U.S. federal debt interest payments exceeded $1 trillion for the first time in fiscal year 2025. Interest costs now exceed both defense spending and Medicare, a first in U.S. history.

Wall Street analysts and social media users alike are bringing up “Weimar” as warnings of financial crisis mount. Meanwhile, the US Treasury is positioning stablecoins as a strategic tool to absorb the growing flood of government debt.

Numbers: A visible crisis

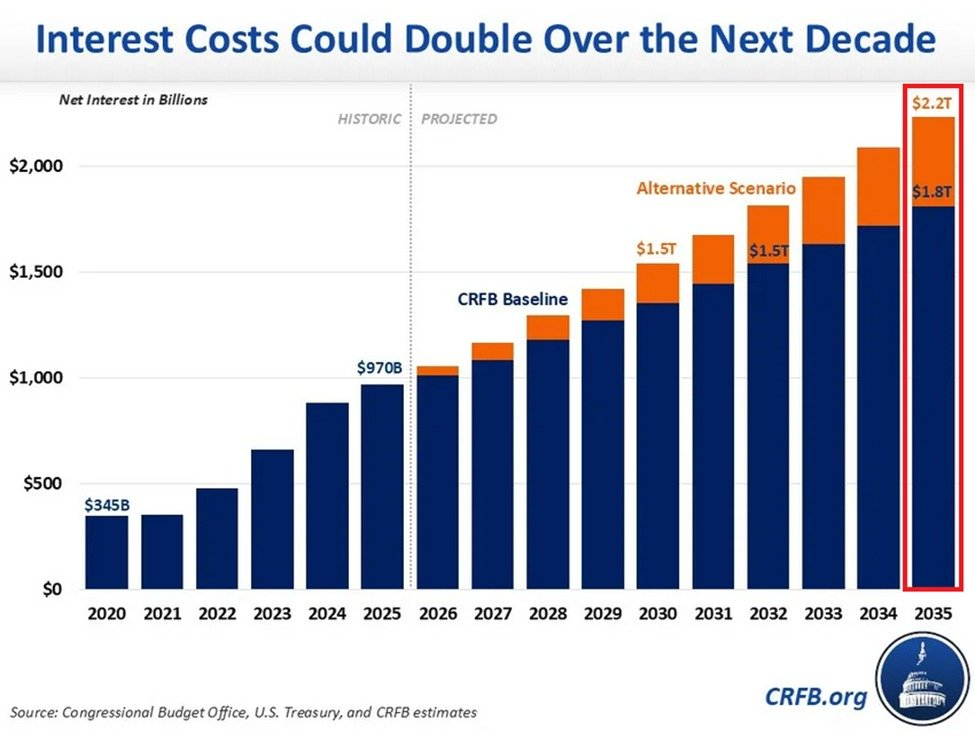

Total net interest expense for fiscal year 2020 was $345 billion. By 2025, that amount will nearly triple to $970 billion, outpacing defense spending by about $100 billion. When all interest on the public debt is taken into account, the amount exceeded $1 trillion for the first time.

Source: U.S. Congressional Budget Office, via KobeissiLetter

The Congressional Budget Office projects that cumulative interest payments over the next 10 years will total $13.8 trillion, nearly double the inflation-adjusted amount spent over the past 20 years.

The Committee for a Responsible Federal Budget warns that under an alternative scenario in which the tariffs are ruled illegal and the temporary provisions of recent legislation become permanent, interest costs could reach $2.2 trillion by 2035, an increase of 127% from current levels.

Why this is unprecedented

The debt-to-GDP ratio has reached 100%, the highest level since World War II. By 2029, it will surpass its 1946 peak of 106% and continue to rise to 118% by 2035.

Most concerning is the self-reinforcing nature of the crisis. The federal government borrows about $2 trillion a year, about half of which goes solely to repaying existing debt. Chris Towner, an analyst at CRFB, warned of the possibility of a “debt spiral”, saying: “If the people who lend us money become worried that we won’t be able to repay them in full, interest rates could rise, meaning they have to borrow more to pay the interest.”

Market reaction: “Weimar” and “buy gold”

These predictions caused an uproar on social media. “If this trajectory doesn’t change, it’s unsustainable,” one user wrote. In another post, he posted “Weimar,” a reference to Germany’s hyperinflation in the 1920s. “It’s the era of debt repayment,” he once again declared, capturing the sentiment that America has entered a new phase.

An overwhelming majority advocated flight to hard assets such as gold, silver and real estate. There is little mention of Bitcoin in particular, suggesting that traditional “gold bug” thinking still dominates retail sentiment.

Market impact

A sharp increase in government bond issuance in the short term absorbs market liquidity. With risk-free yields nearing 5%, stocks and cryptocurrencies face structural headwinds. In the medium term, fiscal pressures are likely to accelerate regulatory tightening and crypto taxation.

However, in the long run, it creates a contradiction for crypto investors. As financial uncertainty deepens, the narrative of Bitcoin as “digital gold” strengthens. The worse traditional finance performs, the stronger the claims to assets outside the system.

Stablecoins: Where crisis meets solution

Washington has found an unexpected ally in fiscal matters. The GENIUS Act, signed in July 2025, requires stablecoin issuers to maintain 100% reserves in US dollars or Treasury bills. This effectively turns stablecoin companies into structural buyers of government debt.

Treasury Secretary Scott Bessent declared that stablecoins are a “revolution in digital finance” that will “lead to a surge in demand for U.S. Treasuries.”

Standard Chartered estimates that stablecoin issuers will buy $1.6 trillion in Treasury bills over four years, enough to absorb all the new issuance of President Trump’s second term. This would exceed China’s current Treasury holdings of $784 billion and position stablecoins as alternative buyers as foreign central banks reduce U.S. debt exposure.

The beginning of the debt repayment era

The US financial crisis is paradoxically opening the door to cryptocurrencies. While traditional investors flock to gold, stablecoins are quietly becoming critical infrastructure for the U.S. bond market. The Washington government’s adoption of stablecoin regulations is not just about innovation, it’s about survival. The era of debt repayment has begun, and it may be unlikely that cryptocurrencies will benefit from it.

The post US debt interest rates hit $1 trillion: The hidden catalyst for stablecoin adoption appeared first on BeInCrypto.