Spot trading volume for cryptocurrencies on major exchanges has fallen from about $2 trillion in October to $1 trillion at the end of January, indicating a “clear exodus from investors” and weak demand, analysts said.

Bitcoin ($BTC) is currently down 37.5% from its October peak, with trading volumes shrinking amid a liquidity drought and significant risk aversion.

“Spot demand is drying up,” CryptoQuant analyst Dirkforst said on Monday, adding that the correction was “primarily caused by the October 10 liquidation event.”

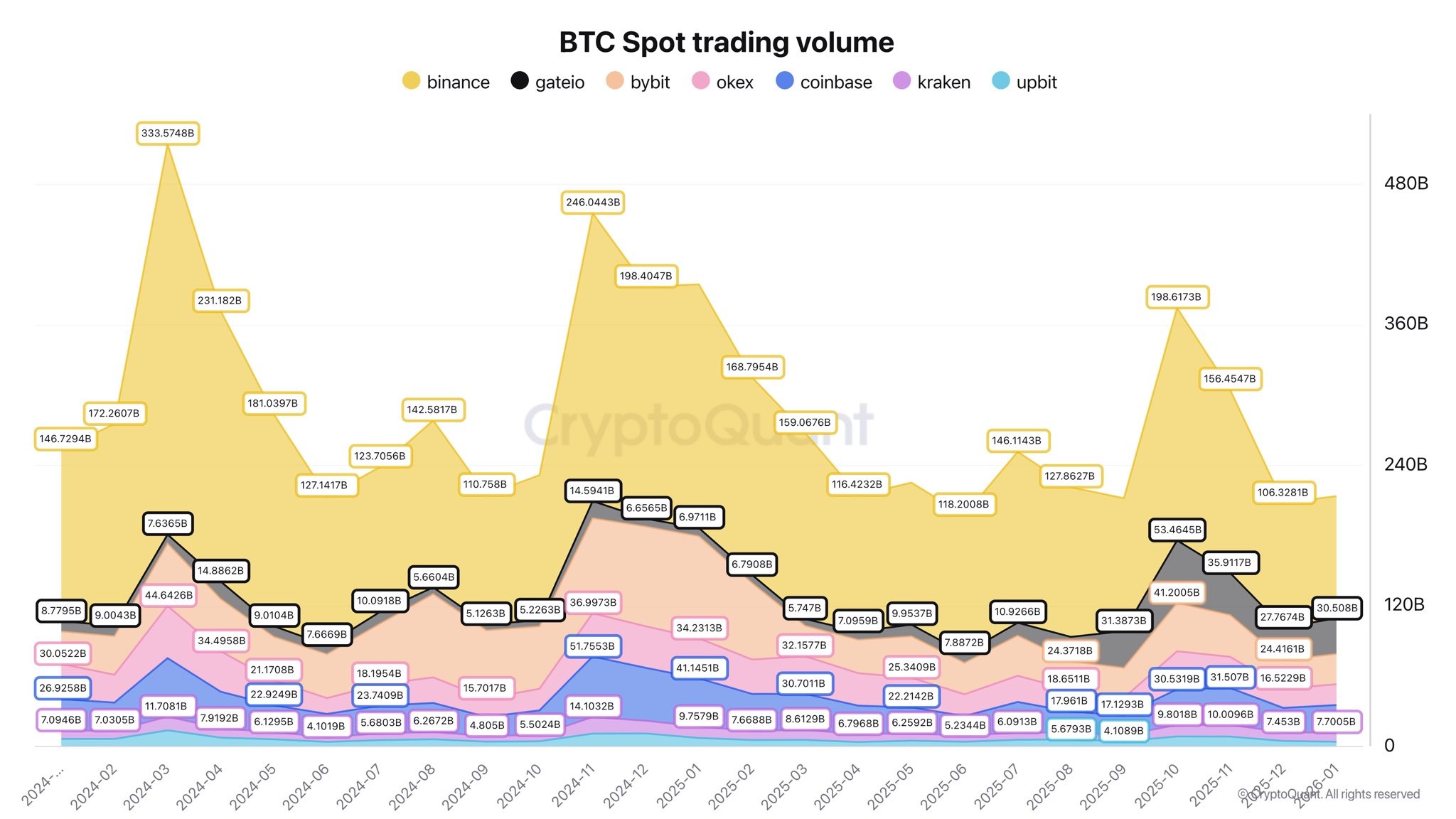

According to CryptoQuant, since October, the trading volume of spot cryptocurrencies on major exchanges has halved. For example, Binance recorded $200 billion in Bitcoin trading volume in October, which has now fallen to around $104 billion.

“This contraction in trading volumes has pushed the market back to the lowest levels observed since 2024. This suggests that investors are clearly leaving the crypto market and demand is weakening as a result.”

Spot Bitcoin trading volume on major exchanges has fallen to its lowest level in 2024. sauce: cryptoquant

But this is not the only factor, they said.

He added that market liquidity is also under pressure, as reflected in the outflow of stablecoins from exchanges and the decline in stablecoin market capitalization of approximately $10 billion.

A bitter pill to swallow, but a necessary market trend

Justin Danesan, head of research at Arctic Digital, told Cointelegraph that the biggest short-term risk is: $BTC The coming months are likely to be macro-driven.

“Uncertainty surrounding Kevin Warsh’s hawkish stance as Fed Chairman could mean fewer or slower rate cuts, a stronger dollar, and higher real yields, all of which will weigh on risk assets, including cryptocurrencies.”

