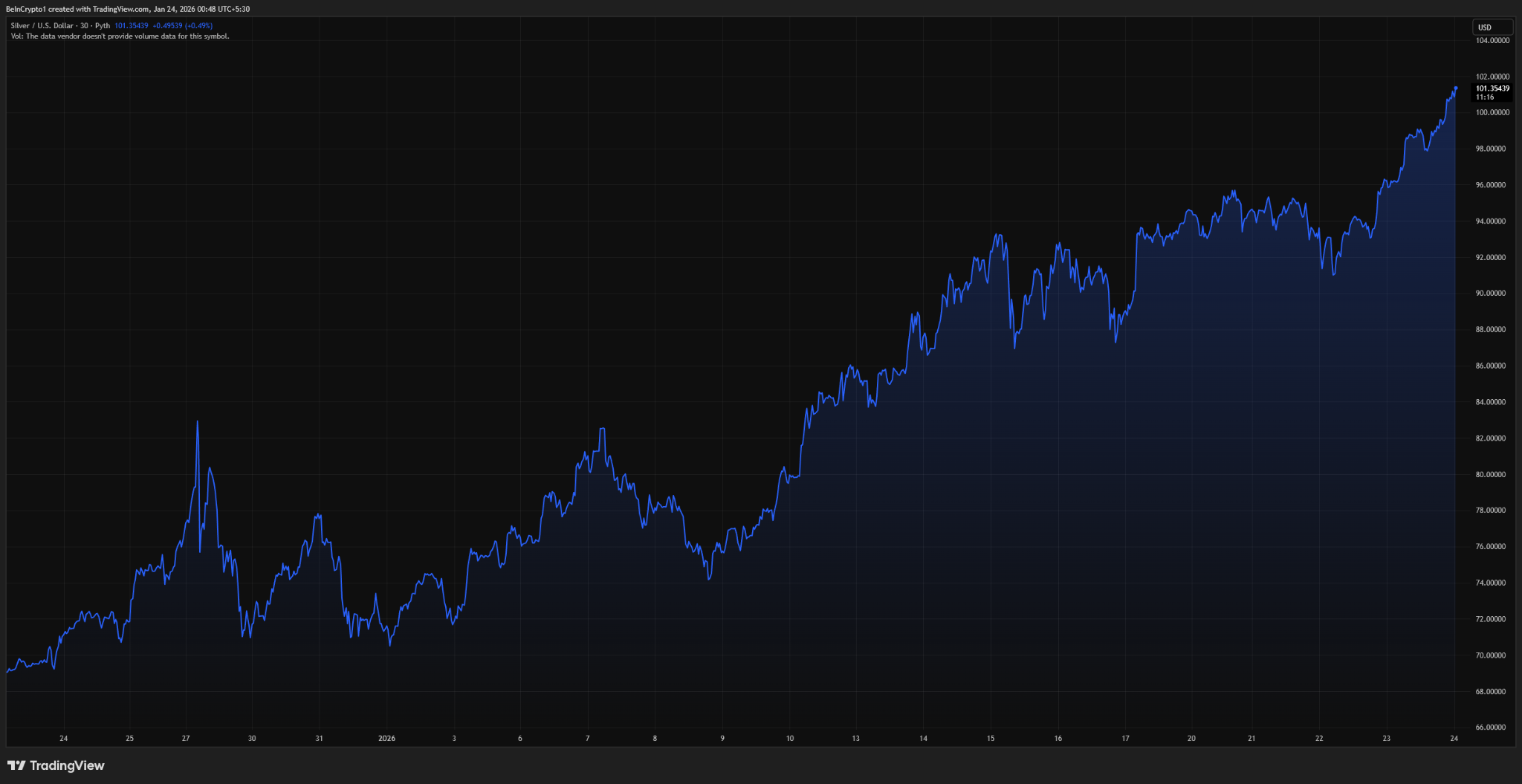

Silver soared to an all-time high of $101 today. The bull market built for several months and accelerated sharply in January 2026. Silver has now outperformed gold, making it the best-performing asset in the current macro environment.

