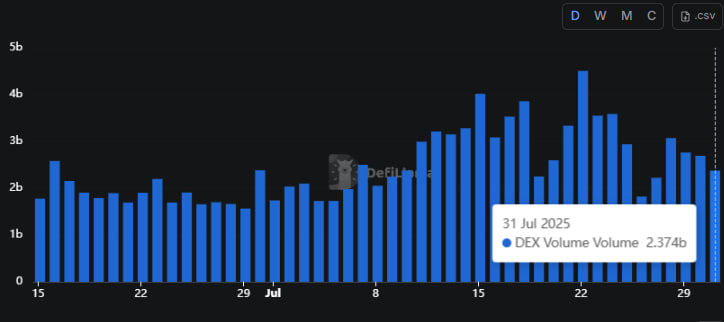

- Solana’s Dex volume has lost nearly $700 million since Monday.

- The downside follows comments from co-founders criticizing meme tokens and NFTs.

- This statement sparked controversy, especially as the meme codes promoted Solana’s growth.

The latest comments from Solana co-founder Anatoly Yakovenko have shaken up speculative trading enthusiasts.

Blockchain, on the other hand, reflects its impact on the decentralized exchange (DEX) front.

Yakovenko dismissed the NFT and meme coins as assets of essentially no value in the X-Post on July 27th.

He compared them to mobile game loot boxes, which serve speculative individuals.

Meanwhile, the comments thwarted sentiment as Solana’s Dex volume fell 220% from $2.374 billion today from $2.37 billion.

Sudden dips are not uncommon in the cryptocurrency industry, but some participants are connecting dots.

Meme codes have driven Solana’s growth

It’s ironic that it caught the attention of the community. Meme tokens don’t have traditional utilities, but they’re essential in Solana’s latest boom.

Almost all thematic cryptocurrencies that have dominated the trend over the past few years have been launched on the Sol blockchain.

pnut, wif, fartcoin, and current pengu can be named.

Plus, Solana boasts the largest meme launchpads (Pump.Fun and Raydium).

When top chains like Ethereum and Cardano were quiet, Solana flourished for viral meme assets and NFTs.

Furthermore, major Solana Dex, like Jupiter, flourished during the season of memecoin.

These trends have helped Solana gain strong community, culture, profit and growth momentum.

Therefore, many equate Jacovenko’s comments with biting the ecosystem-fed hands.

The Solana-based exchange has experienced a significant slowdown just days after controversial comments.

Whether the 20% slide was a normal cool-off or a response to Jacovenko’s remarks, Solana’s ecosystem was a hit.

Tone may have discouraged participants who are likely to be considering alternative meme launchpads.

For digital asset enthusiasts, meme tokens and NFTs represent the culture, accessibility and creativity of the crypto industry.

Additionally, they lower the entry barrier to Web3.

Meme tokens are not worth it, but they promote excitement

Yakovenko’s comments were not unfounded. Most meme tokens lack the utility with caution.

They face criticism because they lack legitimate support, use cases and the fact that most creators launch them as speculative plays.

The project records incredible surges overnight and can crash within minutes.

You probably remember the controversial case of Libra.

Libra surged into a $224 million market capitalization project before crashing within hours, leaving investors with a huge loss.

The current market capitalization is $3.94 million.

Hype, not fundamentals, determines the life cycle of most meme coins.

But they work too. Themed cryptocurrencies have no realities, but they attract attention and excitement in the digital currency market.

They also ride retailers who want to join the market without navigating complex protocols.

This phenomenon benefited Solana, shining the spotlight during the period when the top blockchain was dormant.

Yakovenko’s statements seem true, but it uncovered the vulnerability between Crypto’s market behavior and logic.

In addition to decentralization, the fun aspect of the blockchain industry remains essential to the vibrancy of the sector.