This is a segment of the 0xResearch newsletter. Subscribe to read the full edition.

Solana’s consensus stack, the proven history sequenced in TowerBft, has always provided faster block time than its competitors. However, Finality is still sitting in 10-20 seconds, far from the Nasdaq-level latency that Solana aims to do.

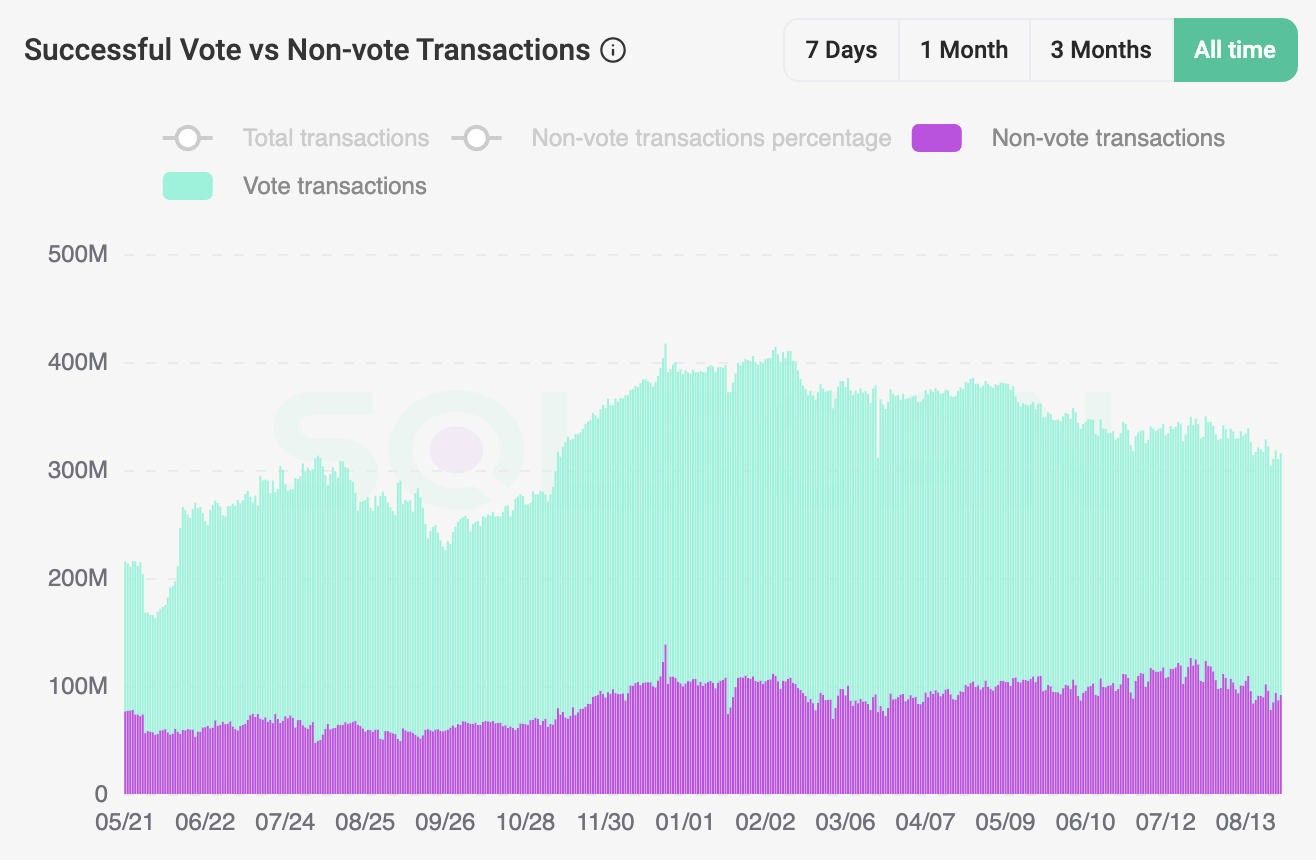

SIMD-0326 (“Alpenglow”) proposes reducing finality to 100-150 minutes by moving validator votes off-chain. Today, Validators continue to post Onchain votes to signal fork selection, and these votes dominate throughput despite their lack of user value.

Source: SolScan

Source: SolScan

Under Alpenglow, the validator instead paid a fixed “admission ticket” of 1.6 Sol per epoch and burned it into the network. The leader then collects off-chain via the components called Voterscompress them into certificates and write those certificates on-chain. As a result, the exchange will take place. Millions of low-value voting transactions are replaced by one predictable fee per validator, reducing consensus overhead by 20% and freeing up block space for user activity.

The design also adjusts fault tolerance. TowerBft remains today, unless more than 33% of its stock is hostile. Alpenglow will introduce the “20+20” model. Here, the chain lives on 20% malicious stocks, and even 20% offline. For applications such as defi, persistent exchanges, especially drift, convert Solana from “fast” to the real-time payment layer.

Economics is still under discussion. Small validators face flat 1.6 SOL per epoch fee regardless of interest, but the reward flow remains undefined. The Governance Discussion (Epochs 833-842) highlights the need for a clear rollout path, such as a sequence of Alpenglow components. Still, when implemented, SIMD-0326 represents one of the most important structural upgrades of Solana.