This is a segment of the LightSpeed Newsletter. Subscribe to read the full edition.

How was Solana like in August? Let’s solve some numbers.

In August, the deal with Solana was paid about $78 million in Rev (fees + tips). In 2025, it was Solana’s third lowest REV month.

Compared to the previous year, Solana’s Rev grew by around 24%.

Solana’s total supply of Stablecoin has stagnated in the range of $13 billion to $13 billion since March.

Solana is far from death, but these numbers certainly don’t scream “all cylinder growth” as they did in early 2025.

Application revenue talks more optimistic. The Solana app generated $148 million in August, up 93% year-on-year.

I would like to call it a “Fat App Paper,” but in the case of Solana, it is probably more accurate to call it a “Fat Memecoin App” paper. Most of the disassembled and profitable applications belong to the categories of trading tools and memo coins: axioms, pumps, phantoms, letbonks, photons, and more.

Over the past few months, Solana has sought to establish herself as a go-to venue for trading crypto assets encapsulated by the “Internet Capital Market” meme.

The data appears to confirm the story. The chart below shows that the overall spot Dex volumes of the major L1 chains are classified.

The BNB chain has taken the top spot with a $214 billion volume, but these numbers are bulging by ongoing “alpha” incentives campaign It’s a rewarding wash trading. If adjusted to exclude alpha tokens, the August volume of the BNB chain is estimated $138 billion.

This brings Solana to $153 billion and Ethereum to $143 billion.

Zooming into the volume of the Solana Dex, NONAME AMMS (prop AMM) carved out a significant portion of its market share of approximately $47 billion in August. These amms use one single market maker to provide liquidity and route users by connecting to Dex aggregators at the backend (read more) here).

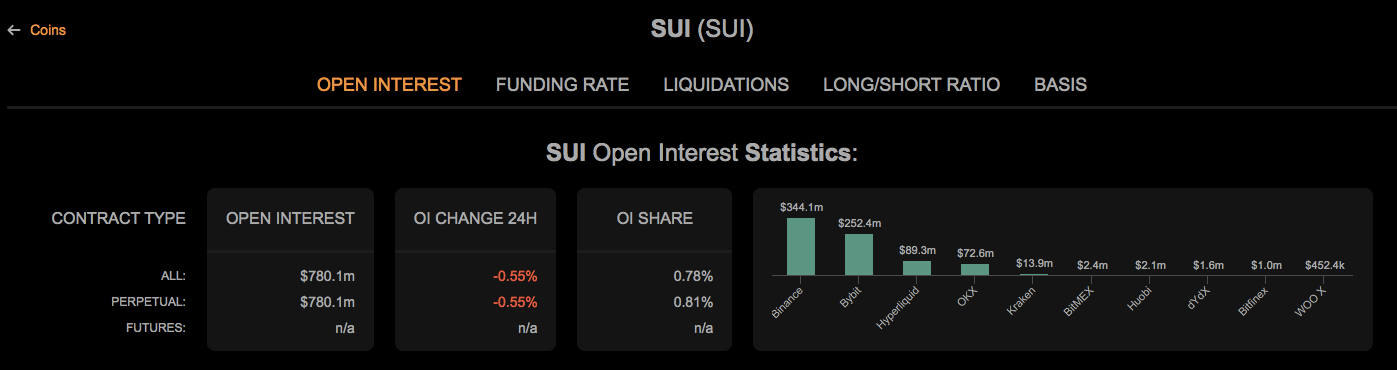

Now let’s take a look at the Perps volume. The two main Perps exchanges for Solana are Jupiter Perps and Drift, which have a volume market share of 4.9% and 3.3%, respectively. Naturally, they are being dug up by high lipids (71.6% market share), an average daily amount of around $10.4 billion over the past 90 days.

The slower growth of Solana could be attributed to Hyperliquid’s advantage over the past four quarters, Ryan Connor of Blockworks Research told me.

“To Solana’s success, doing drifting (or similar) tasks is important.”

However, drift is not sleeping on the wheels. Perps Dex did some of its best lifetime volume in August thanks to unique features such as the cross-margin feature.

Finally, you cannot speak to Solana without speaking about memokine.

After a short two to three weeks, when the pump appears to have lost its main position, the platform has regained its control over competitors like Letsbonk and Heaven. As of last week, the 148K token was released on the launchpad of the pump. This means that approximately 89% of the total tokens have been released.

Solana’s biggest tailwind in the near future may have nothing to do with on-chain products.

I saw it last week Report Of three new Sol Treasury companies on the market for a total of around $2.65 billion.

On the horizon, there is a possibility of October approval for existing Solana ETF applications.

The new ETF “is more tax efficient than Rex-Sosprey, has a better distribution of fidelity, bitwise, etc.), and may include redrawing and staking support with existing creations.” Report