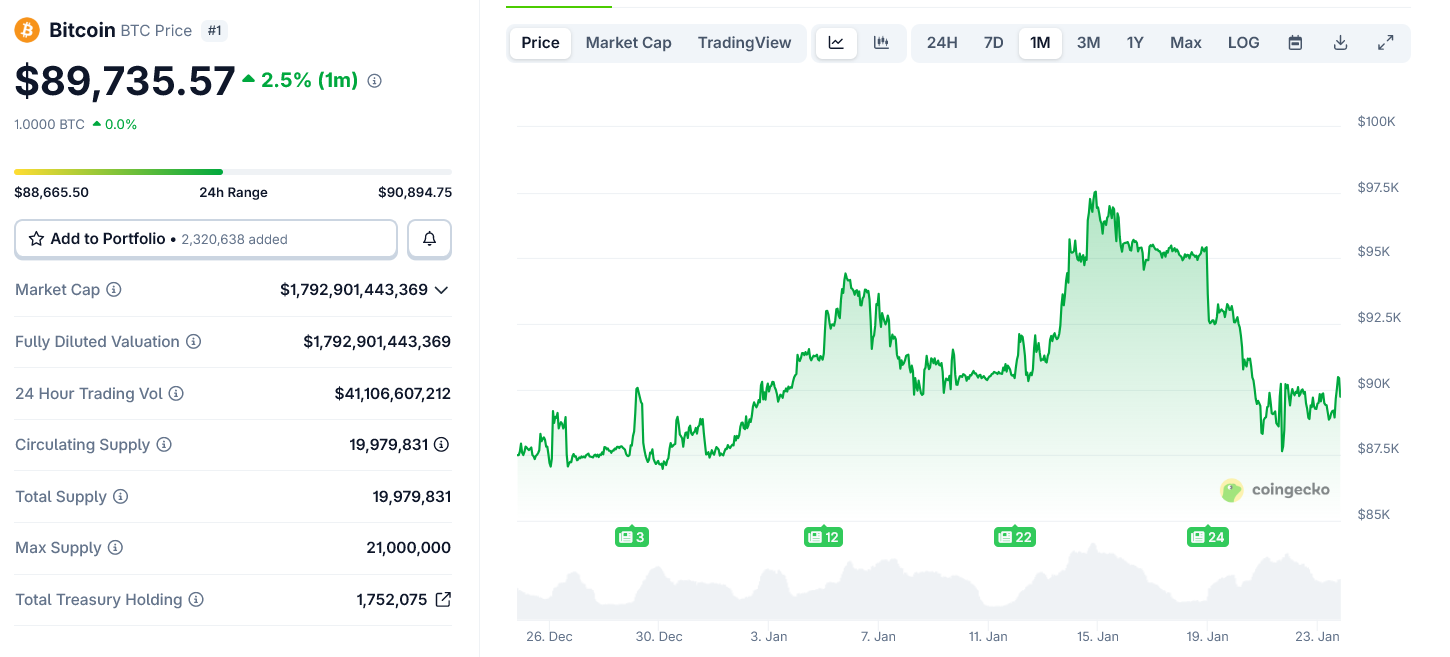

But Bitcoin has not followed the same trajectory, at least not yet. This divergence raises important questions for the cryptocurrency market. What does the silver breakout tell us about where Bitcoin might go next?

Why is silver soaring?

Silver’s rally isn’t just driven by speculation. This reflects a broader shift in how global capital is positioned in a time of heightened uncertainty.

Silver price chart for January 2026. Source: TradingView

1. Risk-off demand dominates the market

Over the past few months, and especially in January, investors have ramped up their exposure to defensive assets.

