The Winklevoss Twins-Run Exchange is next in line with its public debut on stock indexes.

Coinbase and bulls have already made a leap, raising some eyebrows. What’s next for Gemini?

Ongoing minutes

Shared via a press release through the exchange’s parent company, Gemini Space Station Inc., it announced earlier this week that it had begun an initial public offering (IPO) process with offers of over 16.6 million shares of Class A common stock.

This follows the registration statement on the S-1 form filed with the US Securities and Exchange Commission. In addition to the offer, shareholders selling Gemini and stock plans will offer the underwriters (the financial institution/experts who assess potential loan risk and envision potential loan risk) the option to purchase additional shares for a month.

These amounts are 2,396,348 and 103,652 shares of Class A common stock, respectively, which are used to cover over-allotment (an option that allows the underwriter to sell up to 15% more shares than originally planned). The IPO price for the stock is currently in the range of $17 to $19, depending on the economic situation and other conditions.

Additionally, the announcement has announced that there is no guarantee as to when the offering will be completed or its actual size. Gemini applied for a list of Nasdaq indexes with the ticker “Gemi”. The major bookrunners (underwriters) are financial giants Goldman Sachs, Citigroup and Morgan Stanley.

Do you see another great performance?

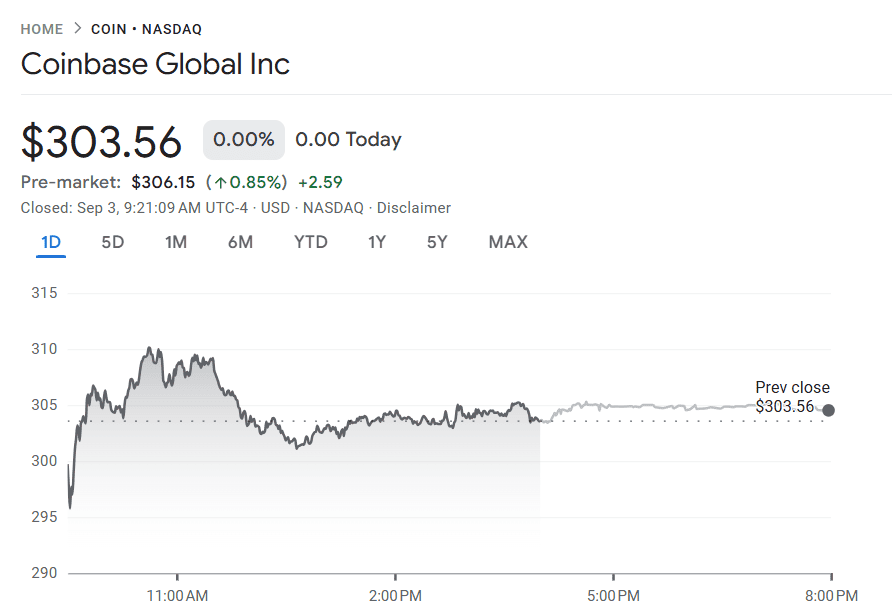

Remember Coinbase in 2021. This has now been straightened to Nasdaq’s direct list, rather than the usual IPO. Before the list, the reference price per share was $250. At the end of the first trading day it ended with a 31% jump of $328.28. Earlier this week, the coin traded for Arond $303. This represents a slight decline over the past few years.

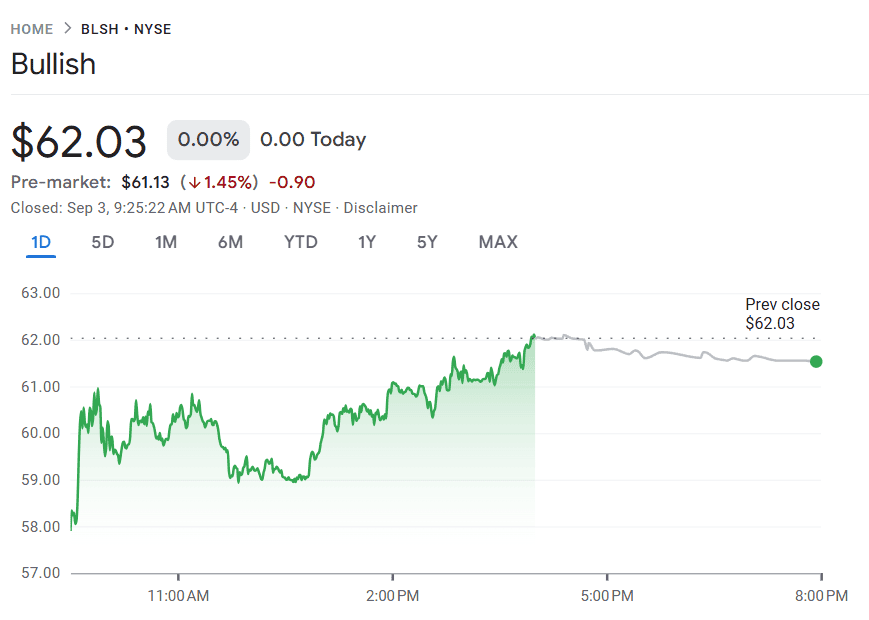

Recently, Bullish Exchange, which was released last month on the New York Stock Exchange (NYSE), also saw an impressive debut after the IPO.

That first trading day went well, with stocks opening at $90 and Peaks reaching $118, representing an increase of 143% and 218% before finishing the day at $68 respectively. When printed, the stock price is stable at around $62.

In particular, this IPO was unique in its own right. Because it was the first to be completely settled in Stablecoins.

“Getting IPO revenue with Stablecoins is a baller’s move. A big moment for all crypto. Soon this will become a new normal.” – Brian Armstrong, CEO