nevertheless EthereumPrices are currently in bearish movements, with major Altcoin still well above the $4,100 level. During this fluctuating price action, on-chain activity in the ETH network is booming, as evidenced by a noticeable surge in transactions.

Ethereum’s sharp boom in daily trading

Ethereum prices It builds the underlying strength for upward movement potential and network performance. Over the past few days, the network has experienced a strong revival, reaching levels where daily transactions have not been seen for many years.

darkfost, a market expert and author; It has been reported This rapid rise in on-chain activity highlights a revival of investor interest, an increase in demand for decentralized apps, and the wider use of blockchain across the industry. It also shows increased confidence in the long-term scalability and value of ecosystems.

Experts say ETH is booming Decentralized Finance (defi) Nowadays, networks are growing rapidly as they naturally find themselves in this ecosystem hub. As a result, the number of transactions on the network has skyrocketed, splitting from the range of the last four years.

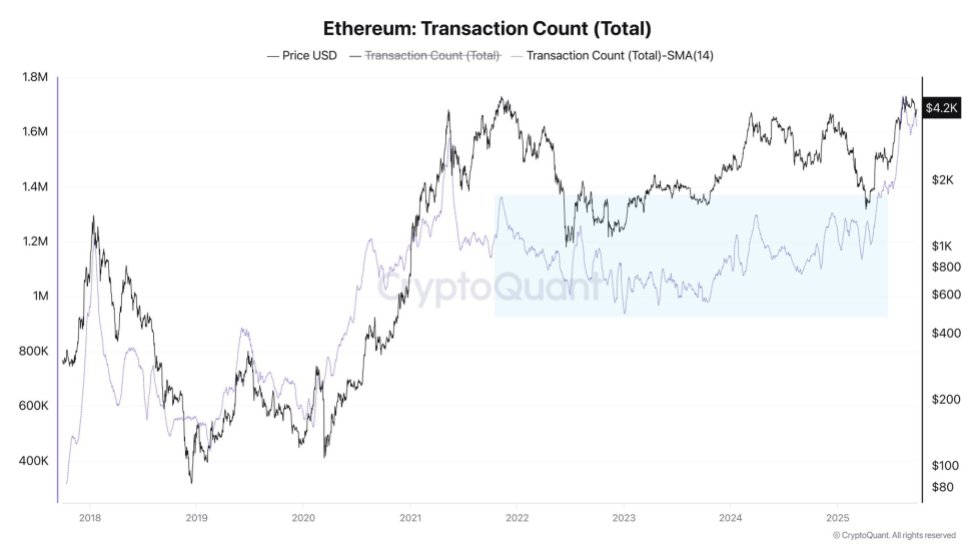

It’s worth noting Daily Trades on Ethereum Over the past four years, it was between about 900,000 and 1.2 million to reduce noise using 14 days of SMA. When ETH experienced a significant amount of FUD during its latest recession in late March, the daily average was already around 1.2 million trades.

Interestingly, this level was much higher than the number observed in January 2023, when the network barely reached 1 million relocations per day. However, the number of daily transactions reaches 1.6 million to 1.7 million, marking the highest ever recorded. Ethereum Network.

DarkFost noted that the rise in Ethereum trades is actually correlated with its price. In the meantime, experts have pointed out the importance of monitoring this data. Because this is where the truth is and it benefited those who used the data.

ETH funding rates are on a downward trend

recently, Investor sentiment It appears to have something terribly bad as funding rates move into negative territory. This change in emotion coincides with preparing for a rally, informing the momentum of cooling among leveraged traders, and raising questions about current uptrends.

Crypto summon It was revealed Ethereum’s funding rate remained negative throughout the last week, but this is similar to previous occasions. However, market experts argue that the downward trend has stopped and the ascending trend is emerging.

This development suggests potential The bottom of ETH price action. Experts say the bottom is consistent with an era of fear for investors, and it is common to bet on additional declines or pay premiums to protect themselves.

Current data from CoinmarketCap shows that ETH prices have returned to $4,127, indicating that they have fallen nearly 2% over the past 24 hours. Its prices have dropped slightly, but its trading volume has also experienced a bearish movement, falling more than 8% in the past day.

Getty Images Featured Images, Charts on tradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.