Over the past month, more than $1167 million in Ethereum, worth $4.167 billion, has been accumulated by unknown whales and agencies.

summary

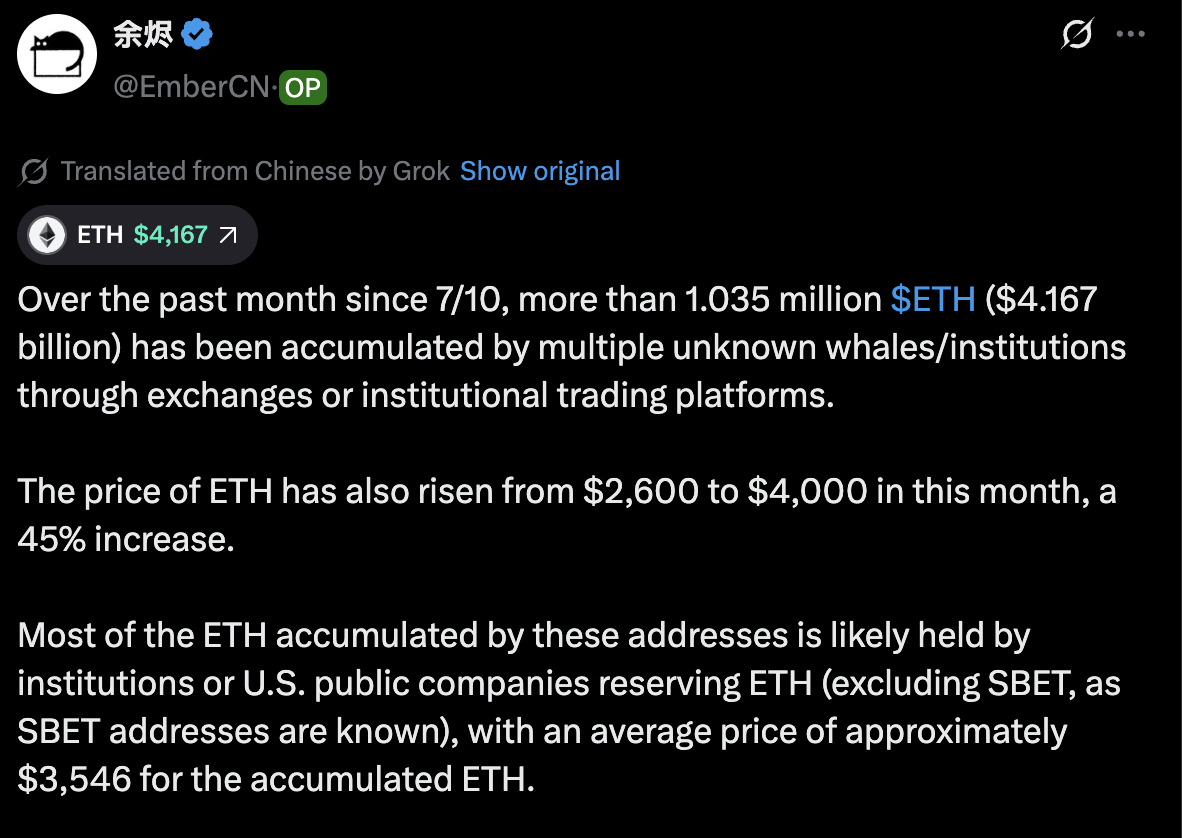

- Whale, the agency has accumulated 1.035 million Ethereum worth $4.17 billion in a month.

- The average ETH buys $3,546 as prices soar from $2,600 to $4,170.

- Analysts warn of over-expansion and advise ETH ecosystem play instead.

According to analyst Ember CN, the massive purchases coincided with a surge in ETH prices and $4,000 above $4,000.

Institutional accumulation occurred through exchange and institutional trading platforms, as well as through the average price (ETH) of around $3,546 per Ethereum.

Ember CN suggested that most addresses belong to the institutions that build Ethereum reserves or public US companies, excluding known addresses such as SBET.

xPosted by analyst Embercn

When the price breaks $4,000, Binance moves ETH

Arkham Intelligence Data shows that within hours of prices surged, thousands of ETH have been transferred to market maker WinterMute.

Transactions began with a flow of 250-500 ETH per transfer before escalating to a larger movement involving a single transaction of more than 1,800 ETH.

WinterMute’s transfer suggests that institutional demand needs to be better implemented to avoid market impact. Market makers process large orders by breaking them down into smaller transactions or providing liquidity during the volatile period.

Ethereum 24-H Price Chart: Coingecko

Ethereum’s 24-hour 6.6% profit pushed the price to $4,170, bringing its all-time high of nearly $4,800. A 30-day performance of nearly 50% indicates sustained institutional purchasing pressure across multiple time frames.

Technical analysts warn of over-expansion

Analyst Michael Van de Poppe warned against purchasing ETH at the current level. He also described the move as “wild,” saying the price “sweeped out the highs.”

Poppe suggested that the setup could lead to a “big breakout to Ass,” but instead recommended allocation of funds within the Ethereum ecosystem.

$eth’s wild movement.

It’s dominated the highs and is a bit too risky to buy $eth at these highs.

It’s set up for a big breakout to ATHS, but it should bring about higher returns, so I think it would be wiser to allocate funds within the $ETH ecosystem. pic.twitter.com/slydtcukqt

– Mycal Van de Poppe (@cryptomichnl) August 9, 2025

“It’s a bit dangerous to buy $eth at these highs,” posted Van de Poppe. “I think it would be wise to allocate funds within the $ETH ecosystem.

Analyst recommendations illustrate a general strategy for purchasing ecosystem tokens that may outweigh ETH during meetings while being exposed to Ethereum growth.

The $4.17 billion accumulation period coincides with an increase in institutional cryptocurrency adoption.

Public US companies are increasingly adopting cryptocurrency financial strategies, and Ethereum has become a secondary option after corporate-holding Bitcoin.

Read more: As the Shiv Burn Rate jumps 1,800%, the price rebound for the Sheeva Dog