Strategy ($MSTR) soars 25% as Bitcoin rebounds

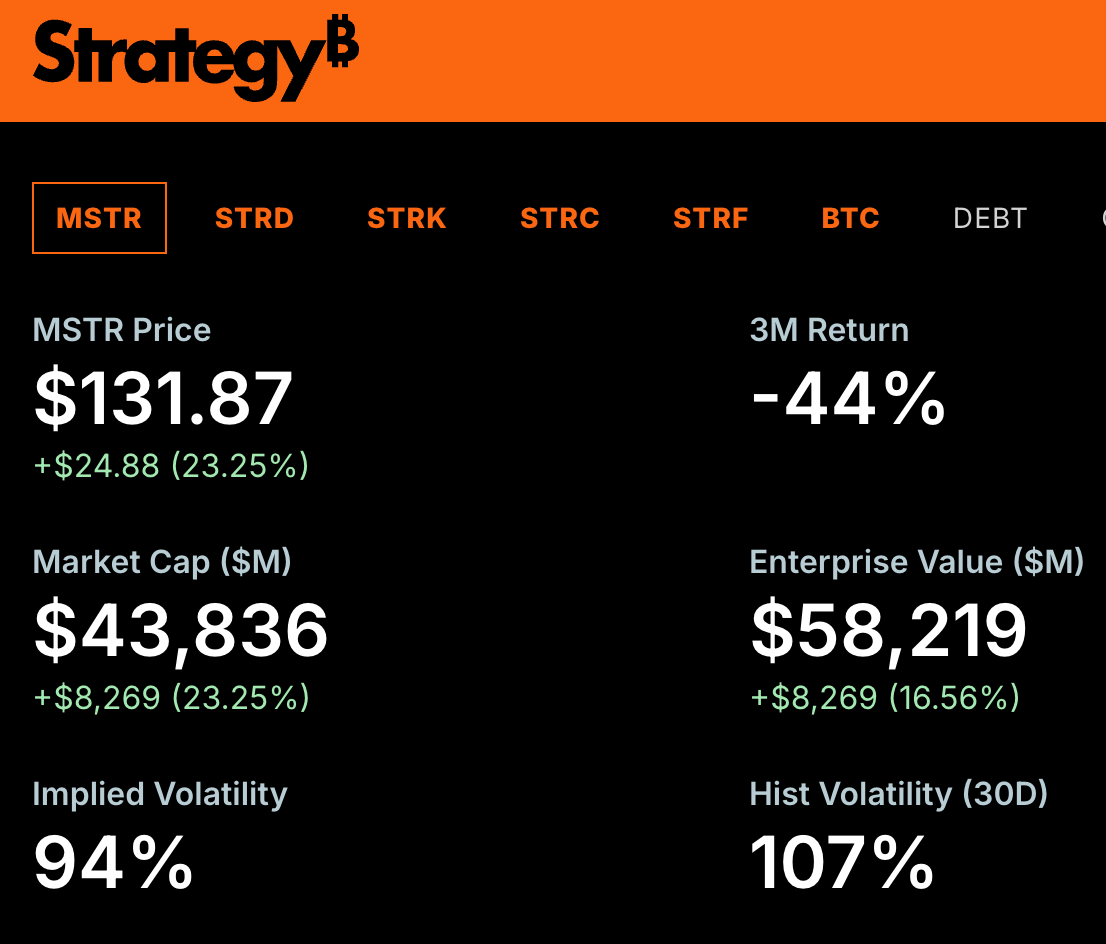

Strategy stock ($MSTR) soared on Friday, rising more than 25% at one point to trade around $133 after a brutal trading session left Bitcoin-related stocks severely oversold.

The rally came as markets stabilized and Bitcoin recovered from multi-week lows to around $71,000, injecting newfound demand into stocks related to the digital asset.

Friday’s rally reversed Thursday’s dramatic decline, during which MSTR stock fell to multi-year lows due to profit losses and renewed pressure in the crypto market.

From a macro perspective, Strategy’s stock price movements track Bitcoin’s rapid fluctuations. As a major corporate holder of Bitcoin, MSTR’s performance is highly correlated with BTC price movements.

The digital asset’s sell-off earlier this week sent the stock plummeting, with bears pushing the strategy price down to the $105 level on Thursday.

Strategy revenue loss

Strategy posted a loss of $12.4 billion in the fourth quarter of 2025, primarily due to an unrealized decline in the value of its vast Bitcoin holdings.

The overall loss was well below market expectations and weighed heavily on the stock, contributing to the stock’s decline on Thursday.

Despite the lack of revenue, management remained committed to its long-term Bitcoin strategy.

Executive Chairman Michael Saylor said the company is launching a Bitcoin security program to engage with the global cyber and cryptocurrency community, and has positioned quantum computing as a long-term challenge that is unlikely to threaten Bitcoin for more than a decade.

The company said quantum concerns are the latest form of Bitcoin “FUD”, pointing to continued global investment in quantum-resistant security and the potential for protocol upgrades through broad consensus.

Strategy executives emphasized resilience, saying the company can withstand extreme declines in Bitcoin prices without immediate solvency concerns.

Executives like CEO Von Leh emphasized their confidence that Bitcoin will grow stronger from its long-term strategy, continued funding, and future technology and market challenges.

Lee said Bitcoin would need to fall to around $8,000 per coin and stay there for five to six years before the company faces serious difficulties repaying its convertible debt.

“On the extreme downside, if Bitcoin price drops 90% and its price was $8,000, that is the point at which Bitcoin reserves equal net debt,” Lee said. He noted that under these circumstances, the company may consider restructuring or raising additional capital.

This article first appeared in Bitcoin Magazine and was written by Micah Zimmerman.