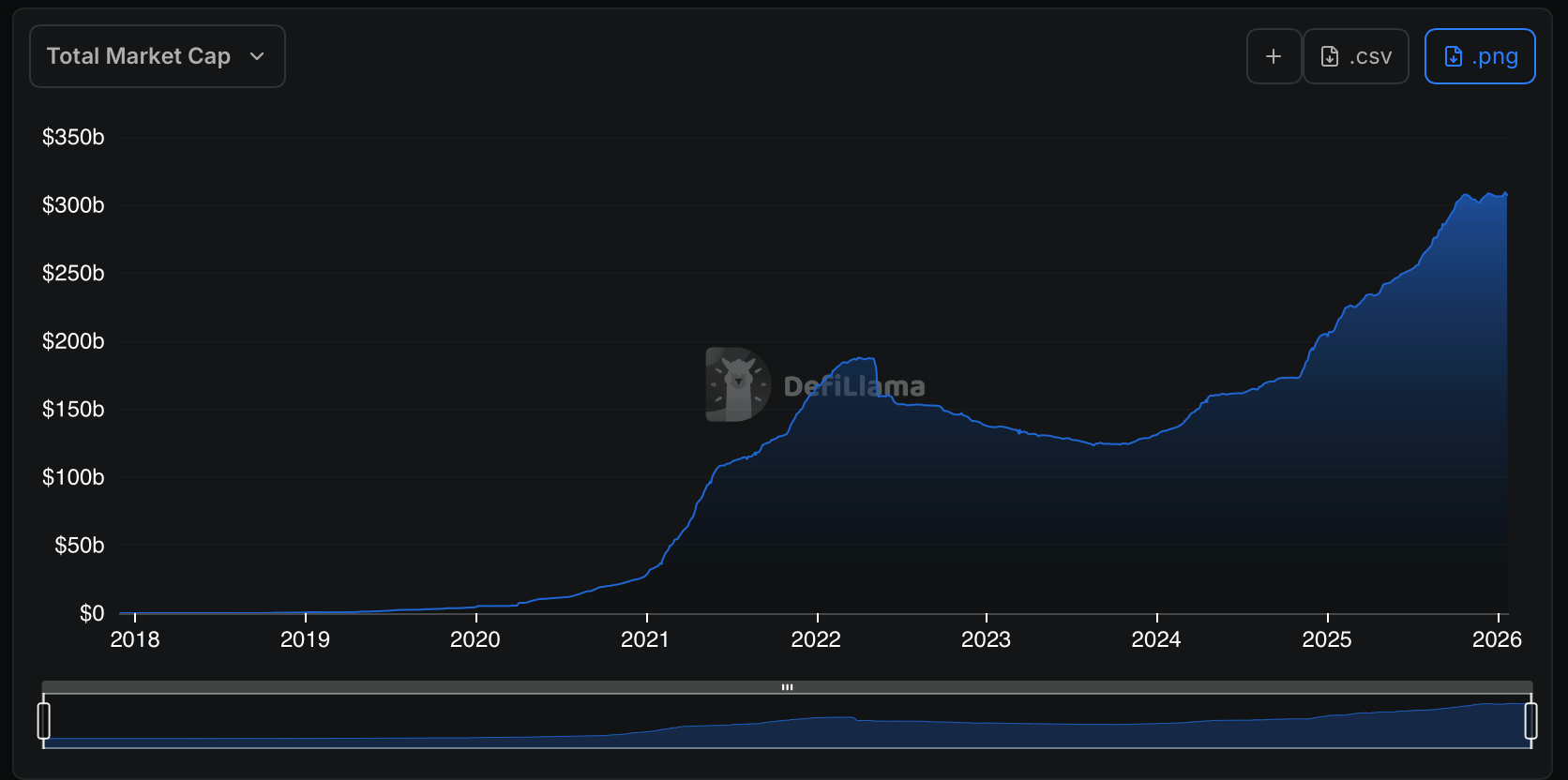

Seven days after the stablecoin sector issued a record $310.426 billion on January 17, the market has returned $3.327 billion. This proves that “stable” capital also has a sense of timing.

Post-peak pause: stablecoins take a step back

First up is the heavyweight contender, Tether ( USDT) has a market capitalization of approximately $186.59 billion and has seen zero activity in terms of reductions or issuances in the past 7 days. USDT It currently captures 60.76% of the net value of the entire stablecoin economy this weekend. Stability at the top is important. USDT The sector’s liquidity pillars remain, even as the broader category shrinks in size.

Just behind that, the stats for defillama.com show data for Circle. USDC It moved in the opposite direction, dropping 5.44% this week to about $72.9 billion. This 5.44% loss corresponds to an outflow of $4.19 billion. USDC‘s decline has contributed more to the sector’s net contraction than any other single asset, reminding traders that redemption flows remain important.

As of Saturday, the stablecoin sector stood at $307.099 billion, after declining $3.327 billion from January 17, 2026 to January 24, 2026.

Elsewhere, synthetic and yield-linked dollars were more positive. Ethena’s USDe rose 1.51% to $6.57 billion, Sky’s USDS rose 0.78% to $6.25 billion, and Sky’s Dai (DAI) fell 1.21% to $4.62 billion, showing a more mixed pattern than a clean trend.

A midfielder brought fireworks. World Liberty Financial’s USD 1 rose 22.34% to $4.29 billion, outperforming PayPal’s stablecoin contender. PayPal’s PYUSD was still up 1.07% at $3.73 billion, while Falcon Finance’s USDf was nearly flat at $2.06 billion, up 0.26%.

Smaller lines also moved forward. The Global Dollar, also known as USDG, rose 2.46% to $1.52 billion, Ripple’s stablecoin RLUSD rose 0.71% to $1.42 billion, and BlackRock’s Treasury-backed stablecoin token BUIDL was essentially unchanged at $1.27 billion, up 0.02%.

Also read: Support Retains, But For How Long? Bitcoin Showdowns at $89,000

The standout gainer among the top 12 this week was the Ondo USD Yield Token (USDY), which rose 46.54% to around $1.25 billion, highlighting continued demand for high-yield structures tied to tokenized U.S. Treasuries and on-chain credit.

Summarizing the number of tokens pegged to fiat currencies this week, the data paints a simple picture. Stablecoins did not collapse after reaching historic highs, they simply rebalanced. Capital circulated between cash-like safeties, yield wrappers, and an ecosystem of issuers, making the whole thing a little leaner, but by no means fragile.

Frequently asked questions ⏰

- Why did stablecoins fall after their peak on January 17th?Redemption with especially large coins USDCoutpacing increases in other regions.

- Which stablecoin currently holds the largest market capitalization?Tether ( USDT) leads with about $186.6 billion.

- Which stablecoin made the most money this week?Ondo dollar yield has risen about 46.5% in seven days.

- Is the stablecoin market still growing in the long term?Yes, despite weekly dips, supply remains near record levels.