As Stablecoin and Cryptocurrency adoption accelerates worldwide, emerging markets face increasing risks to financial sovereignty and economic stability, according to a new report from Moody’s ratings.

The credit rating service warned that widespread use of Stablecoins (where the token has fixed 1:1 in another asset, usually Fiat currency, such as the US dollar) could undermine central banks’ control over interest rate and exchange rate stability, a trend known as “cryptologies.”

Banks also “can face deposit erosion when individuals transfer savings from domestic bank deposits to stubcoin or crypto wallets,” the report said.

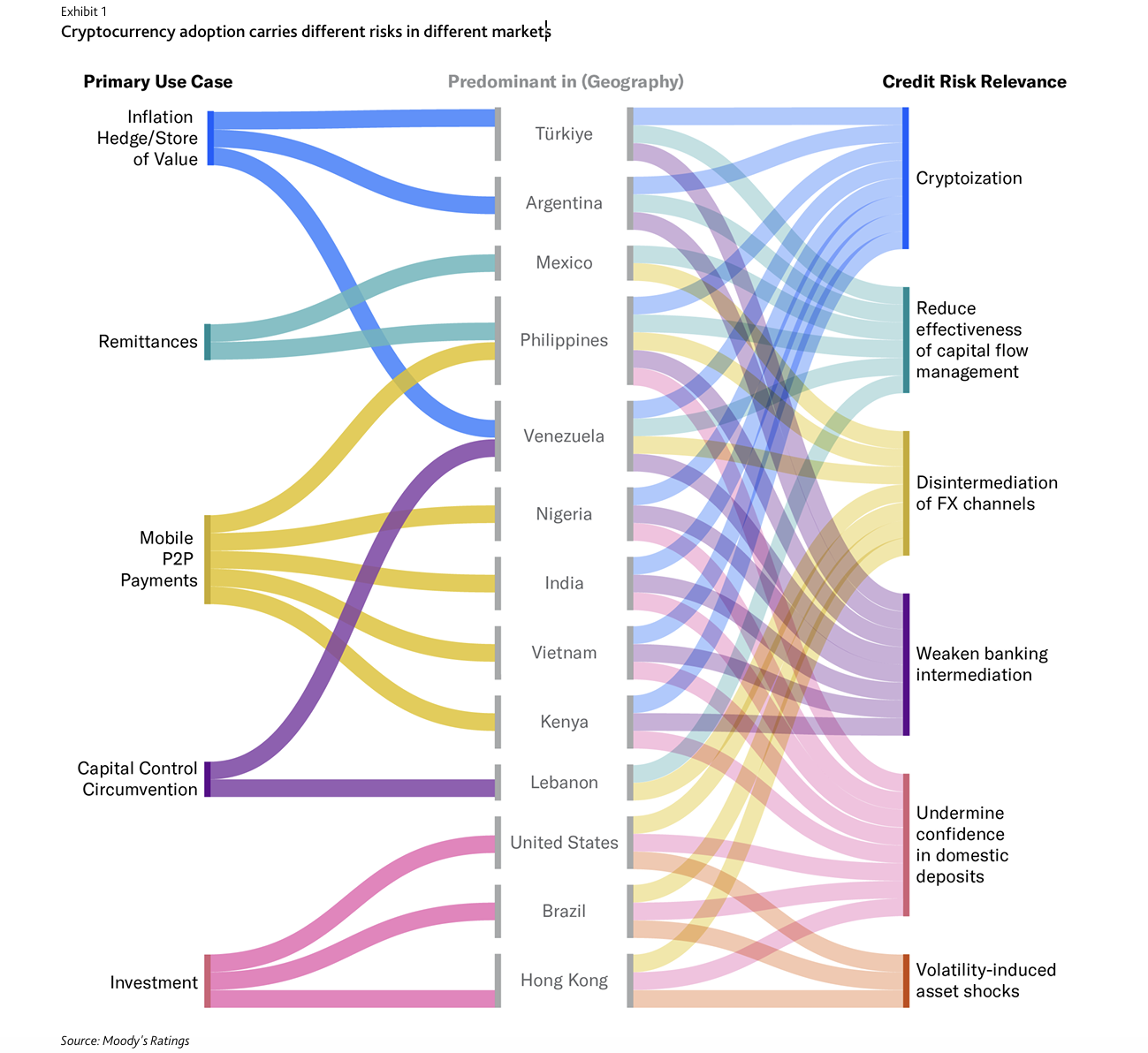

Risk of adoption of crypto in various markets. sauce: Moody’s

Moody’s has left digital asset regulations around the world still fragmented, with less than a third of countries implementing comprehensive regulations being fragmented, and many economies are exposed to volatility and systematic shock.

While clarity of regulations and strengthening investment channels often drive adoption in developed economies, Moody’s said the fastest growth is taking place in emerging markets, particularly in Latin America, Southeast Asia and Africa.

“The rapid growth of (…) Stubcoin brings systematic vulnerability despite their perceived safety. Inadequate surveillance could cause reserves to run and force costly government relief if PEG collapses,” Moody said.

The agency said the boundaries highlight not only the possibility of financial inclusion, but also the risk of financial instability if surveillance fails to maintain the pace.

In 2024, global ownership of digital assets reached an estimated 562 million people, an increase of 33% from the previous year.

Related: New Crypto Rules in Singapore: $200K Fine, Prison Risk

Regulations in Europe, the US and China are accelerating

Although most of the world still lacks clear rules that cryptocurrencies and stupid currencies, Europe, the US and even China have made progress over the last year.

On December 30th, 2024, after a gradual deployment, the remaining provisions for the EU market of the crypto assets (MICA) regime were implemented. MICA is a Crypto Rulebook from Bloc, standardizing service provider licensing and establishing reserve and disclosure requirements for Stablecoins.

In the United States, the Genius Act became law on July 18th, establishing enforceable standards for issuing and supporting stable coins.

China appears to be changing courses as Europe and the US are implementing Stable Coin regulations.

After banning crypto trading and mining in 2021, Beijing expanded its pilot for digital yuan, weighing the yuan-controlled yuan stubcoins, according to a recent report in August 2025.

On Thursday, the People’s Bank of China (PBOC) opened a new operation centre in the digital yuan Shanghai, aiming to focus on blockchain services and cross-border payments as Stablecoin development continues.

Magazine: There is a risk that other countries are “front run” with Bitcoin reserve – Samson Moh