The main factors are:

- Geopolitical tensions intensify, including new trade disputes and unresolved disputes in Eastern Europe and the Middle East.

- Concerns about U.S. fiscal sustainability and rising government debt.

- Growing anxiety over tariffs and the fragmentation of global trade.

In this environment, capital typically flows first. Hard assets are recognized as stable stores of valuehistorically gold and silver are at the top of that list.

Silver’s all-time record reflects this defensive positioning.

2. Declining real interest rate expectations are supporting metals

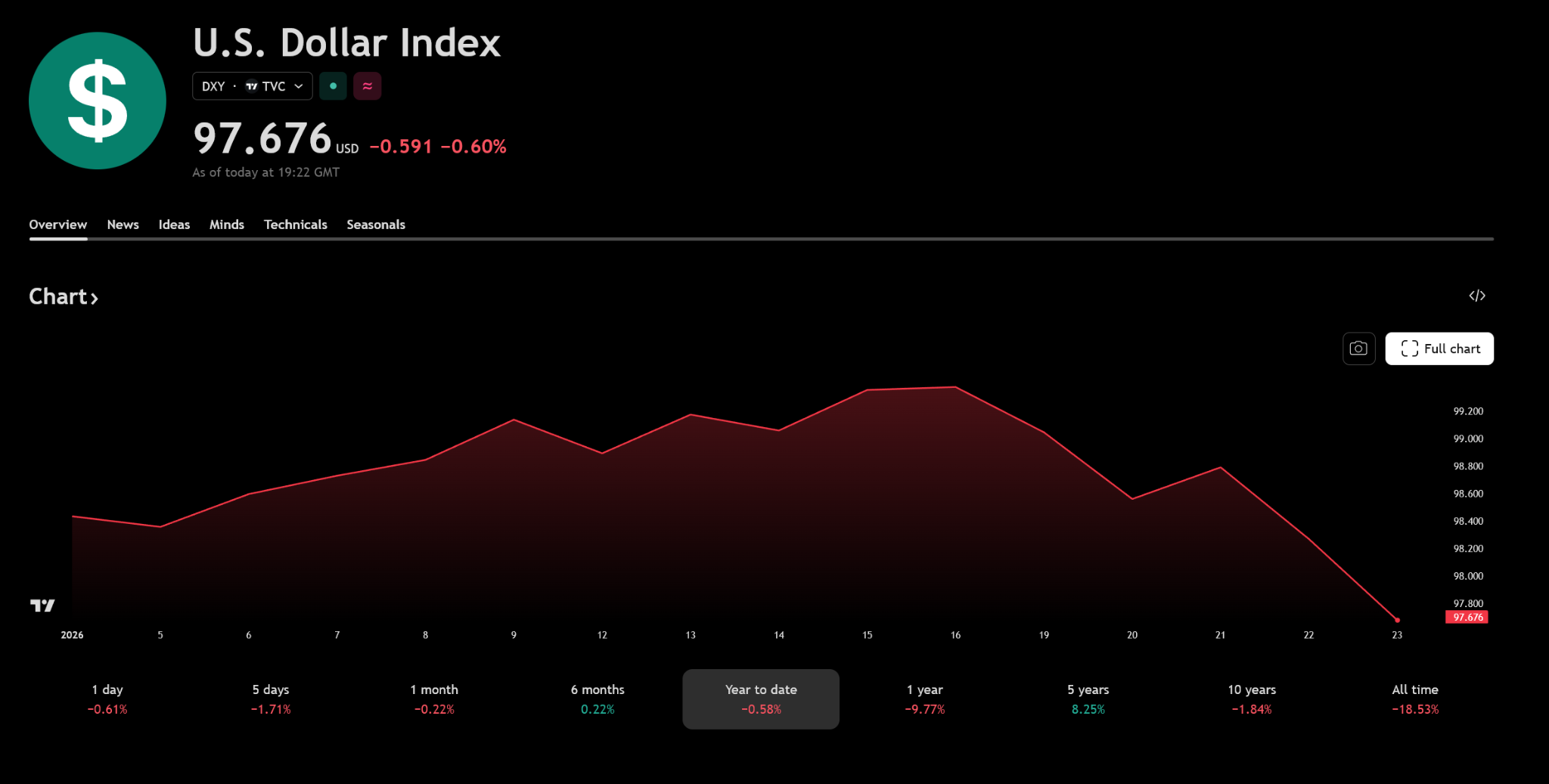

Markets are pricing in multiple interest rate cuts by the U.S. Federal Reserve in the second half of 2026, and expectations are pushing down real yields and weakening the dollar.

This is a powerful tailwind for precious metals. Silver does not earn interest, so lower real interest rates reduce the opportunity cost of holding silver.

A weaker dollar also makes dollar-denominated metals cheaper for overseas buyers. This dynamic was one of the biggest contributors to silver’s momentum in January.

The US dollar’s dominance will continue to decline in January 2026. Source: TradingView

