In 2025, Permanent DEXS processed more than $2.6 trillion in transactions, according to a sector survey. These venues are gradually evacuating central exchanges by providing non-custodial leverage and faster execution.

However, those rises also raise questions about the long-term implications of transparency, token stability, and decentralization. As a result, this sector could evolve into a durable pillar or face challenge related to design.

Market spikes to record

Latest updates

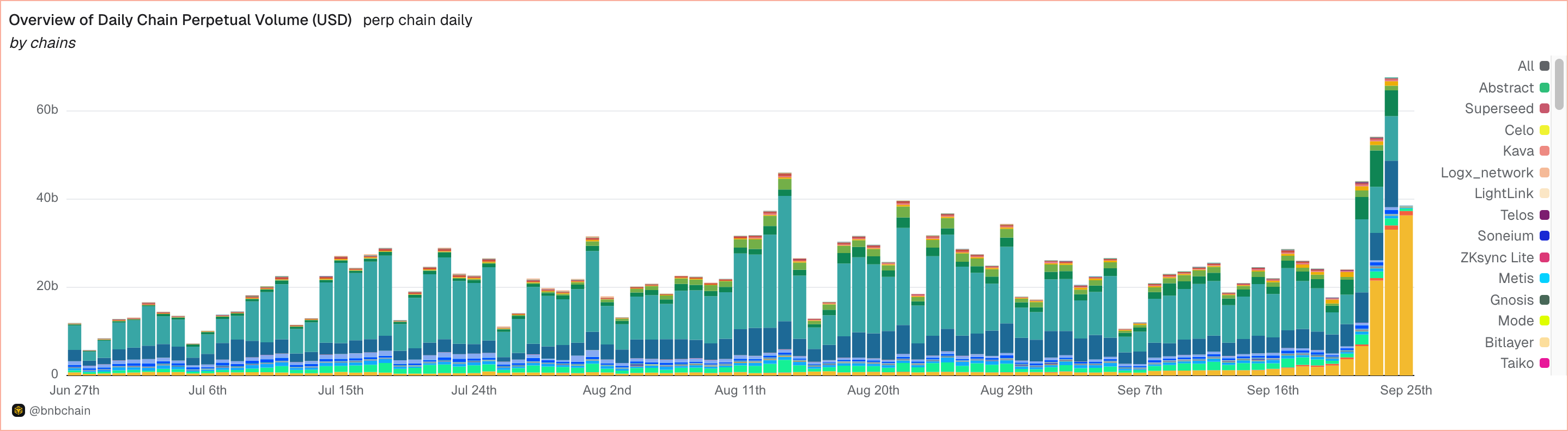

The Dune Dashboard showed daily Perp volumes of over $67 billion in September. High lipids, asters and lighters each cleared up $10 billion, sparking debate over the possibility of washing.

Daily Chain Permanent Volume (USD) Overview dune

Background context

The collapse of FTX has broken CEX’s trust in custody. Furthermore, 21 shares compared Perps to “rental a house” (flexible but expensive) to show why they became Defi’s core engine.

Deep analysis

Coinshares reported a 210% growth in 2024, with high lipid content rising 25 times. Jupiter rose 5,176% and drifted 628%. As the 21Shares survey noted, cumulative PARP trades rose by 138% in 2025.

Behind the scenes

Bybit compared Hyperliquid’s L1 with Aster’s BNB first design. Aster has skyrocketed 300% since its launch, driven by CZ. Aster temporarily overtaked high lipids. As a result, analysts pointed out that decentralization is now often referred to as “illusions.”

The industry is facing structural change

Wideer impact

Perp Dex’s share rose from under 10% in 2023 to 26% in 2025. Defillama observed that the top four venues control 77% of the total. Furthermore, traders are moving away from empty meme tokens towards revenue protocols.

The top 4 perp dexs consists of 77% of all volumes pic.twitter.com/8pckkzsynv

– Defilama.com (@defilama) September 23, 2025

Essential facts

I’m looking forward to it

Oak’s study predicts that Hyperliquid’s share could remain at 4.5% bears, 6% bases and 8% bulls. Messari even called it “on-chain binance.”

Bitwise’s Max Shannon told Beincrypto that the addressable market can expand well beyond current levels. If decentralized PERPS continues to gain a share from CEXS, the annual volume could reach between $20-30 trillion in less than five years. He noted that leverage and transaction termination amplifies growth beyond spot volumes, with facility adoption and regulation clarity serving as an additional catalyst.

Clouds over rapid expansion

Risks and challenges

Defiignas warned that the hype is not FTX or Luna, but that the reflexivity will last. Hayes commented on Aster, but others predicted extreme hype upside down. CZ said Dark Pools Shield agencies will shield the agencies from MEVs and liquidation hunts, but will reduce transparency.

Shannon also warned that regulators might view Perp Dexs as systematic, as daily volumes are already above $67 billion. He proposed that future monitoring could require registered interfaces, standardized Oracles, audited insurance funds, and formal risk management.

Expert opinion

Perp dexs can fail, but unlike FTX. Those weaknesses are structural rather than fraud, and risk is transparent and chained.

– Max Shannon, Bitwise told beincrypto

“High liquids have everything you need to become a finance home,” the analyst said.

– Oak Research

“More players will expand the market size faster. Rising tide lifts all boats,” CZ said in X.

– Binance Founder

Perp dexs are proliferating, supported by advances in execution speed and depth of fluidity. However, their future will depend on whether participants balance incentives with consistent governance with a reliable token model. Furthermore, if implementation continues to improve, but trust weakens, recruitment may be slower.

In contrast, if the project combines strong infrastructure with sustainable economics, this sector could become the central engine of definition and the foundation for broader market integration.

Perpetual Dexs Era: The clouds that grow meet first appeared.