Data from Real World Assets (RWA) tokenization tracker RWA.xyz shows that tokenized institutional alternative funds (IAFs) have increased 47% over the past 30 days to reach a total of $1.74 billion.

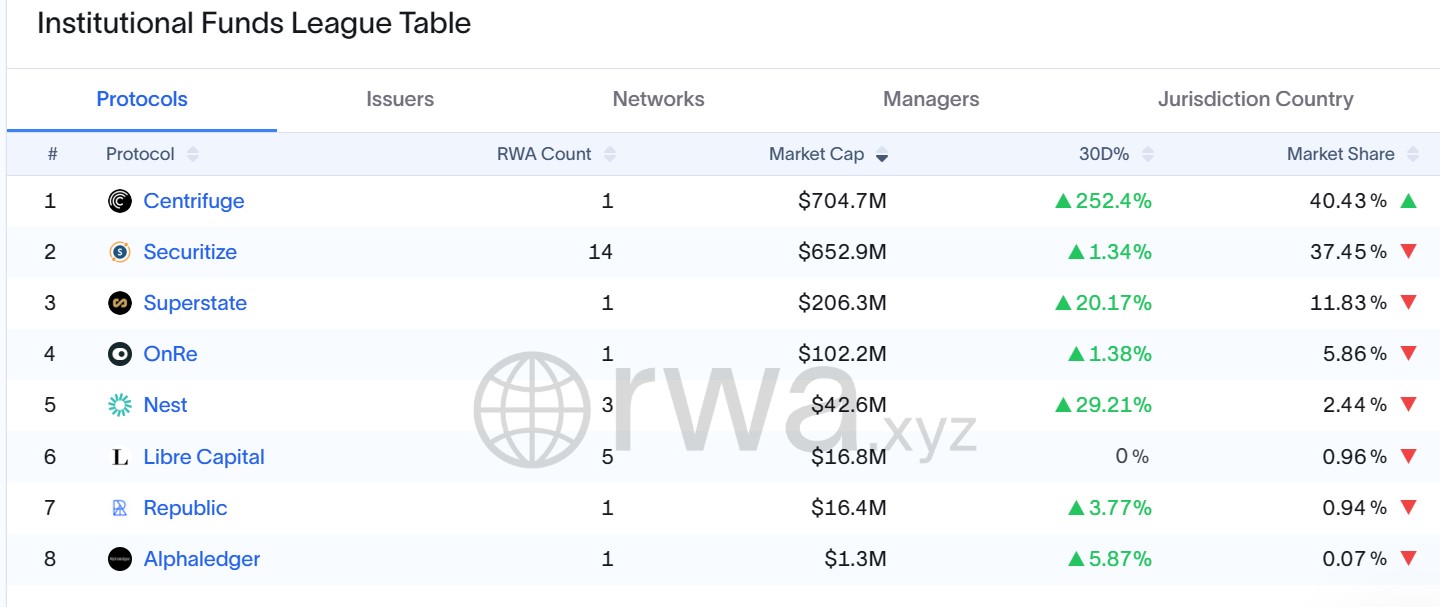

Data showed that all protocols except Libre Capital showed a percentage increase in the last 30 days. Centrifuges led growth, expanding its market capitalization by 252% to $704 million. This gave the issuer a 40.4% market share for IAFS.

Apart from the IAF, centrifugation has nearly $400 million in tokenized US financial products, bringing its total value (TVL) to over $1 billion. This allowed centrifugation to participate in BlackRock’s Buidl fund and Ondo Finance to outweigh the $1 billion RWA milestone.

Securitize accounted for 37.5% of the market at $652 million across 14 tokenized IAFs. Other notable protocols included the $206 million superstar and Onre, which has a $102 million fund worth.

In-facility funding league table. Source: rwa.xyz

What are institutional alternative funds?

An institutional alternative fund, or IAF, is a professionally managed investment vehicle that allocates capital to asset classes other than traditional equity or bonds. These include assets such as hedge funds, private equity, private credit, venture capital, and real estate and infrastructure.

