President Donald Trump, the president of the United States, increased their collective wealth by $1.3 billion this week in the trading debut of mining company American Bitcoin (ABTC), and earned benefits from World Liberty Financial (WLFI), a decentralized financial (DEFI) protocol associated with the Trump family.

According to Bloomberg, World Liberty Financial added $670 million to the Trump family’s net worth, and Eric Trump’s ABTC stake he co-founded was valued at over $500 million since ABTC’s trading debut on Wednesday.

The calculation used family net worth to measure family net worth on Wednesday, when ABTC shares surged to $14 before ABTC stock collapsed above 50% to a low of 6.24.

ABTC price action after merger with Griffon Digital Mining. sauce: TradingView

Additionally, $1.3 billion did not account for approximately $4 billion of WLFI tokens held by Trump people who are eligible for the lockup period.

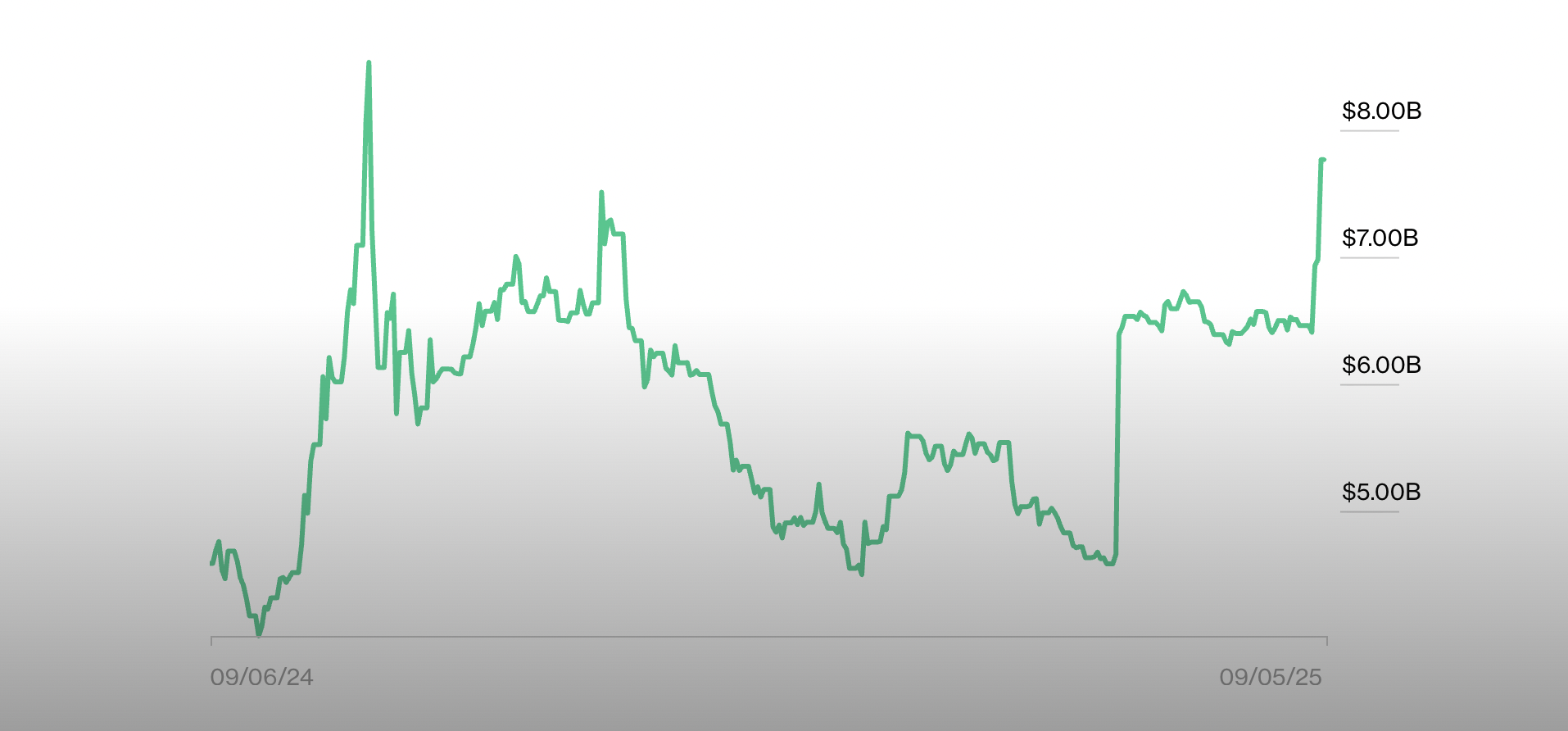

Using current market prices, the family’s collective net worth exceeds $7.7 billion, with the exclusion of $4 billion WLFI tokens.

The Trump family’s collective net worth suddenly increased in September. sauce: Bloomberg

The Trump family’s involvement in cryptocurrency has brought an air of legitimacy to the US cryptocurrency industry, following years of anti-cryptography policies under the previous administration.

However, the US President’s crypto ties invited scrutiny from US Democrats who said that the initial family involvement in the crypto sector represented a conflict of interest.

Related: The Trump family went to pro-crypt after Biden’s “weaponized” bank: WSJ

Bitcoin in America and World Freedom made its high volatility trading debut this week

World Liberty Financial made its trading debut on Monday with major Crypto Exchanges, unlocking 24.6 billion WLFI tokens for launch.

https://www.youtube.com/watch?v=vkc5qcrvdc0

American Bitcoin was relisted on the US stock exchange following its merger with Gryphon Digital Mining, a Crypto Mining Company, which was released on Wednesday.

Trades in ABTC stocks were suspended five times on Wednesday due to increased volatility. This led the stock to a high of $14 before collapsed to its current price of around $7.36 per share.

magazine: Crypto Traders “deceives themselves” with price predictions: Peter Brandt