By numbers, Bitcoin’s network difficulty rose 5.97% at block height of 917,280, winning the third biggest jump title of the year.

Bitcoin mining odds are closed

Finding the block has become very difficult. Network difficulties jumped to 5.97% and landed at 150.84 trillion.

Think of the difficulty of the Bitcoin network as the odds of winning the huge dice toss lottery that resets every 10 minutes. In January 2009, when difficulty was sat at 1, the target was virtually wide open. Minors only needed a small toss to hit digital gold.

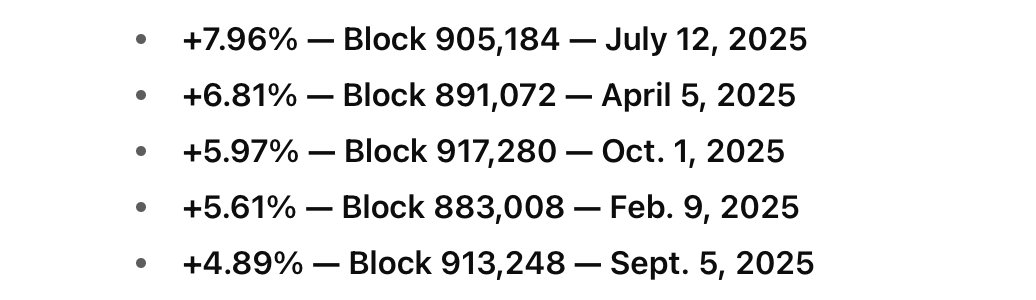

The difficulty of the top five mining in 2025 will increase.

Fast forward to today: With 150.84 trillion difficulties, miners now have to stir 150.84 trillion times more dice rolls on average. The difficulty level has been adjusted for every 2,016 blocks, and in 2025 it has decreased five times to date, up 15 times.

These upward shifts are +50.40%, but totally dropping by -16.54%. After hitting an all-time high at hashrate, using blocks mined faster than the 10 minute average during the final epoch, the computing power is above the 1 Zetta Hash mark of 1,071.28 exhaush (EH/s) per 1,071.28 seconds.

However, the blocks are currently mined with slower clips, with an average clock of 24 hours in 10 minutes and 40 seconds. Revenue has risen since September 28th. We got a lowest price of $48.53 for 1 second (PH/s) per second. This is worth $50.66 and BTC is trading at $120,337.

It’s still shy at $54.13 per PH/S minor, earned 30 days ago. At this point, miners will welcome the decline in difficulty paired with a steady price rise, but it remains to be seen whether that is actually unfolding.

All eyes will decide on October 16, 2025 if the next retarget will decide whether miners will take a break or catch even steeper odds.