Tokenizing these funds will bring them to the blockchain, allowing you to access perks such as faster settlements, wider investor access and greater transparency.

Protocols that bring such funds to blockchain highlight the growing demand for RWA tokenization between traditional financial institutions.

The value of tokenized IAFs has increased, but data from RWA.xyz shows that monthly active addresses have declined at 21,867 over the last 30 days, while the number of owners has increased to 13.5% to 114,922.

This suggests that institutions or professional investors may be consolidating their funds into smaller addresses. It also suggests that new investors may signal long-term trust in their invested vehicles.

Related: Coinshares reported a 26% AUM increase to $3.46 billion in the second quarter

Ethereum remains the most dominant blockchain of tokenized IAFs

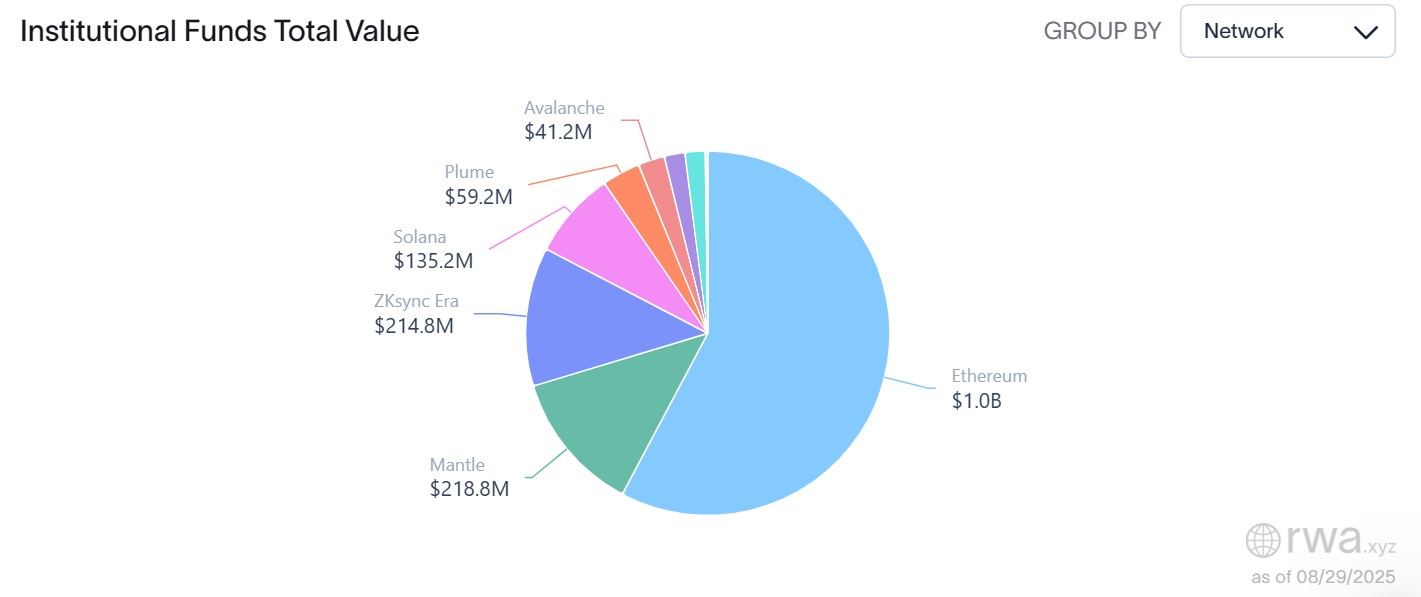

Data from RWA.xyz showed that Ethereum remained the most dominant network of tokenized IAFs. Blockchain totals $1 billion, more than half of the overall market.

Mantle and Zksync Era accounted for $228.8 million and $224.8 million, respectively, while Solana accounted for $135.2 million. Networks like Plume and Avalanche have been reduced by $59.2 million and $41.2 million.

Institutional funds are the total value per network. Source: rwa.xyz

magazine: Japan and China Stubcoin, India changes crypto tax: Asia Express