Bitwise CEO Hunter Horsley says Solana could have the advantage over Ethereum in the staking exchange trade fund (ETF) market.

Speaking to Andrew Fenton, editor of Cointelegraph at Token 2049 in Singapore, Horsley argued that Solana’s rapid staking period has an advantage over Ethereum for staking products. Ethereum’s withdrawal queue has recently reached a new high, but Solana is cleared faster than usual. Horsley said the difference is important for issuers who need to be able to quickly return assets to investors.

“That’s a big problem,” Horsley said. “ETFs need to be able to return assets in very short time frames. So this is a big challenge.”

Staking helps you lock cryptocurrency and protect your network in exchange for rewards paid with the same token. With assets locked, withdrawals can face delays as they fluctuate based on network demand.

https://www.youtube.com/watch?v=_gbfudrmny0

Horsley pointed out that Ethereum-based products can avoid this issue. For example, Ethereum’s Staking Exchange Trade Products (ETPs) from Bitwise in Europe use a credit line to keep the redemption fluid liquid. However, such facilities are at a cost, and there are “capacity constraints,” he said.

Another option is liquid staking tokens such as Lido Steth. This represents a piling-driven property, allowing investors to maintain the liquid while earning rewards.

Horsley’s comments came after Ethereum’s staking entry queue rose to 860,369 ETH in early September, the highest level since 2023.

The ETH staking queue is currently 201,984 ETH, with an average latency of approximately 3 days. According to OnChain data, the exit queue is about 34 days, and over 2 million pile tokens are waiting to be withdrawn in about 34 days.

Related: Add staking for NASDAQ file application BlackRock ISHARES ETH ETF

Sol and Eth ETFs face an October deadline

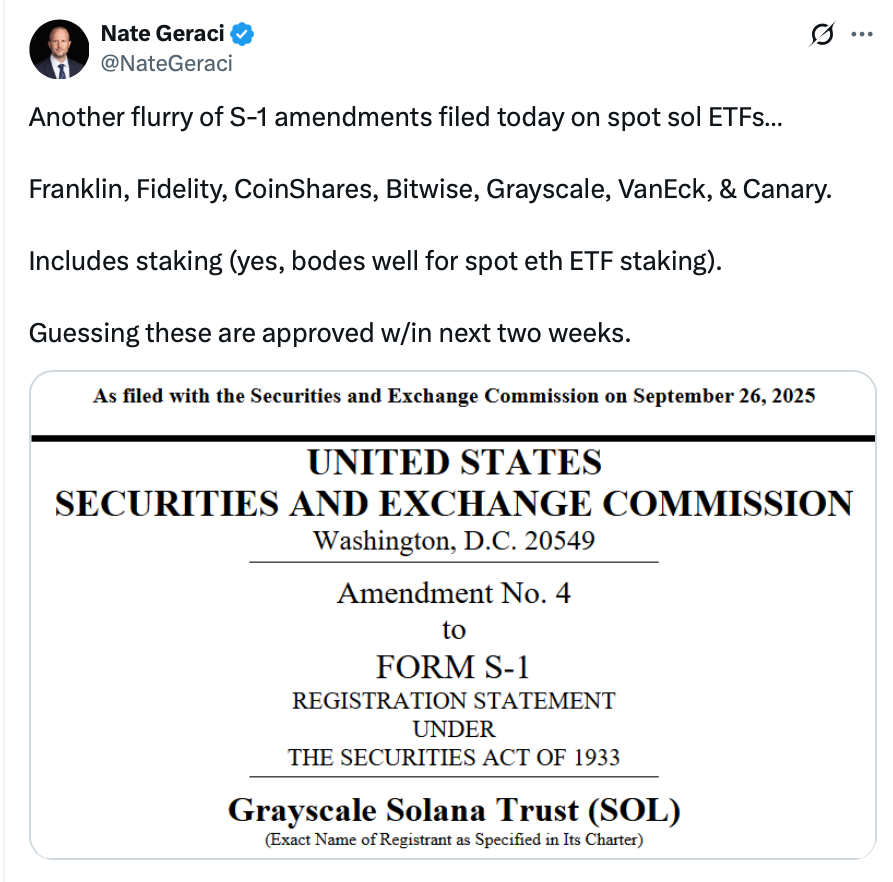

The Securities and Exchange Commission (SEC) plans to decide on several pending applications for Solana and Ethereum Exchange Sales Funds in the coming weeks, including proposals with staking capabilities.

Among them are Bitwise, Fidelity, Franklin Templeton, Coinshares, Grayscale Investments, Canary Capital, and Vaneck Solana ETFs. All of these have submitted an amended S-1 document to SES to update the staking provisions of existing funds in SES.

sauce: Nate Gelach

In August, the SEC delayed its decision to approve ether staking for two ETFs from grayscale to the end of October.

Silent approval of BlackRock’s iShares Ethereum Trust was also pushed back on October 30th.

As Cointelegraph recently reported, 16 crypto-related funds await a decision from the SEC this month.