Strategy (MSTR) stock has fallen for six consecutive months for the first time since the company adopted Bitcoin as a financial asset in August 2020, according to an earnings report shared by cryptocurrency analyst Chris Milas on Thursday.

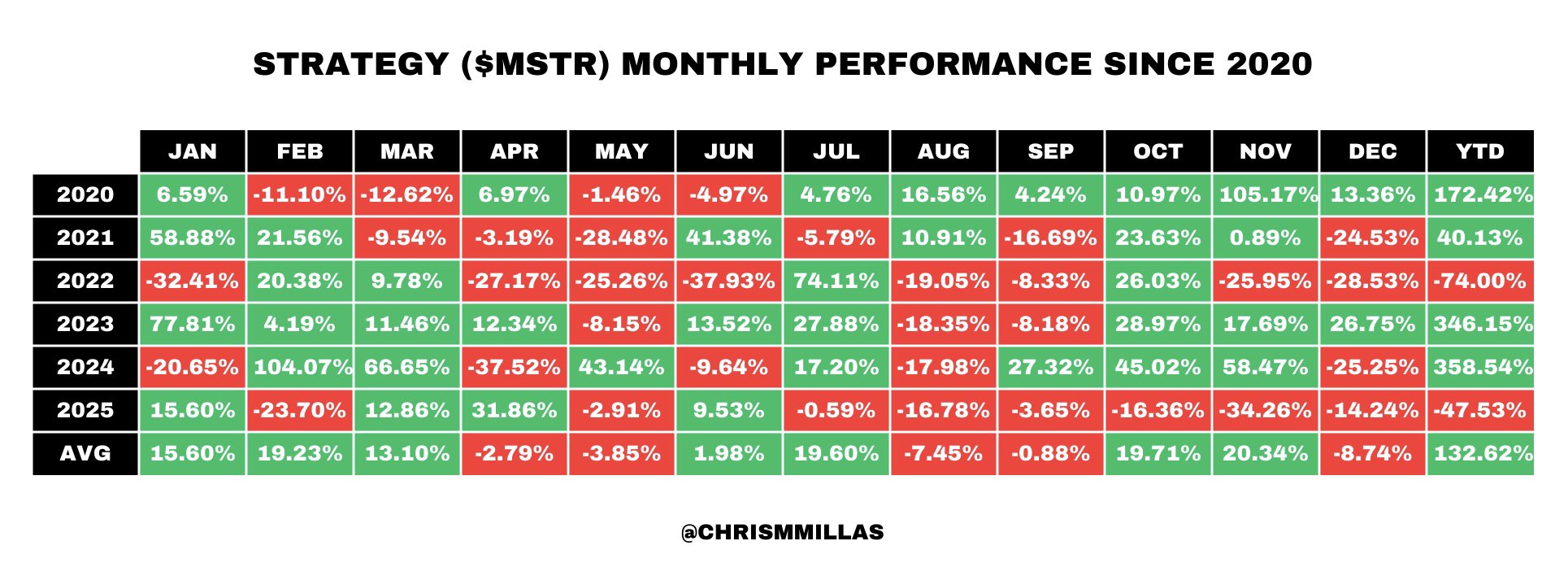

In a Jan. 1 post to X, Milas highlighted this rare streak and attached a graph showing the strategy’s monthly gains since 2020. According to the data, the stock has recorded consecutive losses from July to December 2025, including a decline of 16.78% in August, 16.36% in October, 34.26% in November, and another 14.24% decline in December.

Strategy (MSTR) Monthly Performance since January 2020 (Chris Millas / X)

Strategy has suffered larger single-month losses in the past, but the chart shows those drawdowns were typically punctuated by months of sharp recovery. For example, the 2022 bear market saw significant declines followed by over 40% gains within months. The absence of a comparable bailout rally in the second half of 2025 marks a break from that historical pattern and suggests a more permanent repricing rather than a temporary decline.

According to Google Finance, Strategy stock closed at $151.95 on Dec. 31, down 2.35%. The stock has fallen 11.36% in the past month, 59.30% in six months, and 49.35% in the past year.

Bitcoin has held up better over comparable periods of time. Bitcoin was trading at $87,879 as of noon ET on January 1, up 0.38% over the past 24 hours, according to CoinDesk Data. The flagship cryptocurrency is down 5.06% over the past month, 27.36% over the past three months, and 9.65% over the past year.

This discrepancy comes even as Strategy continues to increase its Bitcoin holdings. On December 29, Executive Chairman Michael Saylor announced on X that the company had acquired 1,229 BTC for approximately $108.8 million. According to him, as of December 28, Strategy holds 672,497 BTC, which it acquired for approximately $50.44 billion.

Strategy’s stock performance also lagged the broader market. The Nasdaq 100 index, of which the company is a constituent, rose 20.17% in 2025.