Important insights:

- Circle, Coinbase and Robinhood crypto stocks are located for the third quarter of 2025 for positive meetings.

- CRCL, coins and food are all pre-market trading and ready for the next week.

- Investors have seen a potential Q3 Altcoin season, backed by historic patterns with crypto stock tie.

Over the years, crypto stocks and associated currencies have solidified their status as key asset classes. The market continues to attract attention from both individual and institutional investors.

Bullrun in the current market is further increasing investor interest in stocks associated with crypto-based companies. Cryptocurrency stocks allow investors to profit from both traditional stock prices and crypto prices.

When market participants turn their attention to the third quarter, there are three top crypto stocks to take note of:

Circle Internet Group (CRCL)

Despite the mild correction, Circle CRCL remains the top performer among other crypto stocks. According to TradingView data, the price of CRCL stock was $187.33, up 0.92% in pre-market trading.

Circle (CRCL) began trading on the New York Stock Exchange (NYSE) on June 5, 2025. The stock opened at $69 and surged to $103.75 during the day and closed at $83.23.

Circle Stock traded 800% for $279 in just 18 days. Circle CRCL has collected about 550% since its initial public offer. This rapid increase shows strong demand and effective positioning.

As of July 14, 2025, the stock had a market capitalization of $42.644 billion at the time of filing this story. Circle is the publisher of USDC, the second largest Stablecoin by market capitalization, $63 billion (Press Time).

Beyond the Stablecoin settlement, Circle has a network of over 500 partners. Additionally, the US Senate passed the Genius Act with 68-30 votes on June 17th.

The legislation will create the first federal framework for Dollar Peg stubcoin, further boosting the outlook for CRCL.

Using a 10-year discounted cash flow model, Bernstein analysts predicted a $230 target for circle stock.

Coinbase Global Inc.

According to Google Finance Data, Coinbase (Coin) is another promising inventory to watch in the third quarter of 2025.

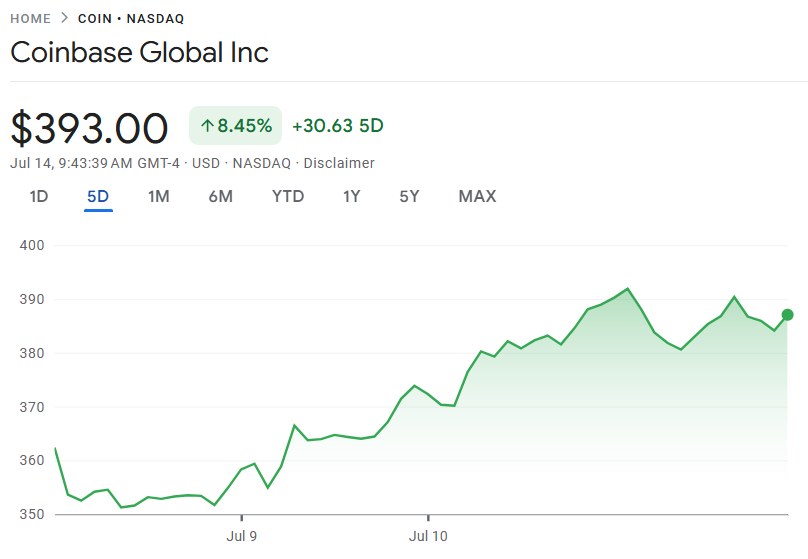

The shares are currently trading at $387.06, reflecting an annual increase of 55%. At the time of writing, Coin was trading at $393 at a five-day rally of 8.45%.

Coinbase Price Chart | Source: Google Finance

Coinbase shares debuted on April 14, 2021 at the Nasdaq Global Select Market for $381. Prices fell below $50 in 2022, but bounced back in 2023, 2024 and 2025.

The rally is supported by the Bitcoin Exchange Sales Fund (ETF) and the growing popularity of the fourth Bitcoin half.

Analysts are optimistic about Coin’s future prospects. Popular market analyst Ali Martinez recently predicted a $2,000 target for coins, citing a rare bullish pattern on the coin chart.

Additionally, the coin has recently reached $388.96 despite selling 16,627 Coinbase stocks.

Separately, the Czech National Bank recently announced its acquisition of $18 million worth of Coinbase stock in the second quarter of 2025.

Robinhood Markets Inc (Hood)

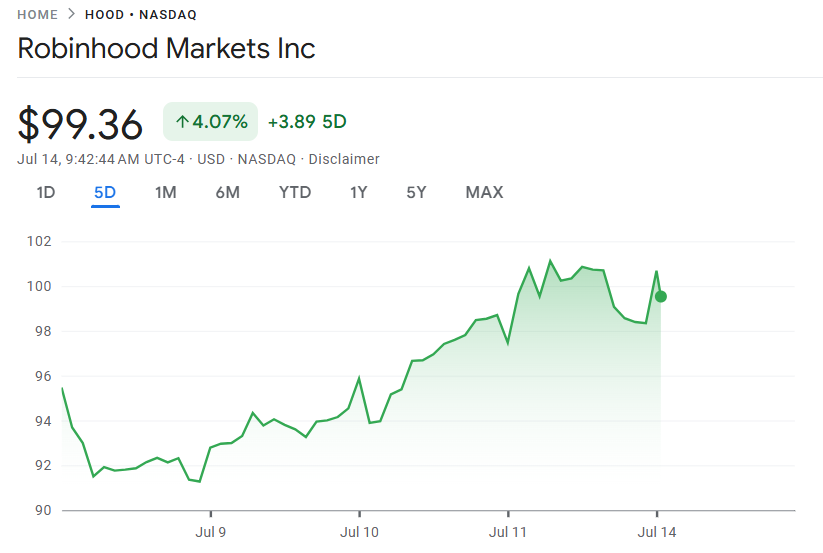

Robinhood Markets, Inc. (Hood) is the third crypto stock to consider in the third quarter of 2025. Hood opened on July 14, 2025 at $98.34 and has a market capitalization of $867.8 billion.

At the time of writing, it was up 4.05% over the past five days to $99.36.

Robinhood Price Chart | Source: Google Finance

Robinhood Markets has a 52-time high of $13.98, a low of $52 and a $101.50. Food has skyrocketed over 163% and over 310.7% since the start of the year.

Analysts have noted a strong upward trend, while some predicted that it would increase by 117% over the next three months.

In a research notes on Tuesday, July 1, KeyCorp raised its price target for food stocks from $60 to $110. The bank-based financial services company has given food stocks a “overweight” rating.

In its final quarterly profit announced on April 30th, Robinhood reported earnings of $0.37 per share (EPS) for the quarter. This figure does not reach an analyst consensus estimate of $0.41.

However, the company reported revenue of $927 million for the quarter, with a consensus estimate of more than $917.12 million.

Beyond Crypto Stocks: Does the Altcoin season look like the third quarter?

Historically, the Altcoin season follows a strong Bitcoin gathering and subsequent integration.

Bitcoin hit a new all-time high of $123,000, driven by positive market sentiment, according to data from CoinMarketCap.

This rally creates opportunities for prices to consolidate and gives altcoins room to shine.

Ethereum (ETH) is often leading the Altcoin Rallies because its performance against Bitcoin signalling the strength of the broader Altcoin market.

In the last 24 hours, ETH has skyrocketed over 2.7% to $3,046. Blockchains such as Solana (Sol) and Avalanche also benefit from the recent BTC rally.

Additionally, Altcoins like Aave (Aave) and Toncoin (Ton) see renewed interest in scalability and Defi innovation.