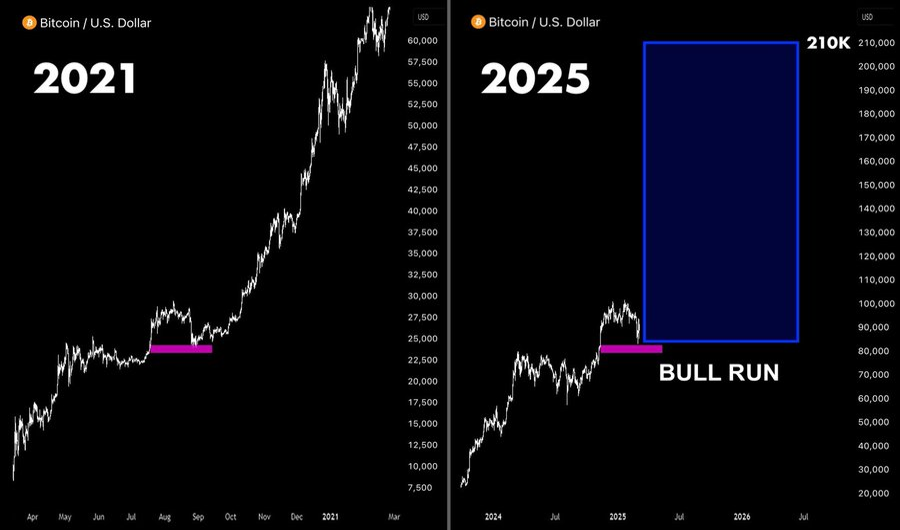

- Bitcoin mimics the 2021 setup, with $30,000 in support informing bullish base.

- The analyst chart shows a repetitive cycle phase suggesting a $210,000 breakout pass.

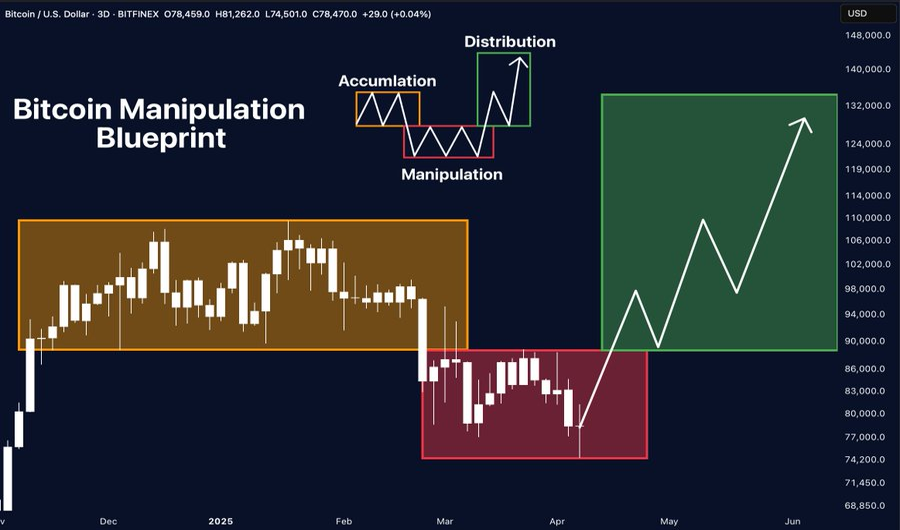

- The market stage reveals the transition from manipulation to bull distribution zones.

Bitcoin’s current time span reflects the 2021 pattern, with repeated breakouts that could exceed $30,000. Technical analysts quote repetitive levels of support and emotional cycles, meaning new moves with higher prices.

Chart Patterns reveal familiar market setups

Bitcoin is currently stable around the major support zones previously marked during the 2021 integration phase. The historic pattern shows strong gatherings following this structure, especially when support is retained despite market modifications. Price action suggests that similar technical actions could drive the next bullish leg.

Recent activities highlight the notable similarities before the 2021 pattern of Bitcoin surged from $30,000 to $60,000. Technical analyst Lofty has published an analysis of the 2021 and 2025 time frames, focusing on price structure and key zones. According to Lofty, Bitcoin gathered sharply after forming a powerful base of nearly $29,000 in 2021.

sauce: Highly popular

In his view, the 2025 price action reflects this previous setup, with a different base around the same support range. He marked this level in the magenta zone in both time frames, identifying it as the basis for a potential breakout. His projection places the next peak at nearly $210,000, shown by a blue box along historic momentum.

In addition to time frame symmetry, the noble ones identified a repeating four-year cycle phase that strengthened this setup. He also outlined investor behavior in accumulation, markup, distribution and decline. According to this breakdown, current activity is consistent with early markup, following accumulation and shakeout.

He further emphasized the psychological stage from optimism to surrender, noting that the present moment reflects a new optimism. Based on this sequence, he hopes that market confidence will increase and drive further profits. This matrix model combines the movement of altcoin with the shift in dominance of Bitcoin and price changes, suggesting future ALT rallies.

BluePrint highlights the market manipulation structure

Analyst Merlijn Traders provide additional insights focusing on price manipulation stages and institutional behavior. His framework divides recent Bitcoin price activity into accumulation, manipulation and distribution zones. Each segment reflects its own price response and trading behavior.

sauce: Merlin Trader

According to Merlijn, Bitcoin was merged between $85,000 and $90,000 between November and February, forming a build-up range. In March, prices fell sharply to $74,000, creating an operational zone featuring panic and stop loss triggers. He marked the breakdown in red and identified it as the intentional shakeout phase.

A strong rebound occurred in April as Bitcoin returned to its previous range with a big bullish candle. The move moved the price into the distribution phase, with the target expanding to $132,000. Merlijn’s structure outlines how the price stage corresponds to emotional cycles and institutional strategies.