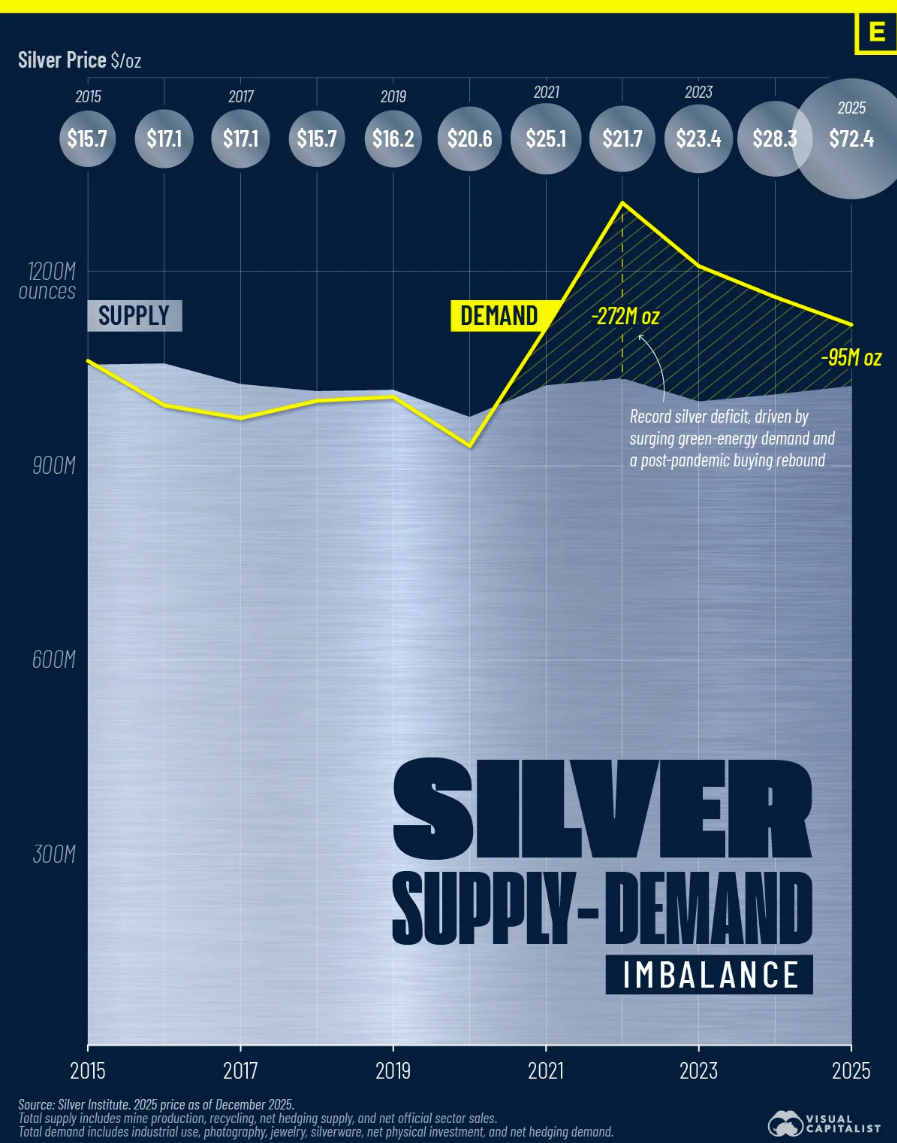

3. Structural supply talk fuels movement

Unlike gold, silver is faced. Real-world supply constraints.

The silver market has been in a structural deficit for several years in a row. Most silver production occurs as a byproduct of mining other metals, which limits supply flexibility.

The US has recently important mineralsprompting strategic stockpiling and tight inventories.

While demand increased, available supply could not keep up, causing prices to rise faster.

Silver demand imbalance over the past decade. Source: Visual Capitalist

4. Strategic layer added due to industrial demand

Silver’s role in the global energy transition is becoming increasingly important. This is a critical input for solar panels, electric vehicles, power grids, data centers, and advanced electronics.

This industrial utility makes silver Safe haven and strategic suppliesstrengthening its appeal in a world focused on energy security and infrastructure resilience.

Why Bitcoin Won’t Rise Alongside Silver

Despite macro tailwinds, Bitcoin has lagged silver. This gap is not unusual and is historically consistent.

Bitcoin is increasingly considered “digital gold,” but the market still classifies it differently during periods of stress.

When uncertainty increases, capital flows first. traditional safe haven (gold and silver). Bitcoin often consolidates as investors reduce their risk exposure.

Historically, Bitcoin tends to move slowly once fear turns into concern. Currency depreciation and liquidity expansion.

January 2026 seems to be here for sure. Phase 1 of that cycle.

Bitcoin price chart for January 2026. Source: CoinGecko

What Silver’s All-Time High Means for Bitcoin

A silver breakout still makes sense for Bitcoin, but it is not immediately bullish. If Bitcoin were to react only to the same forces that move silver, here’s what would happen.

