Solana blockchain recorded $1.6 trillion in spot transaction volume in 2025. This figure equates to a global market share of 11.92%, surpassing major crypto exchanges such as Bybit, Coinbase, and Bitget.

Solana, a high-performance smart contract platform, recorded $1.6 trillion in spot trading volume on decentralized exchanges in 2025. According to on-chain data, this number represents 11.92% of global spot market trading volume. The network’s trading volume exceeded that of all major exchanges, including Coinbase, Bitget, and Bybit.

Solana’s spot trading volume is second only to Binance and higher than all CEX, L1, and L2

🚨Breaking News: In 2025, @Solana will record approximately $1.6 trillion in trading volume, surpassing all L1, L2, and major centralized exchanges except Binance.

Solana also surpassed Bybit, Coinbase Global, and Bitget in total trading volume in 2025. pic.twitter.com/jaKJSe1bpl

— SolanaFloor (@SolanaFloor) January 5, 2026

The network’s spot trading volume was only behind Binance, which handles $7.27 trillion, accounting for 55.11% of the global spot market. Binance’s market share has decreased significantly from the 80% recorded in 2022. Solana’s trading volume also exceeded the confirmed trading volume on all L1 and L2 platforms, including Ethereum, Binance Smart Chain, and more.

data Open-source DeFi data aggregator DefiLlama shows that Solana’s trading volume peaked in January 2025 at $313.26 billion. March was the slowest month for DEX activity, but Solana still led L1 and L2 with $79.73 billion. The data also shows that Solana had more than $100 billion in trading volume in nine of the 12 months this year.

Ethereum recorded a total trading volume of $950 billion during the year. Blockchain transaction volume peaked in August and September, reaching more than $100 billion each month.

According to Artemis researcher ZJ, Solana was ranked 5th among major centralized exchanges just a year ago. Researchers attribute Solana’s increase in on-chain activity to its proprietary automated market maker (propAMM) and central limit order book (CLOB), which have played a pivotal role in moving traders, investors, and market participants from centralized exchanges to decentralized platforms in Solana’s high-velocity environment.

Data and various metrics increase uncertainty about Solana’s performance

Solana’s performance signals transformative changes in the decentralized ecosystem that could drive up asset prices. However, various on-chain metrics and evaluation metrics show contrasting sentiments.

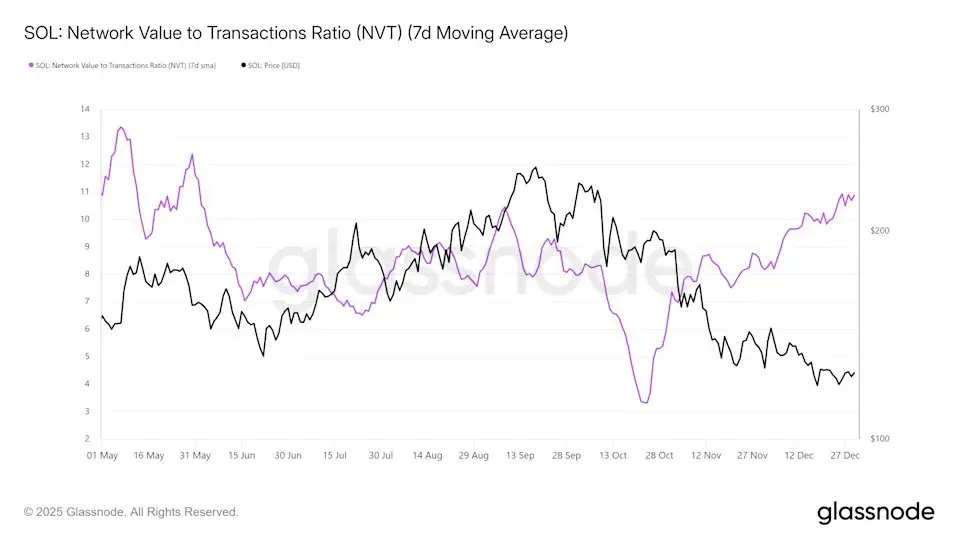

Source: Glassnode. Solana network and transaction ratios

According to data from blockchain data and intelligence platform Glassnode, Solana’s network value-to-transaction ratio is increased rapidly It reached a seven-month high, suggesting a potentially bearish outcome.

Historically, rising NVT numbers have signaled an impending bearish trend, putting pressure on Solana’s price and recovery attempts. The data shows that a divergence exists as Solana’s market value is growing faster than the actual trading demand. The disconnect also shows that Solana’s hype may be outpacing the network’s actual economic activity.

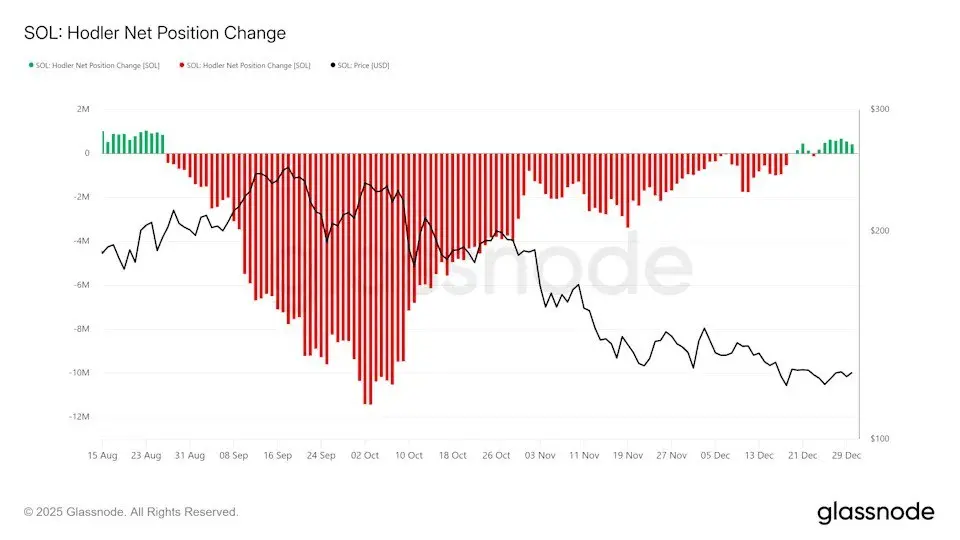

Source: Glassnode. Hodler’s net position change

Meanwhile, the behavior of long-term holders shows contrasting sentiments. Solana’s hodler net position is shifted From about 4 months of distribution to new accumulations in the past week. Holders may be able to take pressure off the skis and reduce bearish risk amid near-term uncertainty for Solana.

Data from ETF tracking website SosoValue, show The US Spot Solana ETF recorded inflows worth $2.29 million on December 31st, marking the third consecutive day of positive inflows. The data also shows that the ETF received significant inflows in December and now has $1.02 billion in net assets under management.

Also previous Cryptopolitan report highlighted Solana crypto fund products recorded the highest growth rate, with $3.6 billion in inflows in 2025. This figure represents a 1000% increase from $310 million in 2024. This data supports Glassnode’s Hodler Indicator and shows that long-term Solana holders are accumulating cryptocurrencies.

As of this writing, Solana is trading at $134.34. According to data from cryptocurrency price tracking website CoinMarketCap, the crypto asset was unchanged in the past 24 hours despite gaining 8.58% over the past seven days.