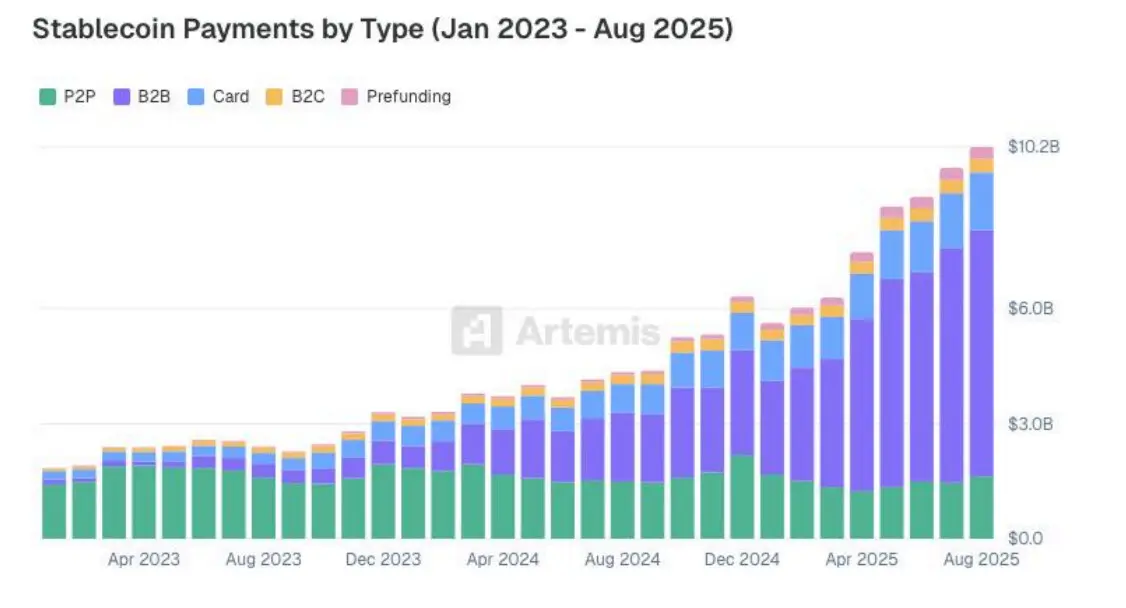

Stablecoin payments will expand in 2025, with an increasing proportion of B2B transfers. According to Artemis, the use of the token as a payment tool has increased by 70% since February.

In 2025, stablecoin payments have expanded by more than 70% since February. Markets pegged to fiat currencies have evolved and payments have become one of the main vectors of development, with Circle’s USDC leading the trend.

Artemis, one of the leading crypto data hubs, collected data from 22 crypto payment companies to estimate the actual usage of stablecoins. A further 11 startups were interviewed for additional data from B2B, P2P, B2C, card payments, and pre-funding.

This data collection tracked $136 billion in payments between businesses settled between January 2023 and August 2025. This period has already shown the evolution of the stablecoin market, with the trend continuing into the third quarter due to growth in supply and active users.

B2B payments dominate the market

Artemis has found that B2B payments are the biggest driver of activity, as they are the assets that enable large-scale, permissionless payments. This type of payment reached $76 billion per year, with P2P payments coming in second at $19 billion per year.

B2B payments have been the most active segment in stablecoin usage. App and card payments will expand in 2025, marking mainstream adoption in retail stores. |Source: Artemis

Crypto cards then became popular, with annual payments amounting to $18 billion. B2C payments were $3.3 billion, while pre-funding solutions had $3.6 billion in payments.

Despite USDC’s growing influence, Tether’s USDT remained the most popular token used by businesses. USDT captured 85% market share in terms of volume, with Circle in second place. TRON held the most stablecoins, followed by Ethereum, BNB Chain, and Polygon.

The United States, Singapore and Hong Kong recorded the highest amount of remittances.

Payment solutions increase the use of stablecoins

One of the factors behind the increased use of stablecoins was payment apps built by centralized exchanges. Most notably, Bybit Pay and Binance Pay emerged as activity hubs, leveraging the exchange’s customers with additional money transfer tools.

BVNK has also emerged as a payment gateway with the infrastructure to connect banks and blockchain. BVNK focuses on business scalability issues. BVNK’s approach is to allow businesses to use fiat currencies and complete stablecoin transactions on the backend using fast, borderless infrastructure.

Stablecoin cards were another factor driving mass adoption. With clearer regulations, card usage has expanded from the 2023 baseline level. As of August 2025, monthly crypto card payment volume exceeded $1.5 billion.

Cards linked to stablecoin balances seek to provide a seamless experience based on normal card usage patterns. The growth of crypto cards has brought payment providers like Exa and Gnosis Pay in line with the use of traditional credit and debit cards. Average Exa payments were comparable to US debit card spending.

No major changes or new trends were observed in P2P payments. These types of payments had smaller average transaction sizes. The average size of P2P payments was lower compared to Zelle and Venmo. Overall, P2P is one of the riskiest uses for stablecoins, as users flock to select apps.

Stablecoins are still widely used for fraud, and only a small percentage of stolen funds are frozen or returned.