The market for tokenized assets has quietly reached new milestones, with managed assets (AUMs) skyrocketing at an all-time high.

This surge is increasingly emphasized on the settlement layer, where Ethereum infrastructure is chosen for stable grade tokenization.

Tokenization reaches historic scale

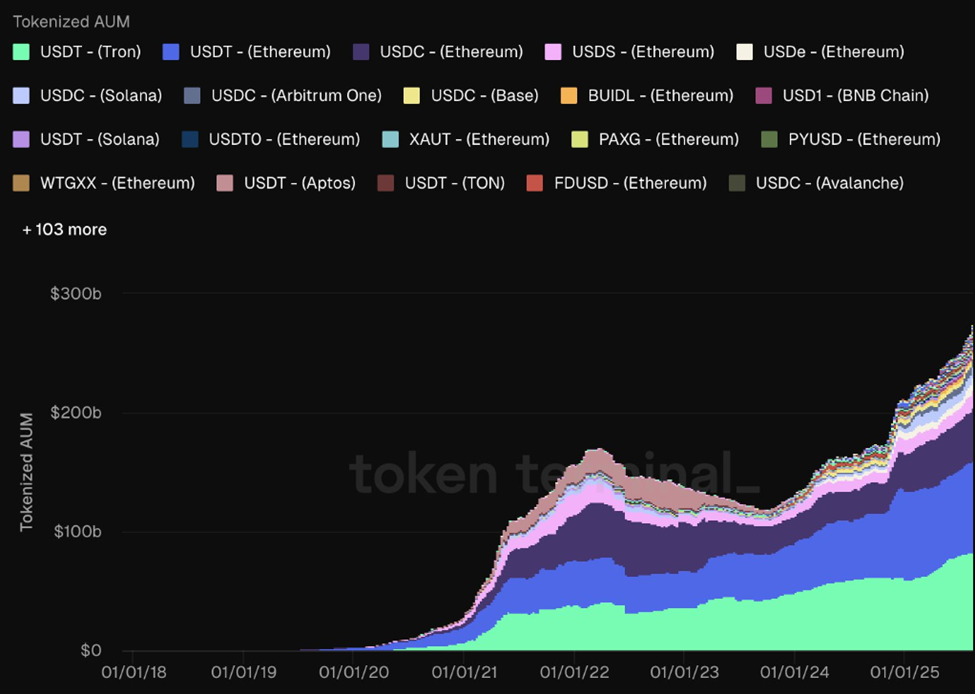

Token Terminal reports that the AUM for tokenized assets is at an all-time high of around $270 billion.

Tokenized assets aum. Source: Token Device

The on-chain data platform highlights tokenized assets across a broad spectrum, ranging from currency and commodities to the Treasury, private credit, private equity and venture capital.

Much of this growth is driven by agencies adopting blockchain rails for efficiency and accessibility, with Ethereum emerging as the dominant platform.

Ethereum hosts approximately 55% of all tokenized assets AUM due to the smart contract ecosystem and widely adopted token standards.

Tokens such as USDT (Ethereum), USDC (Ethereum), and BlackRock’s Buidl funds represent some of the largest pool of value built on the ERC-20 framework.

Meanwhile, professional standards such as ERC-3643 enable tokenize real-world assets (RWAs) such as real estate and art.

With $270 billion already tokenized, ongoing momentum has brought tokenized asset markets to trillions as the tokenized asset markets solidifies their role as the backbone of tokenized finance.

The financial giant is quietly returning to Ethereum

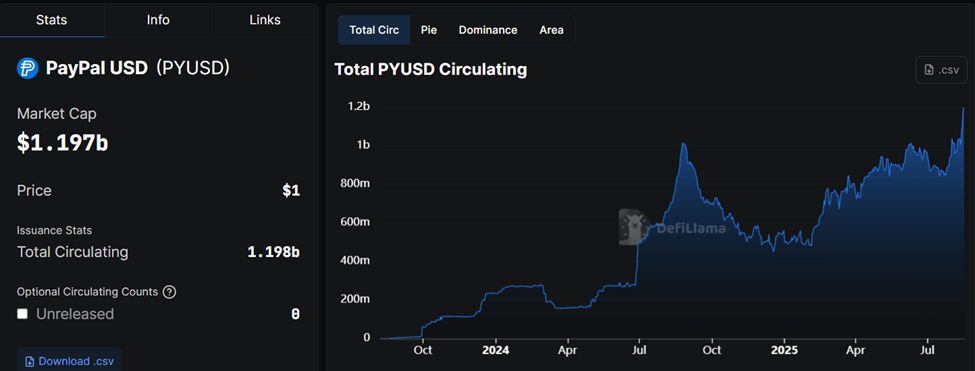

One of the most important indications of this shift is the rise of Paypal’s Pyusd Stablecoin, which has surpassed the $1 billion market in supply, while being fully issued on Ethereum.

Supplied by pyusd. Source: Defilama

For the institution, PYUSD’s rapid growth proves that Ethereum’s rails are fluid and safe and reliable enough to scale global fintech leaders.

“PayPal’s Pyusd cements $1 billion in supply cement Ethereum as the main fiscal settlement tier. Such a Stablecoin Scale will deepen liquidity and usefulness. The agency is quietly standardizing ETH.”

Beyond Paypal, traditional asset managers are also leaning towards Ethereum. Buidl, BlackRock’s tokenized money market fund, is cited as a groundbreaking case of institutional adoption. This shows how traditional financial (TradFi) equipment can be issued and seamlessly managed in a chain.

Meanwhile, Ethereum’s dominance in tokenization comes down to its network effects and its developer ecosystem. The ERC-20 standard becomes the Lingua Franca digital asset, ensuring compatibility between wallets, exchanges and Defi protocols.

Meanwhile, Ethereum’s security, liquidity, and scalability improvements will increase agency trust through upgrades such as implementation (POS) and rollups.

Ethereum’s flexibility allows us to meet retail and institutional needs. Stablecoins like USDT and USDC are fuelled by global payments and Defi liquidity. Meanwhile, tokenized Treasury and credit instruments appeal directly to the institution’s portfolio of yield and efficiency.

However, analysts are urging Ethereum traders to watch out using Altcoin, the largest in market capitalization metrics facing the second highest selling wave. Similarly, the warning signs are flashing, despite 98% of Ethereum supply sitting in profitable states.

Post-tokenized assets hit a $270 billion record as Ethereum standardization first appeared in Beincrypto.