Related: Cryptocurrency decline likely caused by US liquidity drought: analyst

“I don’t think this story is like that.” $BTC Hedging against currency depreciation and inflation is over, so Bitcoin was created to hedge against reckless monetary policy and very long-term currency depreciation,” he said in a contrarian view.

Danesan said a “resurgence of strong ETF inflows, clearer pro-crypto legislation, or softer economic indicators that force the Fed to retreat into accommodative policy” could spark a meaningful rally.

“While it may be a bitter pill to swallow, recent moves ultimately seem necessary and healthy to wipe out leverage, ease speculation, and encourage investors to rethink valuations.”

Bitcoin price is not close to its bottom yet

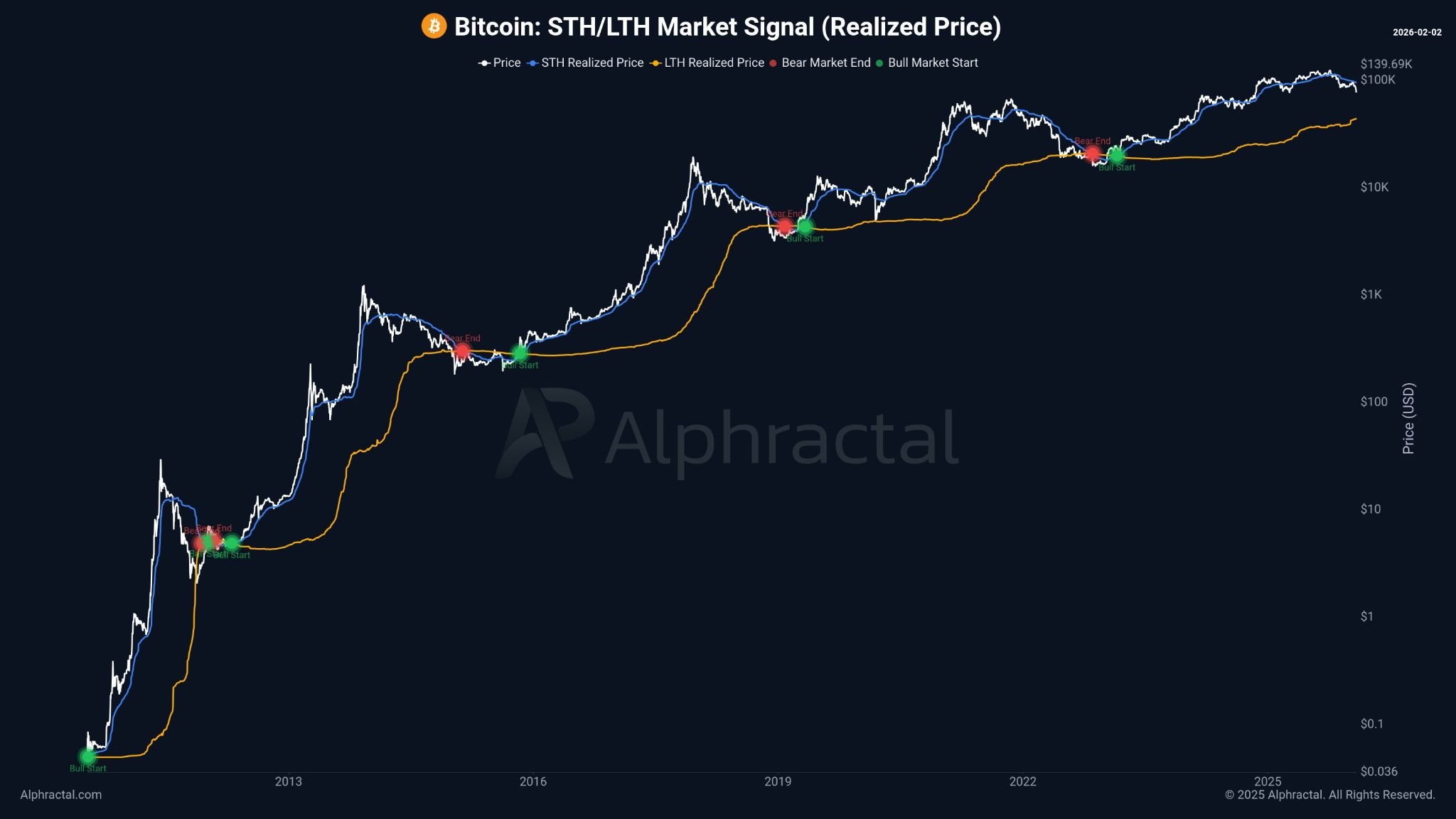

Joanne Wesson, founder and CEO of Alpharactal, pointed out that two things need to happen for Bitcoin to reach a bottom.

Short-term holders (STH) have to stay underwater and this is the current scenario, while long-term holders (LTH) will “start taking losses” and this has not happened yet.

He added that a bear market ends only when the STH realized price falls below the LTH realized price, and a bull market begins when the STH realized price falls below the LTH realized price.

Currently, STH realized price is still above LTH, but we could see a decline below the key support at $74,000. $BTC Enter bear market territory.

Bull and bear market signals from STH/LTH realized prices. sauce: alpha factal

magazine: DAT Panic Dumps 73,000 ETH, Leaves India’s Cryptocurrency Tax Deferred: Asia Express