- Capital will continue to favor metals over risk assets.

- Bitcoin will remain range bound.

- A downside test towards the major support zone is still possible.

this is, Safety comes first when it comes to capital flows..

Historically, Silver’s sustained strength often precedes Bitcoin’s rally — did not match them.

If silver continues to attract defense capital, the story typically shifts from risk aversion to financial asset decline protection.

This is where Bitcoin has historically performed best.

In previous cycles, Bitcoin has trailed gold and silver. weeks to monthsas hopes for liquidity give way to immediate fears.

Correlation between #Bitcoin and #Silver 📈$BTC It follows $XAG, but there is a slight lag in the macro. 💥

Recently, the price of silver has increased significantly.

This means that we were able to see BTC Thank you for following this special movement. 🔥 (NFA) pic.twitter.com/XQQ66BrWSg

— Bitcoinsensus (@Bitcoinsensus) December 26, 2025

Important triggers to watch for Bitcoin breakout

For Bitcoin to become definitively bullish based on silver signals, one of the following would have to happen:

- Not just the Fed’s forecast, but the actual rate cut.

- A sustained decline in the US dollar.

- Fiscal stress increases, reconfiguring Bitcoin as a financial hedge rather than a risk asset.

Silver’s all-time highs suggest that this situation may be forming. However, they are not yet fully factored into Bitcoin.

Again, historically, gold and silver absorb the first wave of defense capital. Bitcoin tends to follow suit once fear turns into concerns about currency depreciation and increased liquidity.

Silver’s all-time high may not signal a Bitcoin breakout, but it could be quietly setting the stage for one.

Silver hits an all-time high, but what does that mean for Bitcoin’s next move? The post appeared first on BeInCrypto.