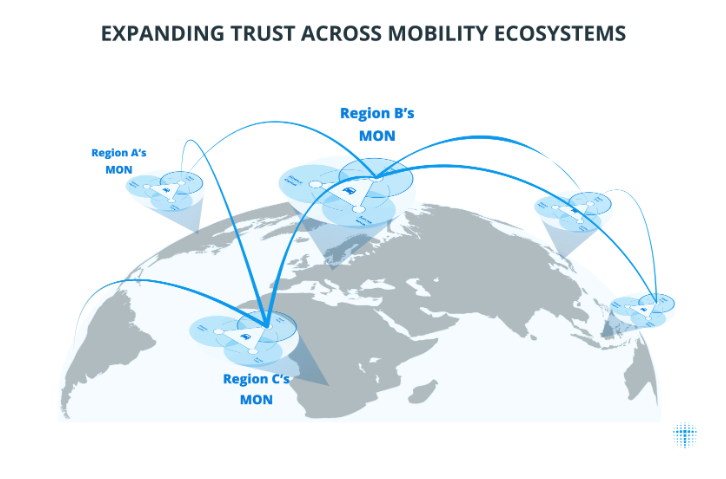

Diagram showing mobility orchestration networks connecting information in several regions | Source: Toyota Blockchain Lab

Each vehicle has its own NFT, which comes with all the history and important information. Potential buyers can use this information to assess the value of their car. Additionally, the network could allow users to purchase these NFTs without physical control of the vehicle.

You might like it too: Escape from the Extracted Economy: Ownership and RWAS Win | Opinion

How Toyota sees the future of car ownership

Toyota Blockchain Labs envisions several use cases for this network. For one, the vehicle is expensive. However, unlike housing, they have so far escaped the trend towards financialization. By tracking the use of blockchain networks, there is no need to closely link car ownership and use.

You might like it too: Interview | Tokenized RWA could hide the next financial crisis, warning MexC exec

For example, automakers can bundle multiple auto NFTs into funds to effectively enable investments in the automotive fleet. The same type of investment vehicle can be used to fund the robot taxi or logistics fleet in emerging markets.

Furthermore, if the car can be securitized, fleet operators could potentially raise funds cheaper than loans. Still, the white paper doesn’t go into how this financialization of ownership of a car affects normal car ownership and car prices.

read more: https://crypto.news/tokenizing-wall-street-rwas-blockchains-moonshot/